Patent Filing Trends Associated with Power Dissipation in Blockchain

Blockchain technology is gradually gaining precedence, which is evident by the fact that the global blockchain market is likely to grow from USD 4.9 billion in 2021 to USD 67.4 billion by 2026. In such a scenario, it becomes vital to understand the nuances of this technology and the patent trends associated with it to help businesses leverage opportunities. The following article explains blockchain technology, bitcoin mining and market insights pertaining to the technology, as well as blockchain energy consumption-related patents trends.

Table of Contents

Blockchain and Distributed Ledger

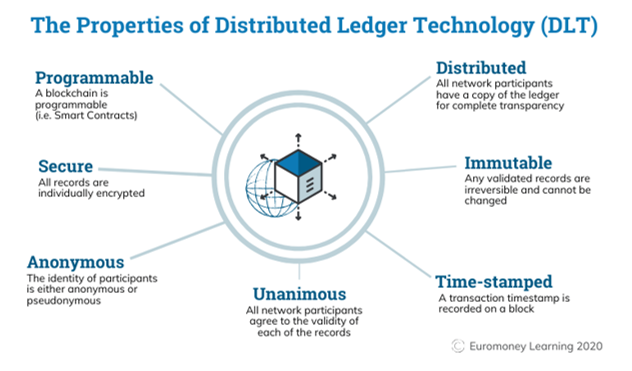

Blockchain is a distributed public ledger for recording transactions that have occurred in the business network. The ledger, decentralized as a blockchain database, is replicated among the participants of a decentralized network. Thereafter, the distributed ledger and its immutable record of transactions can be accessed by all network participants. Each transaction can be recorded as a block of data. In other words, each block contains a set of transactions. As soon as a new transaction takes place in the blockchain, a record for that is added to the ledger of every participant. In the distributed ledger, each transaction is verified by the consensus of a plurality of system participants. Figure 1 below depicts the features of a distributed ledger technology.

In blockchain, each block is characterized by its hash. Similarly, each block has a reference to its previous block, known as the parent block. If some modification is performed on the parent block, its N+1hash changes, which ultimately changes the hash of the current block. This is because the blocks are chained with each other by the cryptographic hash.

There are a number of blockchain platforms that provide a way to develop blockchain-based applications. Some of the popular ones are Bitcoin, Ethereum, Ripple, Quorum and Hyperledger.

Different blockchain platforms use different validation techniques. For example, Bitcoin makes use of Proof-of-Work (PoW), Ethereum uses Proof-of-Stake (PoS) and Ripple is built on Byzantine Fault Tolerance (BFT) protocol.

Proof-of-Work is a decentralized consensus algorithm, used widely in crypto-currency mining, such as Bitcoin, to validate the transactions and mine new coins. A new block can be mined, i.e. added to the blockchain by generating the correct hash and is broadcasted in the network. For Bitcoin, a new block is added to the Bitcoin ledger approximately every 10 minutes. On the other hand, Proof-of-Stake is a concept that enables people to mine and validate block transactions depending on the number of coins they hold.

Bitcoin Mining and Energy Consumption

In the mining process, various miners compete against each other to complete transactions by solving the mathematical puzzles and add a block in the Blockchain network. By solving these computationally-intensive mathematical puzzles to produce the blocks, miners help to secure the network and keep it decentralized. For every successful hash value, the miner receives a block reward.

The mining process needs extremely specialized hardware and consumes extensive power. The Bitcoin software ensures that it always takes 10 minutes for the mathematical puzzle to be figured out. With the increase in the number of miners, the puzzle gets more difficult and requires more computing power. Statically, according to the Cambridge index, one day of Bitcoin mining is slightly more than the electricity consumed by all the commercial buildings in the United States in two months.

