Biosimilars – A Market Research Study

Healthcare management is one of the most fundamental and relevant topics for discussing biosimilars market research study worldwide. Drug regulators across economies and geopolitical boundaries continuously strive to meet the healthcare needs of those they serve. The challenge unifying all these regulators is the ability to ensure maximum utility of the healthcare systems while controlling costs.

This challenge however presents numerous complexities. These complexities owe to the high cost involved in research & development of a single drug. Moreover, it also compels to the patent exclusivity obtained from it. Once a company successfully develops a new drug, they can introduce it in the market. The drug can get attached with tremendous costs as they have an exclusive patent on it.

Table of Contents

The Idea of Generics

The Drug Price Competition and Patent Term Restoration Act is informally known as the Hatch-Waxman Act. It offered a solution to this problem by allowing pharmaceutical companies to copy the branded drug. It offered to sell it at a nominal price as a generic – once the patent expired. This act allowed a reduction in the cost of patient therapies, without significantly affecting the revenue of the developer drug.

Notably, a generic drug is a low-cost substitute for the consumer as the generic development reduces the manufacturer’s cost. This can be attributed to minimal requirement for research & development. It compels to the fact that approval pathway is much shorter for generic as compared to newly launched drugs.

- Genesis of Biosimilars

The shift of the pharmaceutical industry towards biologics has opened new avenues in the field of generics. Moreover, it has also presented new obstacles. Biologic is an umbrella term to define all therapeutic products of a biological origin. The living cells are the major source for extracting them, along with animal or microbial constituents. They tend to be larger, more complex compounds than traditional drugs, proteins and fragments. Thereof they constitute majority of the biologics segment.

Biosynthetic “human” insulin was first such substance for therapeutics which came under the ‘approved’ category. Presently, majority of the approved biologics are antibodies and all these therapeutics fall in the high-cost category. For example, Trastuzumab (Herceptin® by Roche) is used for the treatment of breast cancer. It costs between $1,800 and $1,955 per 440 mg vial. The implications of the high cost are that a full course of treatment with Trastuzumab is about $70,000. [1]

The development and the approval pathway for biologics is tough. Thus the biologics does not mimic with the same ease as a traditional pharmaceutical drug. A replication process for biologics without trials and approvals is not yet possible.

- Paving the Way for Biosimilars Market

A need for lower-cost alternatives combined with differences in their replication process paved the way for biosimilars market research study. The FDA recognizes biosimilars as biologic’s version of a generic drug. This means the biologic drugs are similar but not identical to the original biologic. Unlike a generic, a biosimilar is not an identical copy of the original biotherapeutic. Thus it has to go through a stricter regulatory process before its launch into the market.

Therefore, biosimilars are still quite expensive and time consuming to develop. The cost cutting obtained is due to reduction in number of clinical trials to prove the drug safe and effective. Companies making biosimilars market research study are mimicking a biologic having established efficacy and toxicity profiles. Thus have to only prove that biosimilar has the same route of administration, dosage and strength as the original product. Moreover, this has to happen while maintaining all the safety mandates. This eliminates a significant number of clinical trials, thus reducing the cost of development. [2]

The Biosimilars Market Research Study

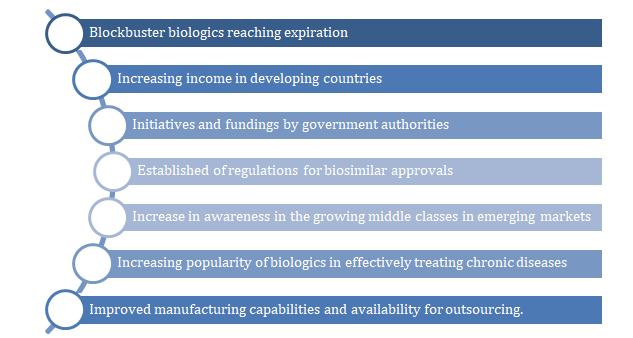

With the end of this decade, majority of the best-known biologics patents face impending expiration dates. This sets the biosimilar market research study on a road of continuous growth. McKinsey estimates the biosimilars market research study to potentially triple in size to $15 billion by 2020, or closely thereafter. [3] Biosimilars provide low-cost alternatives in the market for life saving drugs. Thus this downward price pressure creates intense competition in the biologics market.

