- Home

- Work

- Solutions

- Technology Expertise

Information & Communication Technology

Telecommunication

Computer Networks

Wireless Communication

Networking Devices and Hardware

Cloud Computing & Virtualization

Semiconductors and Devices

Display, Memories and Storage Devices

Enterprise Servers, Storage and Software

Microprocessors & Microcontrollers

Printers and Imaging devices

Consumer Electronics

Medical Devices

Mobile and Web Applications

IOT and Home Automation

Augmented and Virtual Reality

Autonomous Vehicles

AI, ML & DL

Business Process Automation (BPM) and RPA

OS, Middleware and Firmware

Audio/Video Codec

Cyber Security

DLT and Blockchain

Advanced Computer Architecture

Image processing

Engineering

Automotive

Mechanics

Metallurgy

Agricultural Machinery

Aerospace

Hydraulics

Oil field, Oil rig related

Consumer Electronics

NCER

HVAC & R

Manufacturing

Packaging

Optics | Sound

Life Science

Pharmaceutics

Immunology/ Oncology

Pharmaceutical/ Medicinal Chemistry

Food Compositions & Food Technology

Paints/ Dyes

Healthcare and Diagnostics

Chemical Composition

Recombinant DNA Technology

Petrochemicals

Polymer Chemistry

Sequencing Methods and Devices

- About

- Perspectives

- IT for IP

- Media

- Careers

- CONTACT US

- 日本語

- 中文网站

- Home

- Work

- Solutions

- Technology Expertise

Information & Communication Technology

Telecommunication

Computer Networks

Wireless Communication

Networking Devices and Hardware

Cloud Computing & Virtualization

Semiconductors and Devices

Display, Memories and Storage Devices

Enterprise Servers, Storage and Software

Microprocessors & Microcontrollers

Printers and Imaging devices

Consumer Electronics

Medical Devices

Mobile and Web Applications

IOT and Home Automation

Augmented and Virtual Reality

Autonomous Vehicles

AI, ML & DL

Business Process Automation (BPM) and RPA

OS, Middleware and Firmware

Audio/Video Codec

Cyber Security

DLT and Blockchain

Advanced Computer Architecture

Image processing

Engineering

Automotive

Mechanics

Metallurgy

Agricultural Machinery

Aerospace

Hydraulics

Oil field, Oil rig related

Consumer Electronics

NCER

HVAC & R

Manufacturing

Packaging

Optics | Sound

Life Science

Pharmaceutics

Immunology/ Oncology

Pharmaceutical/ Medicinal Chemistry

Food Compositions & Food Technology

Paints/ Dyes

Healthcare and Diagnostics

Chemical Composition

Recombinant DNA Technology

Petrochemicals

Polymer Chemistry

Sequencing Methods and Devices

- About

- Perspectives

- IT for IP

- Media

- Careers

- CONTACT US

- 日本語

- 中文网站

Sagacious IP’s Patent Valuation service enables you to determine the monetary value of your patent which in turn impacts your R&D efforts, bolsters your intellectual property rights and enhances revenue, stock performance, and reputation.

When do you need?

- Patent transaction activities such as licensing, sale, purchase, etc.

- Patent enforcement

- Assessing R&D investments

- Internal IP audits

- Raising funds

- Financial reporting

- Insurance of IP assets

- Liquidation

- Taxation

Detailed patent valuations that are cost-effective and time bound

Detailed patent valuations that are cost-effective and time bound

Why Choose Sagacious for Patent Valuation?

- Adaptable approach for valuation of a patent in any technology

- Expertise in deciding the right value indicator based on subject patent technology

- Deriving a practical value based on highly researched facts

- Evaluation of the patents in technologies that are at early stages of development

- Quick, Accurate and Cost efficient – 1/5th standard market rates

- Valuation certificate

- Experience of working with top brokers

Patent valuation is an approach to calculate real market value of the patent so patent owners can generate money from their intellectual property. There are three major approaches (as shown in this figure by WIPO) used in industry for this (however, we will talk about a fourth more efficient approach of patent valuation below):

Since patents are important intangible assets of any business, it is essential for investors to be able to calculate and account for the value of a patent, in case of an investment, merger or acquisition.

Although regulatory organizations have established patent laws, no law describes specific patent valuation requirements.

Because patents are intangible assets, assigning them a financial value is often hard, time consuming and costly.

Let's begin with Why Patent Valuation Matters

Patent valuations are one of the most important items of an IP strategy,

There might be a case that the patented technology is revolutionary; however, it requires significant changes in current products worldwide to make it publicly available. In such cases, the industry might be apprehensive to adopt the patented technology.

If an inventor has an item patented by him or her, the value of the patent would be the amount of money needed to replace that invention. A prospective client would not be willing to pay more for a patent than the amount he or she would have to pay to obtain an equivalent right of protection.

