Contemporary & Hybrid Technology Watch: Staying Ahead & Mitigating Disruption Risks – Webinar

Table of Contents

Why is this topic critical for the target audience?

- Hundreds of thousands of patent applications are filed globally every year in varied technical domains and therefore to compete within the market and minimize risks, a strategy involving monitoring patents and non-patents is vital.

- Monitoring and analyzing details published through patents and in the non-patents provide exhaustive information that will help a company innovate continuously and be at par with its competitors.

- Monitoring patents (and technologies) helps in keeping oneself up to date in technology areas and in being aware of any new development years ahead of the actual product launch.

- Monitoring technical domains enables decision making in determining obsolete technology/patents and corresponding market significance.

Key points to be covered in the webinar:

- How to setup a technology monitoring and factors to be considered in setting up monitoring.

- How to use the information obtained through technology monitoring.

- How does technology monitoring help in risk mitigation?

- How does technology monitoring help in identifying licensing opportunities?

- How does monitoring help in strategizing the way ahead for Research and Development?

- Case Studies on How Sagacious IP Helped its Clients in monitoring domains for making effective strategic decisions.

Moderator: Ram Tenneti, EVP – Business Development, Sagacious IP

Speaker: Harsha Agarwal, Assistant Manager LSC, Sagacious IP

Submit Your Information to watch the Webinar Video:

"*" indicates required fields

Webinar Transcript

Ram Tenneti – Hello and welcome everyone to the webinar!

I sincerely hope that you and your loved ones are doing great amidst this crisis. This is Ram Tenneti, Executive Vice President for business development at Sagacious IP, and I’m signing in from India to welcome you all to our webinar today.

Just to give you a quick hint, this is the second in the series of five webinars and today we are going to discuss on the topic Contemporary and Hybrid Technology: Watch Modern Way to Ensure Timely Actions, Staying Ahead, and Mitigating Disruption Risks.

Before I go on to introduce this topic and the esteemed speaker on our session today, I am delighted to welcome all the participants from different countries. Just to give you a quick note, your participation is a wonderful engagement and encouragement for us to all the efforts. We’re making constant attempts to ensure that we get information to you and keep spreading the knowledge.

Now, our speaker for the session today is Devika Saini. She’s the manager with the Life Sciences team. She is a qualified Indian Patent Agent, having over seven years of experience in several projects that include Patent Analysis, and also her core competencies in identifying and assessing IP in the fields of Biotechnology, Microbiology, Biochemistry, Genetic Engineering, Food Technology, and Medical Devices.

Welcome to the webinar, Devika.

Devika Saini – Thank you, Ram! Thanks for having me here.

Initial Remarks

Ram Tenneti – Wonderful!

Now, before we set off with the presentation today, let me ask Devika for her initial remarks on this topic Contemporary and Hybrid Technology Watch: Modern Way to Ensure Timely Actions, Staying Ahead and Mitigating Disruption Risks.

Devika Saini – When there’s an upcoming technology or there’s a forecast for upcoming technologies, they are forecasted to do well in the immediate future. Most businesses, they are intrigued, and they want to invest in that technology.

However, the technologies are past innovation stage already by the time they reach the market. It is actually the time for expansion rather than innovation. The right time was when patents were actually filed and researches were getting published. This is a loss to the businesses who wished to invest in that technology.

Therefore, to avoid this gap, contemporary or hybrid monitoring technology can address points of innovation timely so that decision makers can strategize accordingly.

Ram Tenneti – Thanks Devika for setting the context for the webinar.

Now, let me tell you that the participants of this webinar can drop us an e-mail later at [email protected]. We’ll keep sharing the information with them. Let us now get started with the main part of the presentation, and for that let me invite Devika to take us through the Webinar.

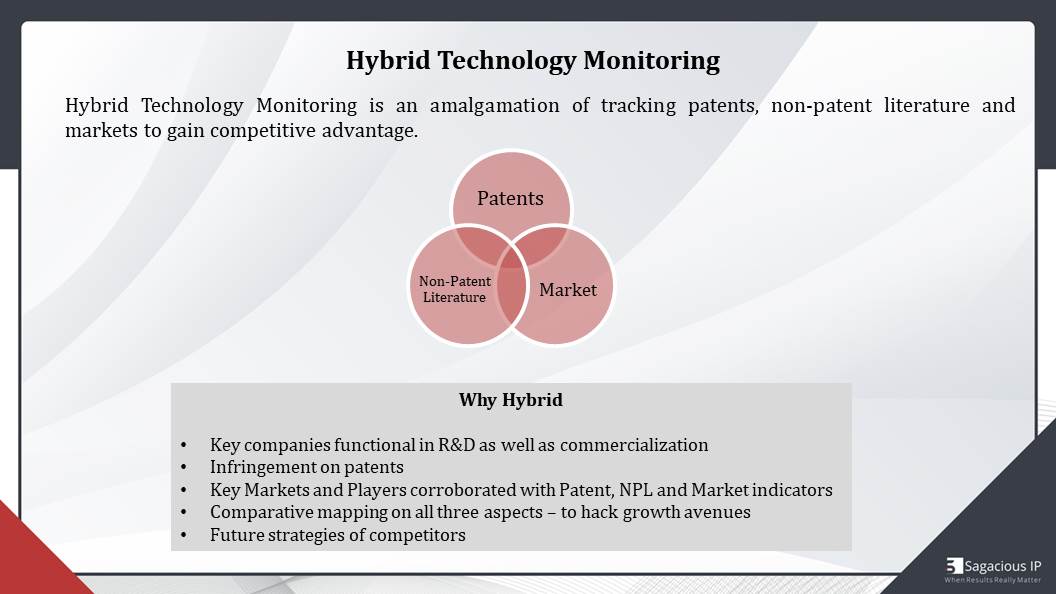

Hybrid Technology Monitoring

Devika Saini – Let’s begin with what a Hybrid Technology Monitoring is and why such kind of technology monitoring is important. Just to give an overview of this type of monitoring, it is basically an amalgamation of tracking Patents, Non-Patent Literature and Markets to gain competitive advantage. The benefits, which arise from such technology monitoring, are key indicators which are Patents, Non-Patent Literature, and Market.

The benefits, which come out of this kind of monitoring technology and the insights, which are received, are the key companies functional in R&D as well as commercialization; they can be identified. Specifically, infringement on patents can be identified. There can be comparative mapping of information derived from Patents, Non-Patent Literature, and Market to hack growth avenues and future strategies of competitors.

Now, there can be a question why all three components are required and why not just one or two of them. To answer that, I would like to mention that patents are published after quite a long time, once they are filed. Moreover, not everything, which is patented, is actually percolated in the market.

They can be some information derived about innovation or disruption in the technology from the patent information. The data which can actually validate that research can be obtained from literature, which includes research papers, articles, product descriptions from different companies’ websites, and, of course, from market news, which is constantly updated with new trends and information related to licenses, partnerships, collaborations, et cetera.

All in all, the information is combined from all three parameters. After removing any option of false positives, the final insights are delivered so that the comprehensive view of the whole technology space can be achieved.

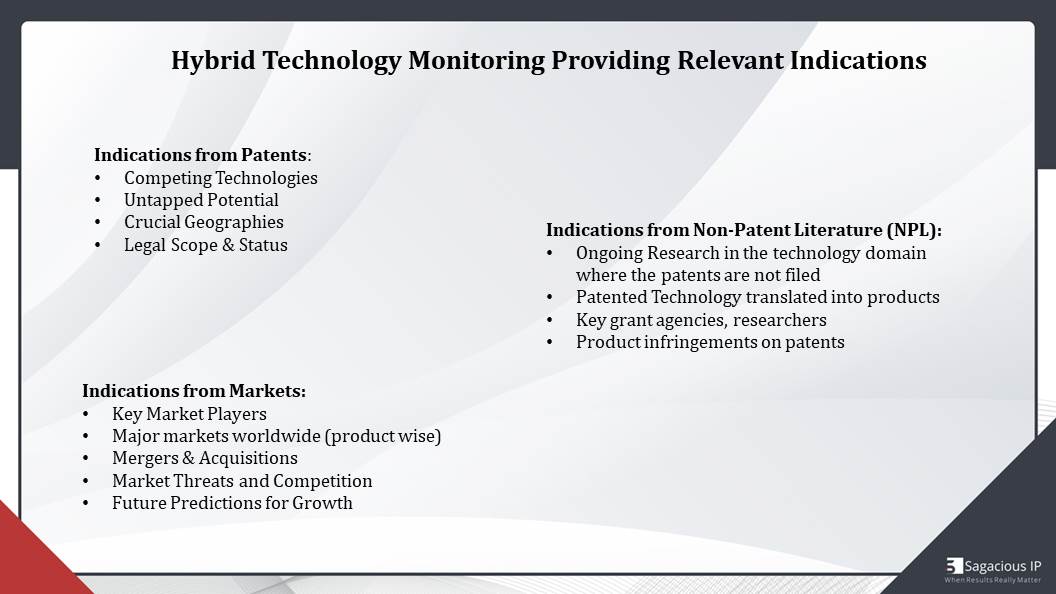

Hybrid Technology Monitoring Providing Relevant Indications

As I mentioned earlier, there are different indications which can be achieved by Patents, Markets, and Non-patent literature.