The two major pharmaceutical markets: Europe and the U.S., demonstrate a stark contrast in growth of biosimilars. The European biosimilars market is growing continuously with their increasing efficacy and safety supporting it through the process. On the contrary, the U.S. biosimilars market tends to be flat. [4]

- Europe in the Lead – Biosimilar Market Research Study

Biosimilars market in Europe is growing steadily, both in terms of development and sales. This attributes to the increase in acceptance of biosimilars as an alternative to original biologics with faith in their competence. This faith relates to their safety, efficacy, and immunogenicity when compared to their patented counterparts. The biosimilar market in Europe reached a value of $2,934.6 million in 2018, with around 36 biosimilars approved by 2018. The market projects to reach a value of $11,663.1 million by 2024, growing at a CAGR of 24.9% during 2019-2024. [5]

The distribution of advancements in the biosimilars field is uneven throughout Europe. The market majorly segments into Italy, Germany, the United Kingdom (UK), France, Spain, Norway & Denmark. It contains regions like the UK and Italy representing the largest market. However, countries like Norway and Denmark show a significantly higher uptake of biosimilars. They owe to widespread promotion of biosimilars by health authorities and national tenders for development. The current European regulatory guidelines foster a neutral or positive environment for biosimilars relative to originator biologics and supports sustainability. [6]

The European biosimilar market research study represents the most mature market in the world. We expect it to continue advancing robustly in next five years with biosimilars of at least five new reference biologics. These might include high-value molecules such as Adalimumab and Trastuzumab. [7]

- Is The U.S. Biosimilars Market Lagging Behind? If so, Why?

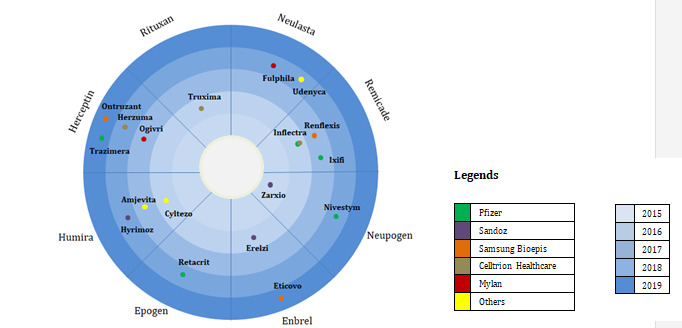

The first biosimilar approval in the U.S. was for Zarxio (filgrastim-sndz), a biosimilar G-CSF myeloid growth factor. It is used in supportive cancer care and was approved back in March 2015. Since the approval of the first Biosimilar in 2015, the U.S. biosimilar market has seen a slow growth. Moreover, the market research study is still in its nascent stage. [8]

Most of the biosimilars face delays and take a long time before they can enter the market. Even with around 18 biosimilars approved – only four of these are available for sales. These owe largely to challenges created by the branded drug companies such as counter-detailing and unfair & complex contracting practices. This is what limits the acceptance and the price advantage of a biosimilar entering the market. [9]

The Possible Roadblocks in the U.S Biosimilars Market

These problems compound with the fact that the manufacturer of a biosimilar has to face the hurdles. These hurdles include high development costs. These are approximately $100 to $200 million per product. There is also considerable uncertainty about risks and costs for regulatory approval and market access before it enters the market. [10]

There is another obstacle faced by biosimilars in the U.S. It is the prevalent concern about the idea of switching patients from well-known biologics to less familiar biosimilars. After the brand-name biologics lost efficacy or brought intolerable toxicities, the patients switched to biosimilars in most cases. [11]

Overall, the U.S. biosimilars market research study offers multiple opportunities and is yet to face various practical challenges.

- Emerging Markets

The pharmaceutical industry is rapidly shifting focus towards new developing countries. This industry has not only embraced globalization but is emerging as one of the front-runners of globalization. This is largely due to flattening growth patterns of pharmaceuticals in developed markets amidst stagnant economies and patent plateaus. Developing geographies, on the other hand, are providing high-growth opportunities and are thus the emerging markets. [12]

Its not the overall sales numbers which identify the emerging markets but its their potential for growth. The developed world still dominates the market in terms of overall revenue. However there is a fast-paced raise in GDPs of the developing countries such as China, India and Mexico. This is responsible for this new-found interest of the healthcare sector in the developing world. There another factor that strongly influences this global shift. 70% of the world’s population resides in these countries. Their governments are continuously striving and struggling to provide universal healthcare to their citizens.

