The Times of India – How to maximize the valuation of patents

In terms of intangible assets, robust IP portfolios are often considered highly advantageous by organizations. These assets, however, are only valuable when they bring commercial worth to the respective businesses. IP-intensive companies frequently face the problem of underutilized IP assets, such as patents. As a result, these assets often remain in the R&D labs without posing any real benefit to the companies. This is a major problem for several businesses across the globe based on recent reports stating that only about 0.3% of patents reach the commercialization stage.

The following article discusses the ways in which companies can maximize the valuation of patents.

Table of Contents

Leveraging a New Financial Asset

Although intangible assets such as intellectual property (IP) have generally been underrated in their capacity to generate commercial value, in recent years, there has been a significant paradigm shift. Research has shown that the proportion of intangible assets such as patents has increased greatly from the 1950s till the 21st century. This calls for a gross reassessment of IP assets for companies holding substantial patent portfolios. Upon successful pruning, most modern organizations have realized that patents can become the new financial assets that they can thrive on.

Ways to Maximize Valuation of Patents

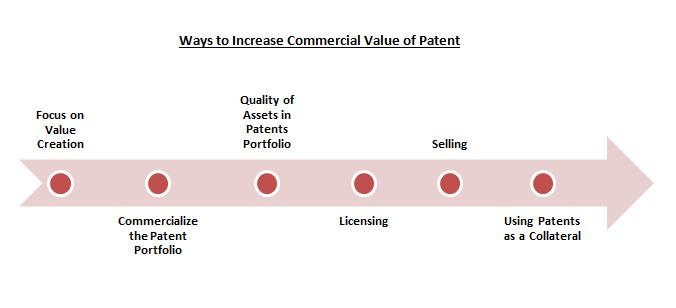

There are several ways to maximize the valuation of patents. It is important to note that maximizing such valuations is not just for IP-intensive companies but also for smaller companies or even non-practicing entities (NPEs). Some of the ways to maximize the commercial value of patents are:

- Focus on Value Creation

Focusing on creating commercial value out of a patent should be the primary goal of any organization that is engaged in the research and development of innovative technologies, designs, or processes. There needs to be a constant focus on the commercial value of a patent throughout the developmental and implementational phases.

- Commercialize the Patent Portfolio

Treating a Patent portfolio as a financial asset is the first step towards gaining maximum valuation of patents. You should evaluate the rights, scope of protection, and technological domain associated with each patent to know when, how and, in which jurisdiction each one can be commercialized. By doing so, you can convert your entire patent portfolio into a revenue stream for your organization and thus get the most value out of your patents.

- Quality over Quantity in Patents

Focusing more on the quality of assets in your patent portfolio rather than just increasing the size of the portfolio can also be considered a sensible way to maximize the valuation of existing patents. This can be done by developing key performance indicators (KPIs) and metrics for each of the patents in your portfolio. By doing so, you can track the value creation of each of your patents throughout their lifecycle. This method can help you focus on the quality of existing assets and therefore maximize their valuation.

- Licensing

Licensing your patents can help your organization establish its innovation in the given market niche as well as reap the benefits of a regular income through royalties. This is one of the most preferred methods to generate the maximum value out of patents because it eliminates the costs of operation, customer acquisition, sales and marketing, etc. It is also an effective method for companies without substantial capital to invest in inventory and still generate great value out of their patents.

- Selling

By selling off patents that are no longer economically viable or hold no practising value to your organization, you can gain some monetary value out of them. All patents have a set lifespan, at the end of which, it is best to sell them off. Some companies hold assets that generate no real value for them but have the potential to generate immense value for others. Instead of holding on to such irrelevant assets, it is better to sell them at a good price and recover the R&D expenses.

- Using Patents as a Collateral

During economic downturns, you can even use your patents as collateral to gain an effective line of credit from an investor. In this way, you do not lose your patents permanently and at the same time have enough capital to help your business stay afloat.

Conclusion

Using the six ways of maximizing the valuation of patents discussed above, organizations can reap the benefits of avid investments into IP. However, these ways are not limited to non-practising solutions. Organizations can also design and develop diversified product lines using their patents.

Originally published on: https://timesofindia.indiatimes.com/blogs/voices/how-to-maximize-the-valuation-of-patents/