For example, patents can actually talk about untapped potential, and they can give a very nice view of top leading geographies, legal scope, and status of technologies. This information is specifically limited to patent, because scope of claims and how technology space is protected are obviously restricted to patent coverage.

Similarly, non-patent literature can give information related to the products which are in the market and on which line the patents could have been there, and likewise related to markets, market threats, competition, and future predictions for growth, for example, revenue, CAGR. All that inflammation can be can be obtained from market analysis.

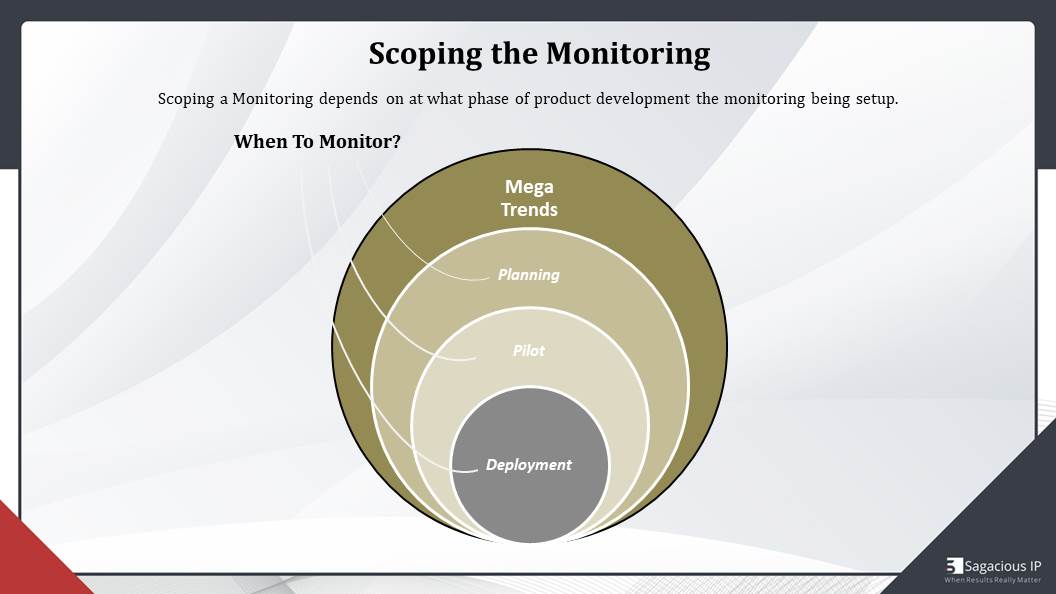

Scoping the Monitoring

The next question is how to scope the monitoring. We know what kind of parameters we are studying. We are studying patents, non-patent literature, and market. Moving on with this information, how we can scope the monitoring further is that there can be different trends which can be identified. Mega trends as we said, because mega trends are a type of trends which are very impactful on a global level. They are related to different parameters on a large scale of population, and how they can affect a company in planning, developing the technology, further moving to pilot stage or deployment of the technology. All these decisions can be affected based on these trends.

However, it is not necessary that monitoring needs to be performed in the same fashion and in the same order. A company can be at any place: planning, pilot stage, or deployment stage. At any stage, if it feels that it needs to monitor the activity, competition in the market, or in the technology space, it should go ahead with it.

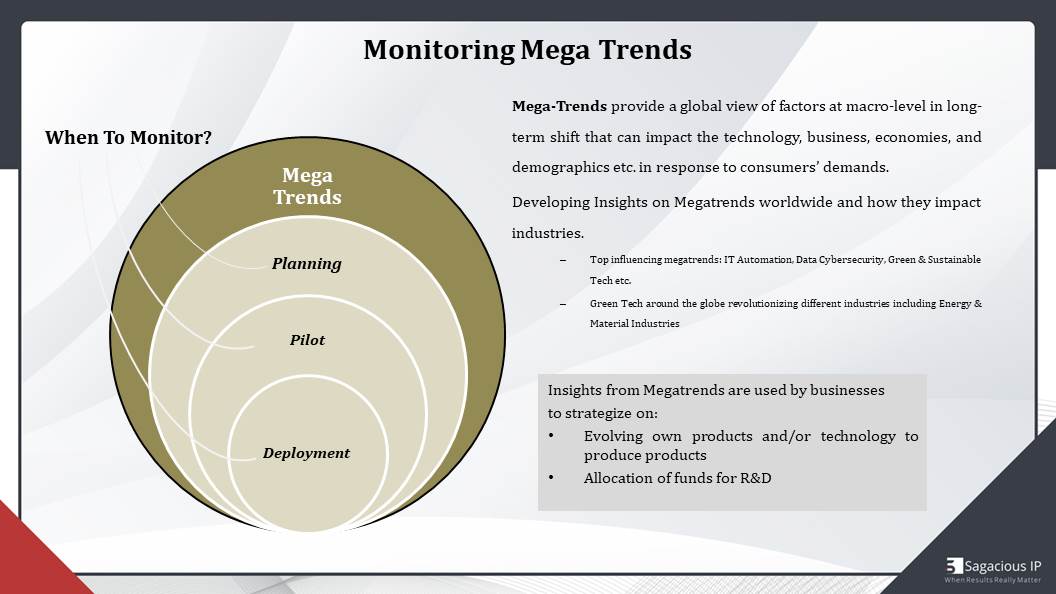

Monitoring Mega Trends

Mega trends provide a global view of factors at macro level in long-term shift that can impact the technology, businesses, economies, and demographics in response to consumers’ demands.

An example is in this category – mega trends for this year. Major Mega Trends are IT Automation, Data Cyber security, and Green & Sustainable Technology. If we take an example of green and sustainable technology, this particular technology is very impactful on energy and material industries. These are industries which can actually take note of green technology and sustainable methods, and they can implement these things in their specific subsectors.

These insights can be useful for businesses that are planning and strategizing whether they should evolve their own products or they should work on new technologies, and whether they should be tweaking, making small improvisations or think about some disruptive innovation. All these kind of decisions can be taken into consideration based on these trends and also the amount of funds which they need to allocate for such R&D. This this thing can also be determined.

Taking example of the current situation, as we all know industries which are not directly related to essential services, they are really hit. Most of these industrial sectors are not really relying on much of R&D and strategizing. Definitely they are planning on how to push past this situation and move ahead further. Different businesses and different industries, they can have different support from such kind of information in planning the way ahead.

Identify Mega Trends

How do we identify mega trends? The key point , which mega trends can address from, while we analyse them, are key geographical coverage of industries. Since megatrends are at the global level, so their coverage is also on a very large scale. Instead of just focusing on some limited competitors, limited companies, subsectors, or small technology areas, their focus is mostly across industries.

Further, these trends can give information related to key players in those geographies and in those industries. They’re usually long-term in nature so, trends, they are studied and translated over a long period of time, around 3 to 5 years. They provide information related to comparative trends across industries and companies, and, of course, market presence and consumer behaviour.

To understand the analysis, which goes beyond identifying mega trends, is a global technology landscape searches, which are hybrid and cover all the three points Patent, NPL, and Market. To add to these insights, competitor monitoring and commercial monitoring can add great value to the insights which are produced from mega trends.