To quickly mine Bitcoins, advanced ASIC chips, such as NVidia CMP HX, are required for the rigs. The rigs are heavy-duty GPUs requiring high-wattage power supplies to handle the mining calculations. Recently, due to the increased demand by crypto-currency miners, there is a global shortage of chips in the semiconductor industry.

Mining uses powerful computer chips and air conditioners to keep the CPUs cool as they churn 24×7 at complex calculations. All of that consumes an excessive amount of electricity.

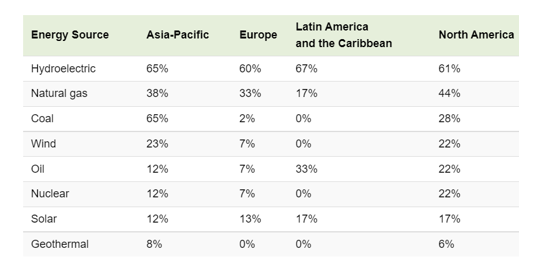

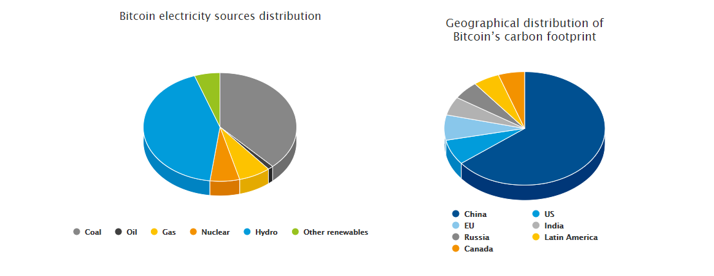

Additionally, hydroelectric energy is consumed by at least 60% of crypto miners across all different regions such as Asia Pacific, Europe and Latin America. On the other hand, other types of clean energy are not much utilized.

Renewable sources, for example solar energy, present problems with their inability to generate consistent and sufficient power for full-day trading without interruptions of shutdowns.

“Shutting down for any period of time is extremely unattractive for the Bitcoin miners who have only a very short period of time to earn back their investment. In terms of profit maximization, they will always prefer never having to shut down,” Alex de Vries, creator of the Digiconomist website tracking crypto’s energy consumption, was quoted by a news agency.

“This makes them the ideal customer for obsolete fossil fuels rather than renewables since these are both cheap and a source of constant power,” Alex de Vries added.

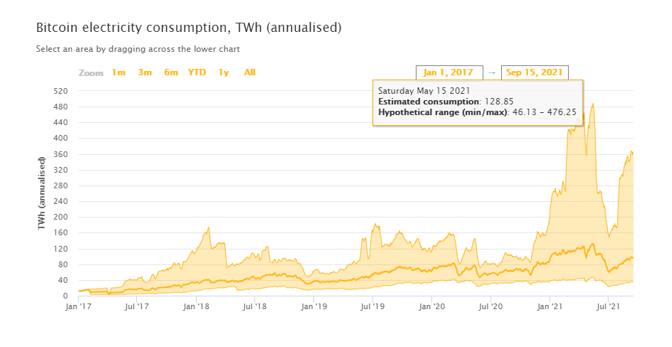

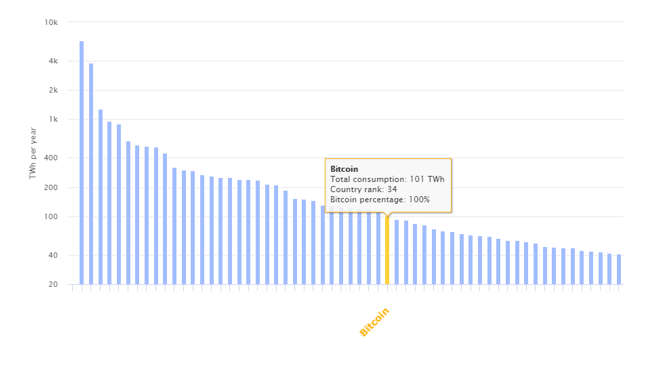

The University of Cambridge Centre for Alternative Finance (CCAF) analyzes the increasing business of cryptocurrencies and has laid out annualized Bitcoin’s total energy consumption in terawatt hours (TWh). At its present level, Bitcoin consumes 101 terawatt hours (TWh) annually. If Bitcoin were a country, it would be in top 30 energy users worldwide.