When a business or a person develops a product with the ability to be patented, the fundamental hope is the item being patented will result in a rise in revenue or at least be a cost-saving measure in the business. This strategy states that the value of the patent is the actual cash value of these future advantages. In other words, the value of the patent is roughly equivalent to the value of previously sold and bought comparable patents or patented products.

For this strategy to be used for patent valuation, two factors must be in place: Existence of an active market for the patent, or a similar one in past transactions of comparable property. Look for similar values when searching for comparable patents for the following products: Industry characteristics market share or market share potential Growth businesses.

Considering gaps and difficulty in valuing patents using above three approaches, Sagacious IP (a leading provider of patent valuation service) has developed a unique proprietary approach named named Hybrid Patent Valuation which combines the best of all approaches and bring down pricing and timelines of expert patent valuation by almost 1/5th. It enables customers to prioritize their IP assets more efficiently and monetize their portfolios.

The Hybrid approach for patent valuation takes into account the following parameters:

- Market size, and market share of said technology.

- Annual turnover generated by the patented technology

- Absolute profit after applying all taxes and duties.

- Discount factor, which is based upon the risk assessment of the patent.

- Product factor, which evaluates how important the patent is to the overall product.

After evaluating the patent on the basis of these key factors, a Net Present Value is calculated, and corresponding licensing fees or market value is given.

More details of this hybrid methodology can be found here (How To Adopt An Intelligent Approach to Patent Valuation – Sagacious IP

(How To Adopt An Intelligent Approach to Patent Valuation – Sagacious IP)

Testimonials

Impact Stories

Impact Story 1

Sagacious helped two SMEs in getting a more practical value for their patents. This valuation was used to raise funds for their businesses.

Impact Story 2

Sagacious IP has been assisting patent owners in extracting the maximum value of their patents listed by various patent brokerage firms. We have also generated claim charts in many cases and used the infringed product sales for incorporating damages calculation in the final valuation.

FAQs

Patent Valuation is the process by which one can calculate the actual market value of the patent or patent portfolio. Companies or inventors must perform patent valuation while negotiating deals such as mergers, acquisitions, sales, or licensing of patents.

Any company or organization looking for M&A, licensing, portfolio sales, and investments shall get the portfolio evaluated to derive maximum value.

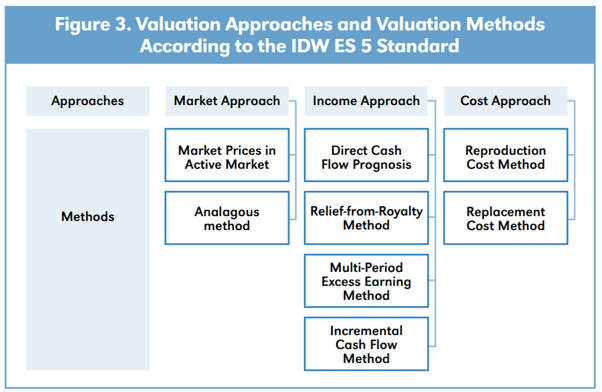

Conventionally, patent valuation can be performed using three main approaches – market approach, income approach, and cost approach. In the income approach, the value of a patent will be the current value of cash flow or cost savings that it will provide. In the market approach, the value of a patent is the amount a prospective buyer will pay for a similar product/service while the cost approach shows that the value of a patent is the replacement cost, i.e., the amount that it will cost to replace an invention.

At Sagacious, we follow a hybrid approach that involves market analysis and a rigorous analysis of the patent under study. The first part of the hybrid approach indeed gives us an expected value. However, different factors affect the applicability of a patent. These factors need to be considered together to understand the actual worth of the patent under study.

In the IP industry, the average cost of valuation study per patent lies anywhere between USD 3000 to USD 5000. However, at Sagacious, we follow a hybrid approach where the process can be customized as per the needs of the client. Thus, we can do it at less than half the average cost per patent prevalent in the industry.

The scope of the patent claims determines their applicability. It helps in determining the infringement potential of the patent. An infringing patent has much more monetary value than the non-infringing one.

Licensing & Monetization Support Services for Patent Owners

Make business-critical decisions powered by accurate patent valuation.

On-Demand Webinars

Join our Community for the Latest Developments in the IP SpaceContact Us

Monetizing Patents: Selling vs Licensing, Core vs Non-Core

Patent Portfolio Pruning: Realizing Immediate Cost Savings

F3 Analysis: A Solution for Strategic Optimization of Patent Portfolio

Directed Prosecution: Generating Future Value from Your Patent Portfolio

Exclusive Webinar Series

Exclusive Webinar Series. Cost: $0 (Free), Limited Seats Available. Don't miss the opportunity, Register Now.

"*" indicates required fields