Exemplary Case

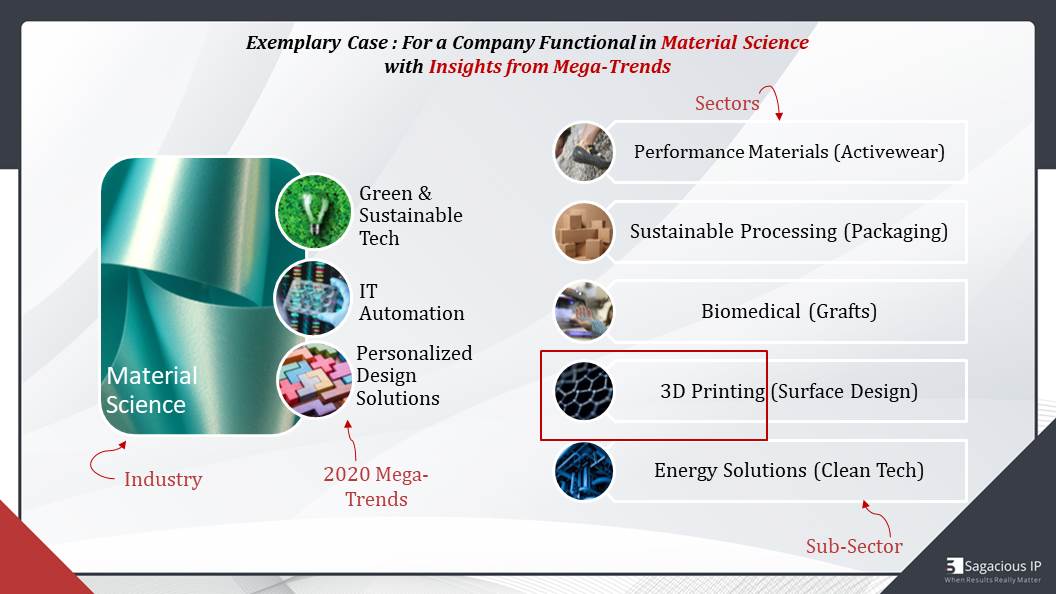

This is an exemplary case: for how a company functional in Material Science can actually read and understand mega trends and its impact on them. Moving forward, I will use this example to explain how different stages of planning in pilot scale and deployment, which are used by businesses, can be relatable to this example.

Starting off with the industry which is material science and the trends which have been identified from analysis, there are three key trends which we think can, actually, impact material science industry. These three trends are Green and Sustainable Technology, IT automation, and Personalized Design Solutions.

This information is very preliminary in nature, and this information is derived from analysis on a very broad scale. Industries, which are under material science, and their sub sectors, which may have a direct implication or an indirect implication from these trends, are also highlighted.

For example, different sectors of material science industry are Performance Materials such as Activewear, Sustainable Processing such as Packaging, Biomedical (Grafts), 3D Printing, and Energy Solutions. These industries, one way or the other, may be impacted by these trends in the material science industry.

For example, a company – its competency, its core skills, and its functional capabilities are more related to 3D printing. With the help of next few slides, we will be able to see how a company can use this information in developing something on 3D printing and making sure that its innovation or the technology can be viable for commercialization.

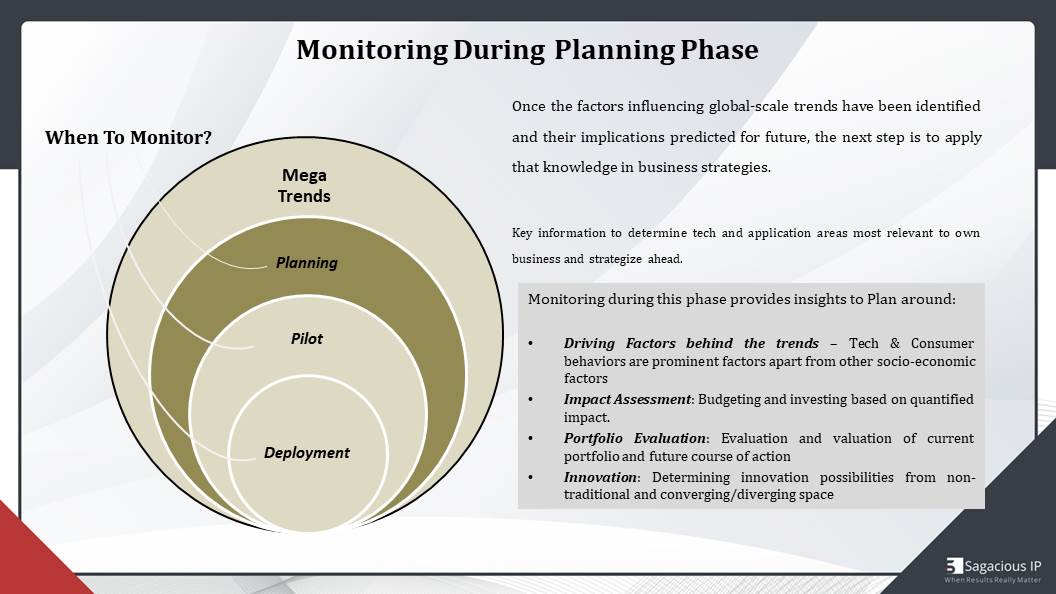

Monitoring during Planning Phase

Starting off with the first phase which is planning phase – if a company or an organization has not considered mega trends before and it is not aware of how trends can impact its business strategies, even then it is definitely engaged in planning, because planning is something in which every business is investing in. The information from mega trends may be used in planning stage, or even if it is not there, even then planning stage can be used from the very beginning to consider the following factors which need to be taken care of and wherein monitoring can really help in understanding how different insights are produced and how they can help their businesses in planning stage.

The number one is: what are the Key Driving Factors in technology space and consumer behaviours? What are the key factors which are prominent? Apart from other socioeconomic factors, how people are interested in technology? What are their demands? How are their reactions to different products coming into the market? What drives people is, I think, a point of interest for many companies to focus on what to do next.

Another is Impact Assessment. It is very important to know, before starting off with anything, how any company would like to budget their investments and how they would quantify that based on the impact the investments may have.

For example, based on the current situation, many companies, which are working in non-essential services, might not be doing a lot of budgeting into that. For example, companies, who are into packaging, they might be doing well, because most of the people, right now, are doing a lot of online shopping. A lot of goods and services are being processed further through online platforms, et cetera. Maybe, this industry might not be that hit as compared to any other industry.

Another factor is Portfolio Evaluation. Every company should be aware of how their portfolio is evaluated, whether they should expand on the current portfolio, whether they should move on, tweak it, make some changes in it, commercialize it, license it, or how to move forward with it basically with the existing IP they have.

Lastly, Innovation, determining if there’s any possibility and any way ahead, moving away from non-traditional technology space or whether they should focus on something which is converging into the technology space or maybe something that is a bit unrelated but slightly related to their technology space. All these considerations are very important in the planning stage and how a company can strategize further.

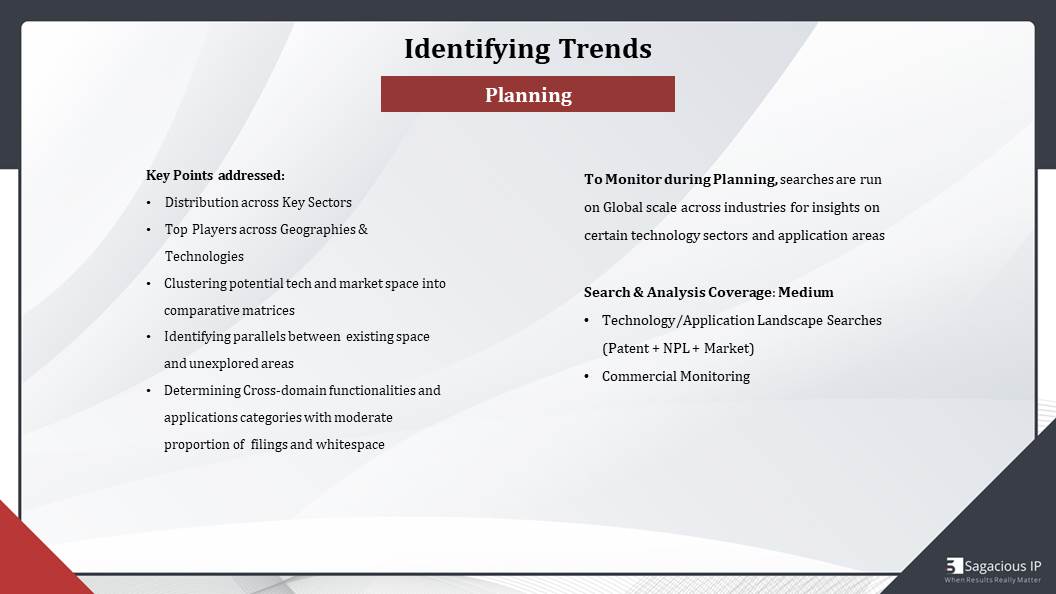

Identifying Trends – Planning

The key points, which are addressed during planning stage, are distribution across key sectors, top players, which are working across geographies and technologies and if there is any parallel between existing space and unexplored areas, also determining cross-domain functionalities and applications with moderate proportion of filings in whitespace.