- The Future of Market in Developing Countries

The daily growing population of the world have created a huge gap of unmet requirements. These especially include the developing world and the significant dearth of healthcare facilities and options. This is potentially the most important factor supporting biosimilar market growth. However, it is not easy for the big pharmaceuticals to easily reach the remote corners of the world. The big pharmaceuticals penetrate these markets. They riddle with problems of stringent regulations and a general distrust of the western pharmaceutical sector. [14]

The future success of biosimilars is not dependent on major markets like the U.S. and Europe alone. The success of biosimilars market research study will be decided by their acceptance in high-need countries. The need is greatest in Asia. Thus, the emerging markets influence the worldwide situation and will be the fastest to adopt biosimilars. [15]

The regulatory authorities of developing countries are starting to focus on development of indigenous products. It is mandatory for the foreign investors to favour local manufacturers and invest in infrastructure and manufacturing development. This, complemented with the new available option of biosimilars, has paved the way for local manufacturers. They can produce the required therapeutics indigenously – thereby reducing the dependence on imports. Thus, this helps in increasing their mark on the overall pharmaceutical revenue map.

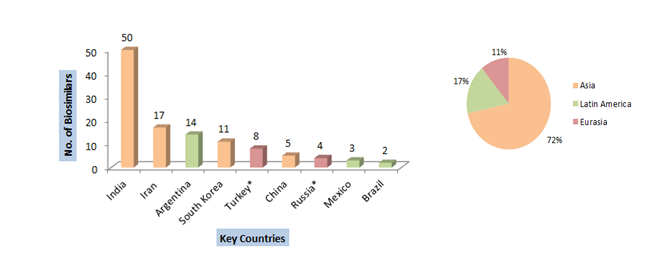

Key Geographies for Biosimilars Market Research Study

China, India, Brazil, South Korea, Turkey and Russia, among others, already have one toe in the marketplace. In addition to that, they are gearing for a full dive into the market. India and South Korea are the fastest emerging markets for Biosimilars. As a fact, both the countries show more than 10 approved biosimilars already. Also, most of these geographies have a well-established regulatory environment that favours biosimilar market growth. [16]

Source: Various articles and Gabionline.net

*The data for Russia and Turkey is only indicative of approximate numbers. This is because the regulatory guidelines are not stable. Thus not all non-originatory biologics present in the market are biosimilars.

Surge of the Indian Biosimilars Market Research Study

India has long established its presence in the chemical generics market. The Indian pharmaceutical market is largely dependent on its chemical generics manufacturing capabilities. However, the biosimilar market is also not far behind. Hence, the biosimilar market is very stable in India, with the first Indian biosimilar approved in 2000 [17] . The Indian pharmaceutical companies have led to the development of a mature and sophisticated ecosystem and regulatory environment for biosimilars.

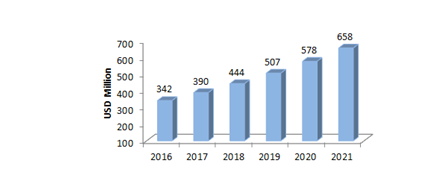

New data from CPhI shows that India’s biologics market might show robust growth in 2019 through biosimilars production. [18] According to some estimates, Indian biosimilars market will be worth $40 billion by 2030. [19]

As seen earlier, India has more than 50 approved “similar biologics”. Biologics is the Indian market term for biosimilars in the market. Furthermore, about 19 biosimilars are also in the development pipeline. The market is yet to grow at a CAGR of 14-16% by 2021. [20]

On 19 June 2012, India announced the release of draft regulatory guidelines for ‘similar biologics’. This event took place at the BIO industry conference in Boston, USA. The guidelines outline a simple procedure for evaluation of ‘similar biologics’. These fall under ‘approved’ category and marketed in India, Europe or USA for more than four years. [21]