Bitcoin Energy Consumption – Country-wise Comparison

If one wants to gauge the energy consumption by Bitcoin, it can be said that it uses more energy than the Philippines (see the figure below). Country comparisons are used in the public debate to support positions of concern over the scale of Bitcoin’s electricity consumption. As seen in the figure below, Bitcoins use less energy than the Netherlands and the United Arab Emirates.

Bitcoin and Carbon Footprints

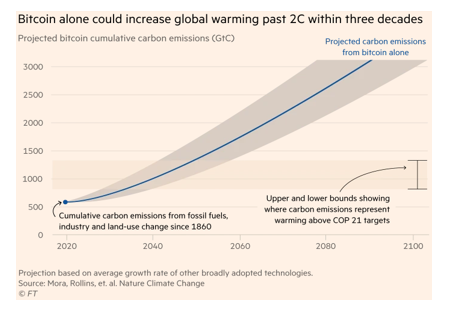

Another challenge with Bitcoin mining is that it generates carbon footprints comparable to that of New Zealand. Bitcoin can produce sufficient carbon dioxide to push global warming above 2 °C within less than three decades.

Figure 7 below illustrates the geographical distribution of Bitcoin carbon footprint and Bitcoin electricity sources distribution. Coal comprises the highest share in Bitcoin electricity sorces distribution, China has the highest carbon footprint produced by Bitcoins.

How to Overcome Bitcoin Mining Drawbacks

As described above, Bitcoin mining uses as much electricity as a medium-sized country. But there are few easy ways to change that.

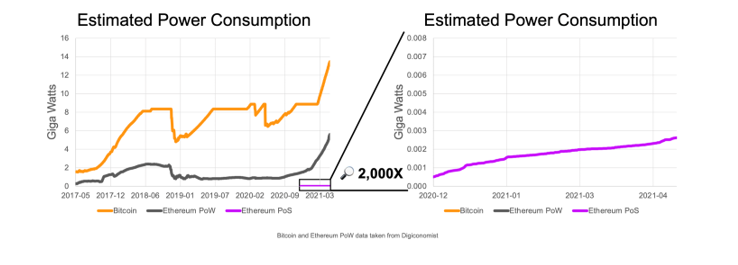

1. Proof-of-Stake: It is more energy efficient than Proof of Work as it eliminates the competition among the miners. PoS validates the block transactions depending on the currency ownership. It eliminates the requirement to spend an extensive amount of electric power in order to validate the blocks. Proof of stake is used in Ethereum. In other words, Ethereum is moving from proof-of-work to proof-of-stake. As per the diagram below (Figure 8), Ethereum uses less electricity than PoW.

2. Proof of authority (PoA): Under PoA, the rights to produce new blocks are assigned to the nodes, also called validators, which have proven their authority to do so. In Proof of Authority, there is no competition between the validators. Also, it requires no electricity for its operation.

Priority-Year-Wise Distribution of Patents

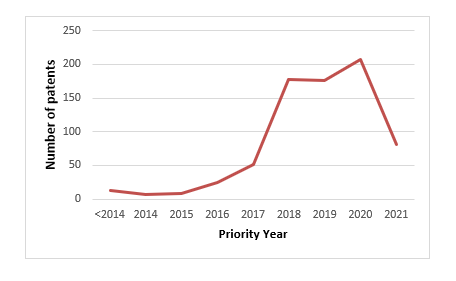

The below data in the Blockchain energy consumption domain reveals how the filing has increased in recent years. With 207 applications, the year 2020 saw the highest number of patents filed in this sector. (Note: the data for 2020 and 2021 would not be very accurate since most of the patent applications might not have been published yet. This is because the patent office takes nearly 18 months to publish a patent application).