This kind of analysis is not as broad as mega trend analysis, but it is not very narrow to limit everything, because we are also talking about cross-domain functionalities, application categories, which may be beneficial to a company. The coverage of such analysis is sort of medium and it is not very broad; it is not very narrow. The kind of searches, which are performed, are technology and application scouting and commercial monitoring to understand how technology level changes are getting reflected.

Planning Stage: Hybrid Landscape

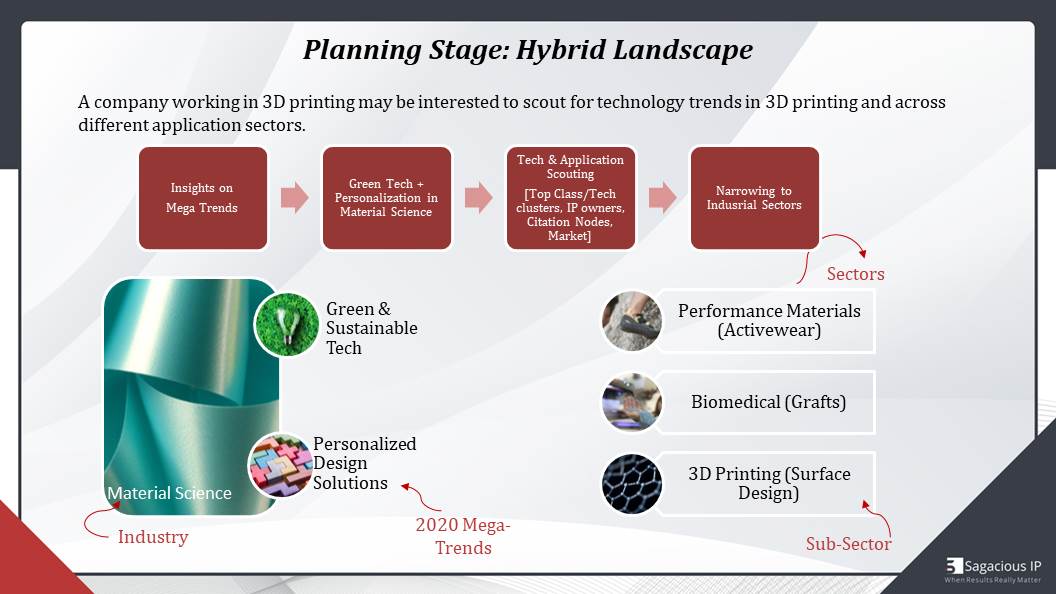

Coming back to this example, which we discussed earlier, if we narrow down from the mega trends to this planning stage, we can see that there has been a change in how things were before and now how things are.

Like, earlier, there were three mega trends, which were considered for material science industry and which were Green and Sustainable Technology, Personalized Design Solutions, and also IT Automation. However, based on some monitoring activity which was performed at planning stage, it was decided that IT Automation can be removed from the picture in this case when we are talking about certain limited sectors. As we see, earlier, we were talking about five different types of sectors. They were Performance Materials, Biomedical Grafts, Energy Space, 3D printing, and Packaging.

If a client is interested in something related to 3D Printing, they have functionalities and capabilities on 3D Printing. As per the initial analysis on planning stage, they can understand that, at this point of time, certain trends, which are very relatable to their industry or their sector, are Green Technology and Personalized Design Solutions. While, in terms of relatable sectors which may be similar in terms of technology they’re using and in terms of application they are working on, they are also very similar to their sector. Now, we have just limited this analysis to Performance Materials, Biomedical Grafts, and 3D Printing.

This analysis is basically based on identifying top classes, which are relevant to the technology of interest, Key Players, IP owners, different citations & their analysis, assignees citing our technology and assignees with whom the company is citing. All that information used come to this result and obviously market information to add-on to the quality of insights.

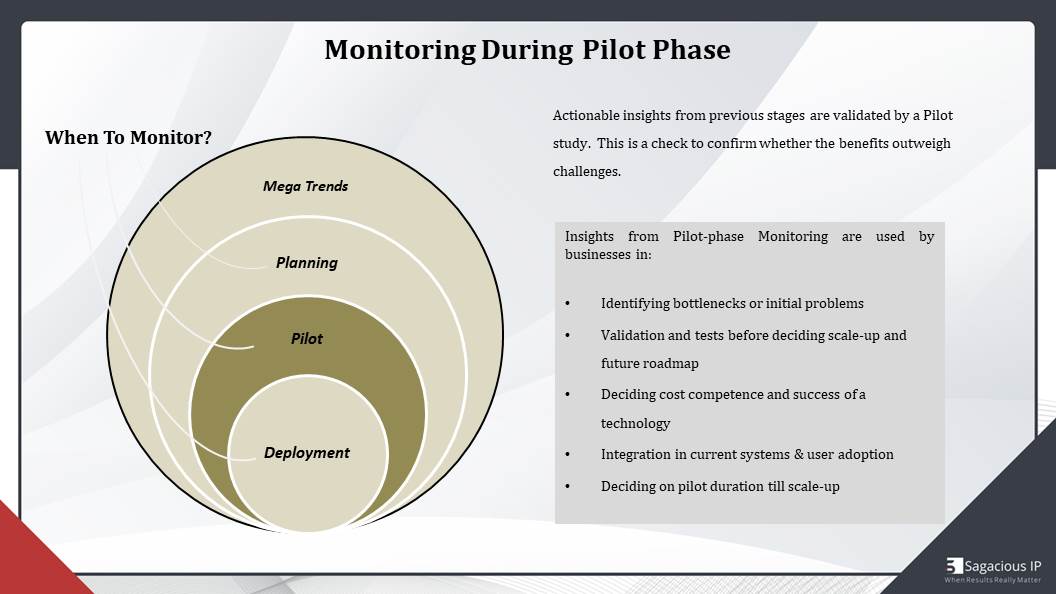

Monitoring During Pilot Phase

At this point of time, we have moved on from planning stage, and now we are looking at a pilot stage study. At this point of time, if a company is just starting out by bringing a pilot stage product or they just want to test its technology whether it is good enough to be introduced further in the market or not. This is a very important and crucial point for any company to check whether its pilot is performing well or not. This is the point when it would like to know that the benefits outweigh its challenges.

The kinds of insights, which can be drawn from a pilot phase monitoring, are identifying bottlenecks or initial problems. Those problems, which are just straight away visible, need to be worked upon very soon, and then validation and test, before deciding scale-up and future roadmap. There can also be a case where validation and test are required from a third party. Before introducing something into the market, there can be some regulatory approvals required. There can be also some geographical limitations before coming up with a market product. All these tests and validations need to be taken care of and whether a company should proceed with this or not.

The next are Deciding Cost Competence and Success of a Technology. There has to be some calculated risk involved, and there has to be some level of hope that the technology can do well once it is there in the market. In terms of cost, it should be competent enough to match current technologies.

Another point to ponder on is whether it needs to be integrated in current systems or not and whether there can be easy adoption by the user. That will be a challenge or not. Certain platforms are very easy for the users. They’re very friendly for users – their interface and everything. However, sometimes, there is a learning curve associated with some new products or new technologies for users. We need to address whether that learning curve is too big or it is manageable. Further, deciding on pilot duration to scale-up, like, how long a pilot needs to be settled. All these considerations and all this analysis can be provided by performing a monitoring search at pilot phase.

Identifying Trends – Pilot

The trends which are identified at this stage include technology grouping and clustering within a niche filing area, because now we are very specific regarding our technology. We are not scouting for any technology application areas. We know what we are working with, and we are focusing on some niche technology areas, how IPs present in that area, and if there is any scope of improvement or not.

Also, since it is very nascent stage for technology, a company might also be interested in identifying incubation options, partnerships, and licensing opportunities. All these key points are addressed while performing this type of monitoring. Search and Analysis coverage is much narrower than it was before in the previous phases, because in this phase we know what we are getting into and we need to check whether it can be a success or not.