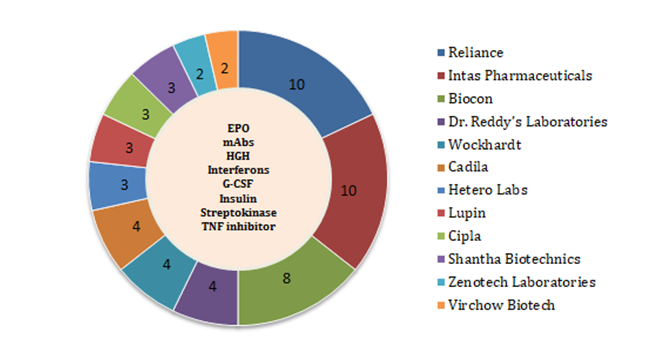

Indian Players in the Biosimilars Market Research Study

Indian pharmaceuticals have the advantage of reduced facility and developmental costs when compared to peers in western countries. They also enjoy the fruits of partnerships with larger MNCs when it comes to clinical trials and regulatory approval processes. Moreover, the Indian regulatory environment is conducive to biosimilar development.

Dr. Reddy’s Laboratories are the pioneers for Biosimilars in India with their biosimilar of rituximab (Reditux) receiving approval in 2007.

Indian players have adopted an all-rounder approach by focusing on types of available biologics ranging from monoclonal antibodies to Streptokinase. Participation of the Indian industry in regulated markets [U.S. & Europe] is witnessing a steady rise. European markets are relatively more encouraging; with some biosimilars such as Intas Pharmaceuticals’ Pelgraz (pegfilgrastim) and Accofil (filgrastim) who have already secured EMA approval. The U.S. market is comparatively difficult to penetrate. However, the Indian made biosimilars have already seen the light of day in U.S. [23]

Biocon became the first Indian pharmaceutical to have a biosimilar approved by the USFDA. It partnered with Mylan to co-develop Ogivri, which is a biosimilar for Roche’s drug Trastuzumab – Herceptin. It is useful for treating certain breast and stomach cancers[24] . This approval by the FDA puts India on the global map of biosimilars. It will serve as a precedent for various Indian pharmaceuticals to enter highly regulated markets.

The thrust of the Indian biosimilars market research study is likely to continue with biosimilars still in the pipeline. As per our estimates, around 20 biosimilars are under ‘approved’ category in India in the upcoming next-wave of biosimilars. If you wish to get more insights in the upcoming Indian Biosimilar Market Trend, then download our report Click here.

Conclusion

In terms of regulation, the market for biologics and biosimilars falls into three broad clusters. It includes the regulated markets (US, Europe, Japan and Canada); the semi-regulated markets (dominated by China and India) and the unregulated markets. The unmet need for cost–effective alternatives to biologics manifest the growing demand for biosimilars. This will be the driving factor for the expansion of the market in the regulated and the semi-regulated markets. However, there is a colossal gap between the approved number of biosimilars between the regulated and semi-regulated markets. China and India have over 50 approved biologics and US having none.[25] Among the regulated markets, Europe has been way ahead of others despite having similar regulatory requirement in US.

The surge of the biosimilars in the semi-regulated markets is conducive yet streamlined with regulations and increasing market acceptance. The Indian government offers subsidies to Indian biosimilar manufacturers and funding companies that enter into public-private partnerships.[26] Such steps secure the availability of affordable biosimilars both in domestic and export markets; and ensure that the Indian biosimilar landscape remains competitive.

Looking five to ten years down the road, India seems to be on a route to market expansion. The ability to expand beyond the domestic markets however will fall contingent on the strategies adopted by the developers. Unlike in India, where price is the deciding factor for the success of a biologic/biosimilar; the prominent factors in the western markets include quality, clinical data and safety. Prescribers in the western markets have limited faith in the products manufactured by developers of the semi-regulated markets [27] . Thus, forming strategic partnerships with multi-national manufacturers elevate the manufacturers’ profile. It is a tactic that the Indian companies could consider adopting if they wish to enter the international markets.

Sagacious IP offers customised solutions to meet your individual needs. Based on our long standing expertise, we strategically address your business challenges and then propose novel solutions. Our consulting approach rather than a report-only tactic drives actionable results for businesses to adapt and grow.

– Harsha Agarwal (Life Sciences) and the Editorial Team

Having Queries? Contact Us Now!

"*" indicates required fields