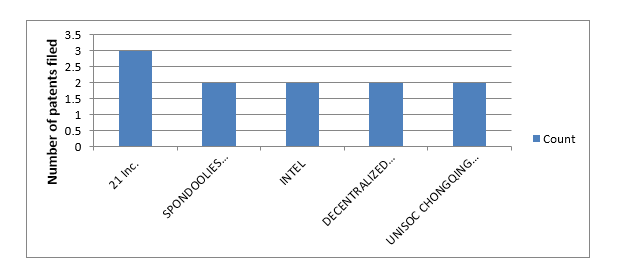

Top Companies with ‘Bitcoin Energy Consumption’ Related Patents

Sagacious IP performed mining of Bitcoin Energy Consumption-related patents and identified that different companies are filing patents for an increased energy usage in Bitcoin Mining. While 21 Inc. leads the race with maximum patent filings, it is followed by Spondoolies technology and Intel.

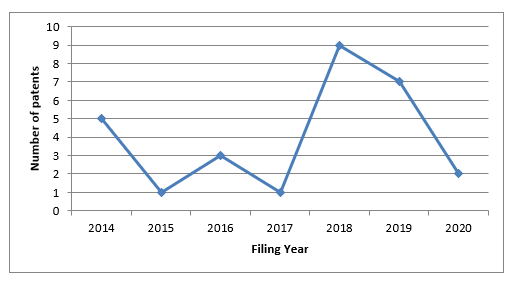

Priority-Year-Wise Distribution of Patents

Figure 11 data reveals information on the number of patents, related to efficient energy usage in Bitcoin, filed across different years. The maximum number of patents were filed in the year 2018.

Market Trends Related to Blockchain and Bitcoin

- Twitter owner Jack Dorsey’s payments venture – Square announced that it will partner with blockchain technology firm – Blockstream Mining to build an open-source, solar-powered bitcoin mining facility in the U.S. The goal is to facilitate the adoption and efficiency of renewables within the bitcoin ecosystem.

- A blockchain start-up named Candela Coin recently developed solar-powered eco-friendly cryptocurrency mining protocol. This platform would also be environment-friendly while offering eco-incentives for Bitcoin mining.

- Ziyen Energy is planning to install solar panels to back its bitcoin mining operations in Colorado’s Alamosa County.

- Atlas Power is planning to use solar power to back its energy-draining business. Atlas Power mines cryptocurrency and plans to construct eight more buildings of servers containing thousands of graphics processing units.

- IMD Companies Inc., which is focusing on mining bitcoin, has upgraded the server mining rigs and implemented solar-powered crypto mining to take care of the power cost.

- Solteir, a bitcoin mining firm, has partnered with OPTEC International for renewable energy mining. As per the partnership, Solteir will use OPTEC Solar Paneled Generators to mine Bitcoin.

Conclusion

As Bitcoin mining leads to excessive energy consumption and Co2 emission, solar energy becomes a green alternative for Bitcoin mining operations. However, renewable sources, for example solar energy, present problems with their inability to generate consistent and sufficient power for the full-day trading without interruptions of shutdowns. Therefore, the alternative is to shift to Proof-of-stake technology, as discussed above. Meanwhile, companies are gradually coming up with solutions to make bitcoin mining process – environment-friendly. Resultantly, patent filing in the sector has increased.

If you are looking to explore blockchain technology and the bitcoin mining domain and have great ideas, Sagacious IP is committed to turning them into patent-worthy inventions. Our team of skilled patent practitioners is adept at providing services such as technology scouting and patent monetization to help businesses generate revenue.

- Gagan Dua (ICT Licensing) and the Editorial team

Having Queries? Contact Us Now!

"*" indicates required fields