The kinds of searches, which are performed in this time, are FTO Searches and Novelty Searches to know if there is any unique point, which the pilot technology has or which may provide an edge to the technology from other competitors.

Commercial monitoring is also very important – just in case, unknowingly, if the technology infringes on any other competitors IP or not. All these information and insights can be obtained from trends which are obtained from a pilot level monitoring search.

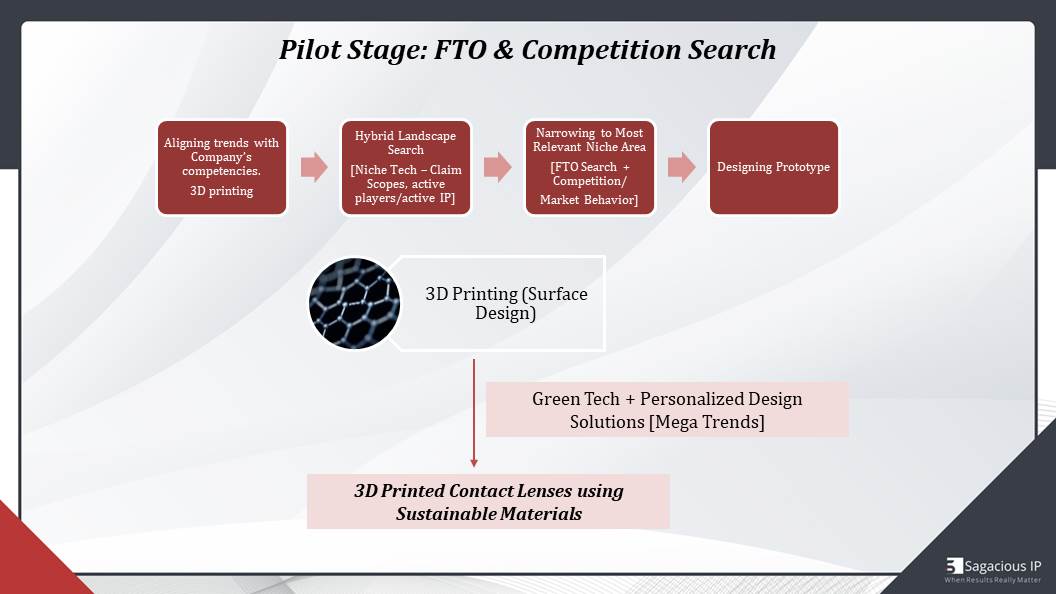

Pilot Stage: FTO & Competition Search

Coming back to the previous example, at that point of time, previously, we had three sectors in our mind.

We had 3D printing and two other subsectors in our mind. The company might work on any of those three technology areas. Now, we already have a pilot scale technology. We have finalized a product or a technology to work upon, so the company can, now, finally, limit or narrow down their analysis just to one area with all the information they possibly needed from every other industry and trained knowledge which they can utilize while working on this technology.

Now, 3D printing technology has been finalized by the company, and if we remember the trends, which we really thought that could affect this technology, were Green Technology and Personalized Design Solutions which we earlier identified in the previous example. Now, narrowing down everything together and building on some innovation in that area, the company can design the prototype around 3D printed contact lenses using sustainable materials. Here, 3D printing technology is the core technology or the subsector, which we were talking about. Green technology is reflected in the sustainable material which we are using. When we talk about sustainable material, it might be a material which is good for the environment. It is very relatable under the category of green technology.

All these things, when combined, can produce this kind of prototype, obviously, in the careful analysis and innovation. The kind of information or analysis, which has been performed, is related to narrowing down niche technology, claimed scopes, active players, further, key features, which are very relevant and performing FTO searches on those key features plus understanding market behaviour. Based on the analysis, pilot solution can be achieved.

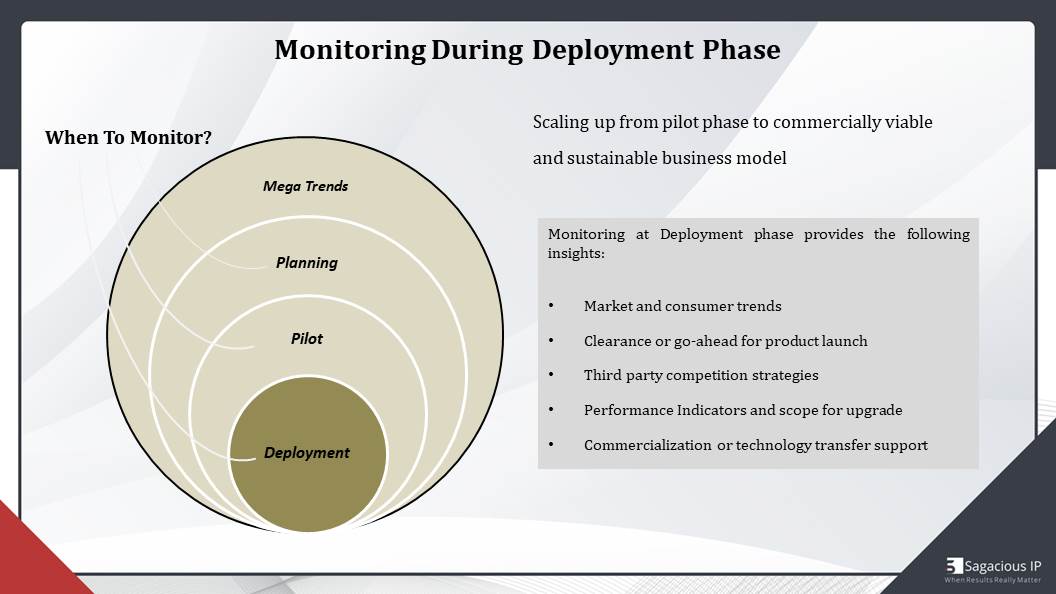

Monitoring during Deployment Phase

The last stage is Deployment Phase, and how this can be worked upon using monitoring insights. A company needs to understand – they need to determine whether their pilot can actually provide commercial benefits or not and if the technology is commercially viable and can be a sustainable business model or not.

To get insights on that, the following trends can be understood: Market and Consumer Trends. What is driving them, them as in consumers? What are different demographics specific limitations or benefits a company can derive which can impact their technology before deployment? Whether they have any clearance or go-ahead to launch their technology in the market? Any third party competition strategies, which they need to come up with so that their technology is risk proof. Then, there can be some performance indicators and if there is any scope of upgradation or not.

Coming back to that example of contact lens, which we were talking about, – the innovation part in that contact lens might be around using sustainable materials, which are based on green technology. The company can also look out for competing technologies – whether there is any competing product in the market, which is also using sustainable materials in its contact lenses or not and whether there is any index or parameter on which the sustainability of both products can be compared or not, like, out of an index for ranking of 10, whether its product is at 8 or a competitor’s product is at 7 or 9. They can come up with some performance indicators, and they can check whether there is a scope for upgradation or not.

Another example is when we talk about personalized solutions we took some information from this trend. Personalized solutions are also gaining momentum as very popular trends. And, we can think whether the contact lenses, which are prepared, can be personalized to colour contact lenses with sustainable materials or not or is it just that clear contact lenses are made up of materials, which are sustainable, but, the coloured lenses, they are using some coating or some pigment, which is not sustainable. Here, there can be a tricky situation when it comes to personalization and sustainability. These small yet significant areas can be compared with their counterparts or with their competitors to understand how their technology can fit in the market.

Lastly, a company may also want to have some commercialization support, like, some support in partnerships or licenses. This information can be considered and analysed from monitoring at deployment stage.

Identifying Trends – Deployment

The kinds of trends, which are identified at this stage, are market trends and technology trends, which are related to evaluation. Evaluating the technology to the very core, checking different competitive parameters to understand how it is behaving with its counterparts. Apart from that, commercial competitor and prosecution monitoring and profiling can be done to understand the competition better and to decide what kind of strategies the company needs to take to move ahead in their business.

The key takeaway from this stage can be getting to know what the performance indicators are as we discussed in the previous slide.

- Any litigation is there for the current IP or current technology in the market or not

- Any regulatory limitations, which may affect the company’s product or not

All these key insights can be derived from the study which is performed at deployment level. Search and analysis coverage is, therefore, very specific, and then there are different analysis parameters such as a SWOT analysis, Risk and Opportunities, and various types of company specific, competitors specific, and commercial specific analysis produced.

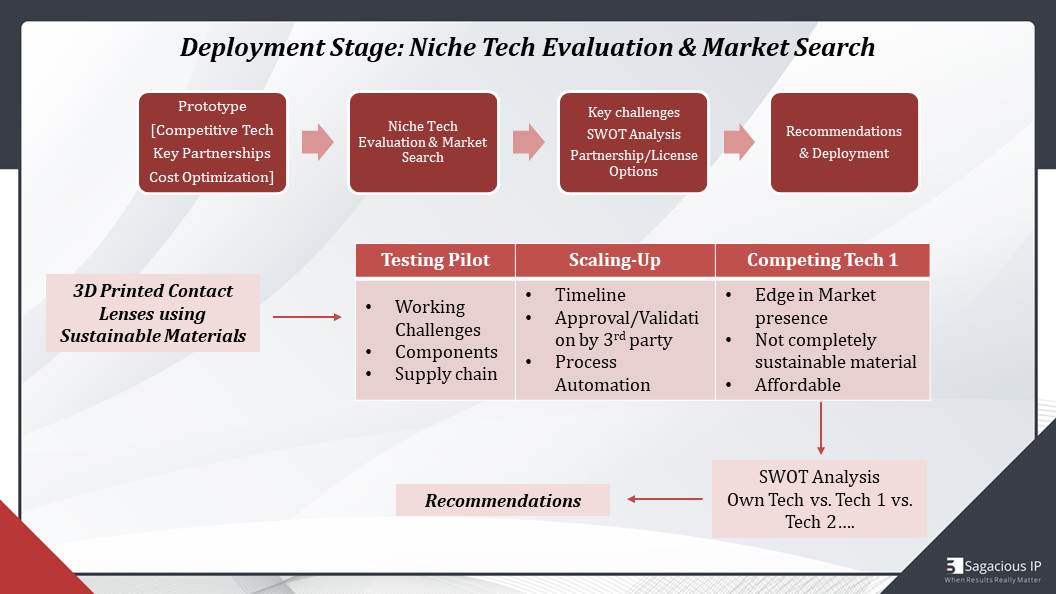

Deployment Stage: Niche Tech Evaluation & Market

Coming back to that example, which we were discussing from the very beginning – this is the final analysis of how things can shape up from that initial stage of just identifying mega trends and then moving one step narrower to planning stage, then moving one step further to the pilot stage, and finally to deployment stage. How the analysis is shaping up and how the key takeaway is shaping up throughout this chain. These can be analysed from this slide. Now, at this point of time, the study is very niche technology based, and there can be different parameters which can be studied.

For example, we have our product, 3D printed contact lenses, which is based on some sustainable materials.

There can be different points where evaluation can be done. Number one is Testing Pilot.

Now, we know the pilot has been tested, but the outcome of the pilot study – can we use those outcomes into our deployment study or not?

For example, whether the challenges, which were addressed during pilot stages – have they been addressed now or have they been worked upon? What are the components, which are used in pilot case – can they be still used like logistics-wise or supply-chain-wise? All these different parameters of logistics and supply chain – can they work or not for a scaled up process? When we talk about scaling up, what is the timeline? By how long time, this scaling up can take place. Is there any third party approval or validation required? Is there any process automation requirement or not? This process automation can be regarding production, or it can be also regarding any step in-between, which may affect the overall commercial viability of the product. And then, there can be analysis of a competing technology.

For example, there’s a competing technology 1 in the market. There can be this study around how this technology has an edge in terms of market presence and whether it is completely sustainable material or not and whether it is affordable or not. All these parameters and all these considerations can also be extended to different competing technologies, for example, Technology 1, 2, 3, and so on, depending upon whatever the results are.

And, of course, there can be SWOT analysis, predicting risk and opportunities and threats and how to work on them. Based on this whole information, the whole analysis recommendations can be provided to the company, and they can work around them and decide whether they should move on with deployment, or they should, again, focus on improving pilot.

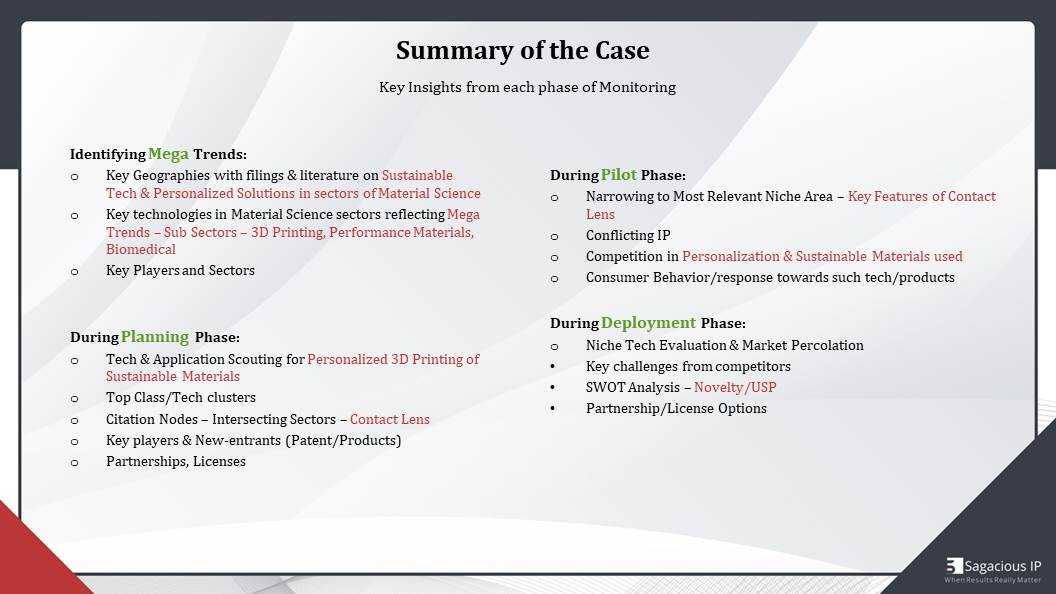

Summary of the Case

Just to have a brief summary of the whole case, we can take a look on the key insights, which are drawn from each phase of monitoring. During megatrends, we identified that there were few trends like sustainable technology and personalized solutions, which were relatable to material science. We identified key players and sectors. Then, during planning stage, we zeroed in on contact lens as our key sector where the company would like to focus on, and this information was analysed and brought by different type of technical analysis, like, class, citations, key players, et cetera.

At pilot phase, the focus was on developing key features of the technology and using specific trends only, not everything together but just the areas which are most relevant to our technology of interest. And then, finally, during deployment, checking whether there is any USP to the technology or not and how well it fits with competitors or not.

From the beginning till now, the analysis has narrowed down quite a bit, beginning with a very large scale data and factors that could affect an industry to narrowing down to different sectors and then subsectors, and finally a technology area.

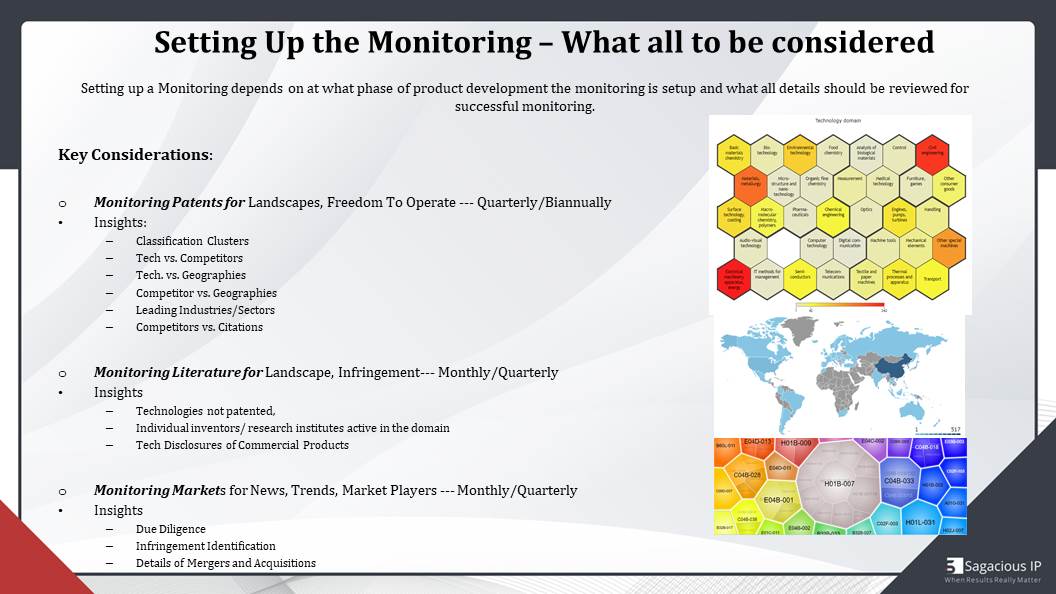

Setting Up the Monitoring – What all to be considered

The next questions which come to mind after understanding that example, are: how to set up a monitoring and what all needs to be considered? So, there can be key considerations when it comes to setting up a monitoring.

When we talk about patents, we know that there is a huge time lag between time they are filed and published. Based on that information, we can set up monitoring of patents as a quarterly basis or a bi-annually basis so as to cover major information and not to miss very upcoming trends.

The kinds of insights which can be obtained from patent data are technology clusters, competitors, key technologies across geographies and citation analysis. All this type of information can be obtained from patent based monitoring. Specifically, this patent based monitoring is very helpful in identifying what is considered as a disruptive technology, and its effects can be corroborated with a next type of monitoring indicator, which is literature.

In literature, we can consider landscape and infringement analysis. This can be done on a monthly or a quarterly basis because literature is published much sooner than a patent is. This can give a clear idea of what are the technologies which are not patented but they are readily available in the market or technology space.

There can be certain inventors and research institutes which are doing very well in a particular domain, but their filing activities are very low. They’re not filing aggressively when it comes to patents, but their work and their research are quite prominent and quite relatable to the technology of interests.

Further, commercial products – their disclosures can be determined from a literature analysis.

Finally, monitoring markets, it is one of the fastest modes of publication. The information is updated very fast in terms of news, trends, market players, business decisions with respect to partnerships, collaborations, Mergers and Acquisitions. All this type of information can be used to have insights on Due Diligence. When we say due diligence, it can be due diligence before strategizing on R&D or it can be due diligence before investing in another company’s portfolio. At any time, this due diligence can be performed.

Part II – Executing Monitoring and using Actionable Information

This brings us to the second part of our webinar, which is using actionable information from executing monitoring. As we have talked about insights and information, which are very useful and which are generated from all that analytics part, the next concern is how to use that information in making business decisions. Because, there are times when that information is being processed and created by some IP division or some other organization or other team, Business team is completely oblivious to what all they understand as insights: how this information can be transferred to that area and what the key points to be considered are. So that we can say that this information is actionable. We can actually bring some action from this information.

The key intelligence, which can be identified, is industry-wise analysis which is not just limited to competitors but to industry as a whole. In that way, we can have a broader outlook. We can have a broader perspective of identifying new entrants, start-ups and those key players, which we were not even considering as our competitors but they are doing really well in the industry, just because they were identified through some industry analysis.

Further, we can consider aligning sectors and intersecting sectors. There could be some sector or some technology space, which are citing our technology of interest, and they’re citing us basically, but they’re not very helpful or contributing much to our business as of now, but they may be helpful or they may support our business in the coming future. These kinds of sectors and players need to be considered for making next business moves.

Same with intersecting sectors, those sectors, which are not very similar to ours, but they cite from our own IP, they consider us some data points. Even, they need to be considered for making future decisions for future strategies, using their functional aspects or their application areas. Then, one of the most important takeaways in this kind of information is identifying disruption much before the technology percolates in the market and to get first-mover advantage. This is what most of the businesses would like to achieve. They are not too late to take any decisions with respect to investing on innovation and something which can bring them highly valuable returns.

Since there’s a lot of data at hand, it is very necessary to let go of traditional way of analysing intelligence and data. Actual contemporary and continuously evolving insights are taken into consideration so that any false positive, any data point, which is just coming across in the analysis, is not captured and worked upon, but it is actually a valid point. There should be no false positives because they can actually impact next business decisions. All these pointers can be helpful as actionable information for business to take the next decision.

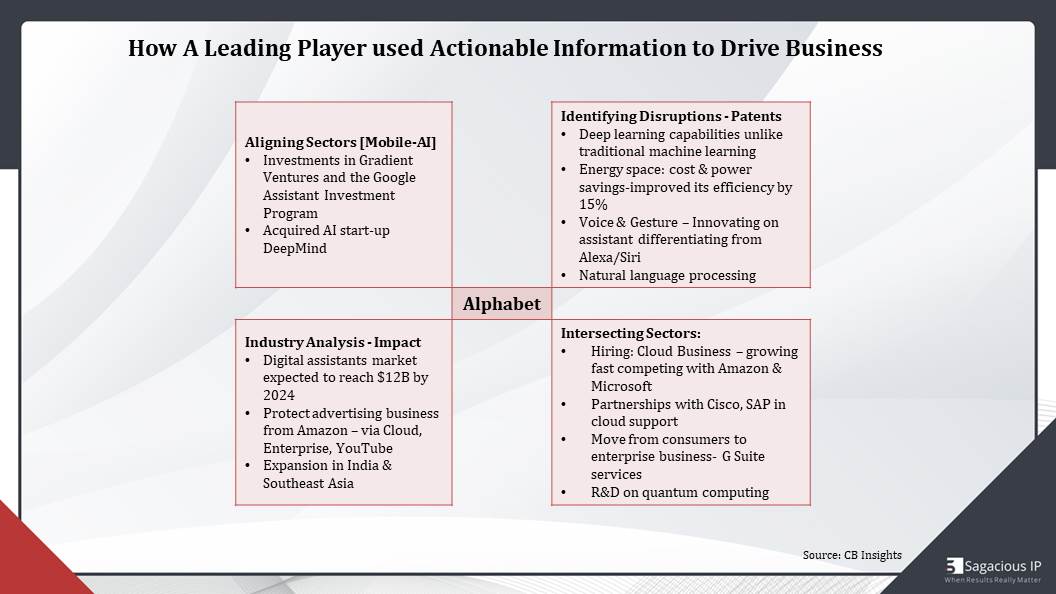

How a Leading Player used Actionable Information to drive Business

There is an interesting example of a player which is using actionable information to drive business. The company is Alphabet, which is a parent company of Google. We know that its main dominant business is Google, but there are a number of small companies that Alphabet owns. It helps further in extending its business further and supporting what Google is doing.

An example of how the company is using its capabilities and insights together. Aligning sectors, which are moving from Mobile to AI, identifying disruptions through patents by investing more in R&D related to Deep Learning and Natural Language Processing, understanding market analysis and its impact on digital assistant market. It is also protecting the advertising business from their competitors like Amazon through Cloud Enterprise and YouTube. It is working its way to expanding itself in India and South-East Asia.

These are the main sectors where Alphabet is really going well. These three sectors come in its direct aligned sectors. When we talk about intersecting sectors, it is hiring a lot in the cloud business. It is making partnerships with CISCO and SAP to do better in cloud. It is also moving towards enterprise with G suite and planning on quantum computing. These are the intersecting sectors that Alphabet is working on.

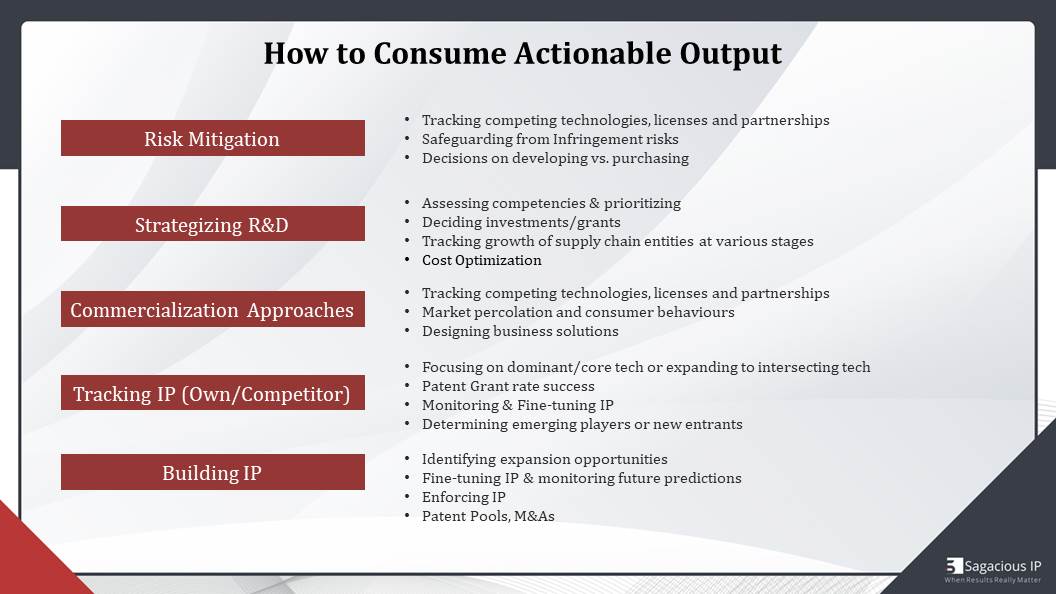

How to consume Actionable Output

Coming to how to consume such actionable output, we discussed in the previous webinar. There can be different objectives for an organization to work on and strategize on.

They would like to probably mitigate risk, improve the commercialization approaches, or build their IP. Based on these requirements or objectives, which they have, they can make decisions related to whether they should develop something or they should purchase a technology and whether they should decide on investments or grants, monitoring and fine tuning their IP, understanding market percolation and consumer behaviour, collaborating towards more patent pool and mergers and acquisition. Based upon the different kinds of requirements, different actionable output can be generated.

A Quick Recap

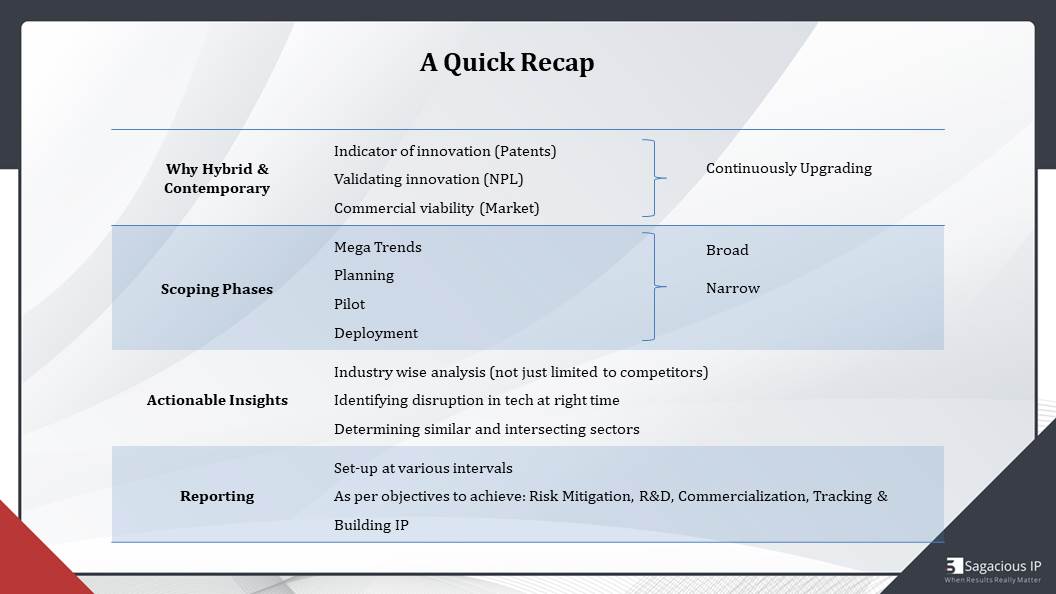

Just a quick recap of all that we have covered in this webinar.

Number one – why hybrid and contemporary searches are important there can be different phases how such searches can be scoped, what kind of actionable insights which we can gain from such kind of analysis, and how we can set up monitoring at various time intervals to get the best from the knowledge we are getting.

We move across these phases. We have understood that we are gradually narrowing down our analysis, starting off with very broad analysis and also continuously upgrading on information which we have received in the last analysis.

All these factors, they, together contribute to competitive and contemporary kind of monitoring service which is very helpful in strategizing way forward.

Finally, to conclude, I would like to re-iterate that technology is way past disruption at once it percolates into the market and monitoring technology space is very crucial to prevent any risk from untracked disruptions for any entity working in the technology sector. A continuous and hybrid approach is very important to understand and plan and eventually bring their technology to the market for any business entity.

This is all from my side in this webinar. Before signing off, I would like to mention that we have another webinar to follow-up. It is on Monitoring Different Stages of Patent Prosecution & Litigation to Mitigate Risk and Improve Commercial Strategy.

Questions and Answers

Ram Tenneti – Wonderful! Thank you, Devika! That was very informative and a very important session. I am sure SMBs and all the people, who have been listening, must have grabbed valuable information.

Now, having said that, I see a set of very important questions. I know that we’re running late, but let’s try to make the best use of time. We still have around 6 to 7 minutes. I’ll quickly cover some of the questions that we have from the audience, and then, probably, we can reiterate to the audience as and when we reach out to them.

What are the major considerations while you are setting up a monitoring report for identifying mega trends?

The first question that’s coming up, Devika, is what are the major considerations while you are setting up a monitoring report for identifying mega trends. How to use the insights in particular?

Devika Saini – There can be various considerations before setting up a monitoring, and it is really important to determine what stage they are in, what stage of technology or product is, and whether a business would like to dig deeper with more insights at that particular stage or they would like to proceed to the next phase. There is another factor, which is what the objective behind a monitoring setup is for them.

For example, in case of a research based company, it may want to focus on R&D and building IP. While a company is functional and outsourcing for R&D and further monetizing on the developed product, it may have a different objective like to mitigate risk or track IP.

Then, there can also be a timeline to consider, because how soon they want to achieve these objectives is also very important. Based on all these factors, a monitoring can be set up for regular intervals, which can be planned across the timeline, and which can be continuously updated so that scoping and insights are meeting their desired objectives.

What are Classification Clusters?

Ram Tenneti – Well, that’s interesting. Thank you for answering that.

There is also another quick question. I think this would suffice within the time, so let me ask. What do you mean by classification clusters? I think somebody’s referring to slide number 20.

Devika Saini – Classification clusters, they are basically prepared from different classes of technology filing such as IPC or CPC which are assigned by the patent examiner while undergoing that patent application. These technology clusters provide idea about how technology is progressing over time. The technology clusters can be broad, and then they can be narrowed down to different subdivisions and subclasses. Based on the information which is obtained from these classes, technology growth with time can be studied. This picture is an example of technology cluster.

Can I setup monitoring on my own?

Ram Tenneti – I have another interesting question, we can cover this as well.

Can I setup monitoring on my own? What are the advantages when it is done by profession? Can I do it on my own? Most of the people, here, would be thinking if this is something that we can do on our own, then why not?

Devika Saini – Right! This is a good question. Obviously, an entity can definitely set up monitoring on its own if it does have the right access to the right tools, platforms, and expertise together contemporary insights.

Mostly, it has been observed that some organizations start off with it. It is a tedious task for them, because they have to focus on their core businesses as well. Eventually, it, monitoring, takes up a backseat. Sometimes, there is a gap in between monitoring sessions, and when they come back to it, a lot of insights are lost.

On the other hand, if this whole thing is taken care of by some professionals in this industry, it can be a better option, because they are working on this day in and day out and on a very large scale data for diverse businesses. They have that kind of resources, experience, and expertise to constantly upgrade the intelligence across various sectors.

I would also like to mention that the professionals can update the organizations when there is any immediate alert or something that really needs their focus.

For example, some alarming situation of very recent activity before the organization actually has to deal with it. They can be helpful in this respect as well.

This way the organization does not need to compromise on its time by attempting to monitor regularly. It can completely focus on its core competencies.

Ram Tenneti – All right! That’s fantastic. I think we are done with time, so I will not be picking any more questions, although we have a bunch of them. I think, Devika, you have covered almost everything. That was fantastic. Thank you for your insights! It was really helpful, and everyone listening also felt the same.

Ladies and gentlemen! It’s been a wonderful session. Now, i’m sure every listener must have got great takeaways from this session and, they will be able to use several of these pointers when working in their businesses and in their own roles. Now, a few questions could not be taken up because of the time limit, but definitely we’ll try to cover them through our subsequent write-ups which we will publish post this webinar.

Thank you Devika again, and all the participants of this webinar can drop us an e-mail at webinar@ sagaciousresearch.com. I want to extend a big thank you to all the listeners who have helped the start on time and finish as well. We really appreciate your time and consideration and thank you very much.

Please do join us in our next webinar. Now, as I said earlier, this is the second in a series of five webinars. As Devika mentioned, we are going to continue deep diving into this subject, and we hope that all of you will come back and join us. Thank you. Have a great day ahead! Take Care!

Submit Your Information to watch the Webinar Video:

"*" indicates required fields