Hydrogel Patent Trends: Leading Innovators, Top Jurisdictions and More

Hydrogels have gained immense popularity in the medical domain, especially in implants and drug delivery systems, due to their high water content, softness, flexibility, and biocompatibility. As a result, the hydrogel-based medication delivery systems market value grew at a CAGR of 7.7% from 2017 to 2021. Numerous organizations from around the world, including Boston Scientific, AbbVie, University of California, and MIT (Massachusetts Institute of Technology), are innovating in the hydrogel space. An accelerated IP filing in this space has been observed in recent years, with more focus on materials/coating used in the prosthetics – indicating research around the implant materials.

This article discusses every aspect of hydrogel implants, their market growth, IP analysis, and current trends in drug hydrogel implants.

Table of Contents

Drug Implants and Hydrogel

Drug implants are implantable devices that help deliver drugs at a targeted site using polymer materials. They belong to the category of remote-controlled drug depots, which are valuable tools for administering drugs and releasing them in a time-bound manner. It may also help optimize the efficiency and tolerability of the drugs, along with their simplified administration. The use of these implants comes into the picture because of certain problems, such as immune tolerance, sequestration, and other concerns which may arise due to increased drug metabolism, different concentrations of the drug supplied in blood, etc. These problems can be controlled by synchronously releasing vaccine components from implants over a defined time period. Controlled drug delivery systems are essential to overcome these concerns. Common examples of these controlled drug depots include nano-particles, hydrogels, and liposomes.

Hydrogels have gained popularity as drug delivery systems in recent years. They are colloidal substances formed by the combination of water and solids, and possess a high absorption capacity, containing over 90 percent water. Moreover, using hydrogels in drug delivery systems has various advantages. For instance, they are biocompatible and remain intact inside the body until catalyzed to disintegrate. Patients can take a pill or a medication that acts as a trigger that would cause this gel implant beneath their skin to deliver one vaccination/drug dosage.

Types of Hydrogel

Hydrogels are made using polymers, and based on the type of polymers, they are mainly classified into three types:

- Natural hydrogels: They are made from proteins like gelatin, lysosomes, collagen, and polysaccharides, such as chitosan, hyaluronic acid, and alginate. These natural hydrogels show good cell adhesion properties but have stability and mechanical issues, leading to the short use of these gels in drug delivery systems. In 2020, the natural category led the market for hydrogel-based drug delivery systems, accounting for 32.3% of total revenue.

- Synthetic hydrogels: They are made from materials like Poly (vinyl pyrrolidone), Poly (acrylic acid), and Poly (vinyl pyrrolidone) starch. They have gained more popularity in the industry than natural hydrogels owing to their improved mechanical properties, higher drug absorbance capacity, controlled degradation features, and enhanced lifetime.

- Hybrid hydrogels: They are innovative, stimuli-responsive, smart hydrogels developed using a combination of natural and synthetic hydrogels. With a 6.6% CAGR in 2021, the hybrid category led the hydrogel-based drug delivery systems market. The research is still in progress for their widespread use in medicine.

Hydrogels can also be differentiated based on porous (macro-pores of 10-500 μm) and non-porous structures. The hydrogels’ size and porous structure also contribute to deciding how they can be delivered in the human body, such as through injections, implantations, etc.

Hydrogel Implant Applications

Vaccinations are one of the promising methods to fight against diseases, such as cancer. However, the absence of optimal delivery mechanisms to produce potent and long-lasting antitumor immune responses severely restricts the clinical effectiveness of the available cancer vaccines. Additionally, most cancer vaccines need numerous injections to stimulate immune responses, which results in low patient compliance. By providing medications in a regulated way, controlled-release drug delivery systems, such as hydrogels, can solve these problems. It enables the co-delivery of numerous treatments, reduces dose frequency, and avoids substantial systemic toxicities.

Every year, on an average, two million women worldwide are diagnosed with breast cancer, and the treatment often involves removing at least one breast. However, the majority of women opt not to have their breasts rebuilt. With the emergence of new technology based on 3D-printed implants, hydrogels can help generate new breast tissue before decomposing completely. Silicon is commonly used for this technique; however, it creates some side effects in rare lymphomas, which could be lethal. Healshape – a regenerative medicine biotech startup – has developed a hydrogel-based implant that gradually colonizes the patient’s fat cells and helps women recover breasts within six to nine months.

Recently, the FDA approved a drug named Dextenza, a human-use ocular therapeutic formulation using hydrogel implant for treating ocular pain immediately after eye surgery. The drug, developed by Ocular Therapeutix, significantly impacted the market since traditional ophthalmic eye drops have trouble delivering medication over time, and eye discharge causes a considerable amount of drugs to be wasted immediately.

Similarly, an injectable hydrogel was created by a team of researchers at NYU to inhibit the onset of Post-Traumatic Osteoarthritis (PTOA). Polypeptides, proteins, and the anti-inflammatory growth factor – Atsttrin – make up the polymer gel. Together, they create a network for healing and regeneration.

Since these gels have good adhesion and stability properties with the mucosal cavity, they are incorporated with drugs for treating diseases associated with the mouth cavity, such as gum diseases and fungal infections. Despite such enormous benefits, the high cost of hydrogels and the challenge of creating a hydrogel with a constant surface area can hinder its acceptability.

Major Market Growth Factors of Hydrogel

Various factors are leading to the increased use of hydrogel implants/vaccines. Following are some of these growth factors –

- Target specified safe transport & therapeutic effect: Hydrogels have become more popular because of their safe transport property to the target area and to achieve the desired therapeutic effect and reduce the unwanted side effects.

- R&D on various clinical diseases: Due to advancements in technology, R&D development on various clinical diseases across the globe, and the growing prevalence of chronic diseases, there is a huge demand for better medication, vaccines, and therapies. Also, the Covid-19 outbreak has enhanced the number of clinical trials and vaccine production in the last three years. A hydrogel-based slow release of a receptor-binding domain subunit vaccination was developed having neutralizing antibody responses against SARS-CoV-2.

Significant Factors Limiting the Market Growth of Hydrogel Implants

Despite the various advantages of the hydrogel implants/vaccines, the complicated development process for these hydrogel-based drug delivery systems with constant surface area is hindering their market growth. Furthermore, due to their complex design, companies find it difficult to manufacture these systems for future use. Apart from these factors, there are various other challenges posing significant obstacles in the clinical translation of hydrogel systems. These include practical adaptability, high fabrication and development costs, good regulatory guidelines, and more.

The regulatory classification and approvals, such as Food and Drug Administration (FDA) approval, are difficult due to the various types of drug hydrogel implant scaffolds available. These factors add to the already time-consuming regulatory FDA approvals for their market launch and observation.

Good and well-defined manufacturing practices are essential for integrating hydrogel systems in large-scale systems. These practices can also make various factors predictable, such as safety profiles, proficiency, reproducibility, etc. However, most of these systems currently exist at a smaller pilot scale.

Consumer Trend in Hydrogel Drug Market

Hydrogel-based medication delivery systems market value has seen a 7.7% CAGR between 2017 and 2021. By 2026, the worldwide macromolecule hydrogel market is expected to grow to USD 578 million from USD 475.7 million in 2020. The covid-19 pandemic played a significant role in the growth of this industry.

Hydrogel was used in 223 clinical studies for therapeutic or diagnostic reasons, excluding contact lens trials, according to a 2019 NCBI (National Center for Biotechnology Information) analysis. Eight of the 223 clinical studies used hydrogel coils, 166 used bulk hydrogels, and 99 used patch hydrogels.

IP Analysis and Trends in Hydrogel Patent

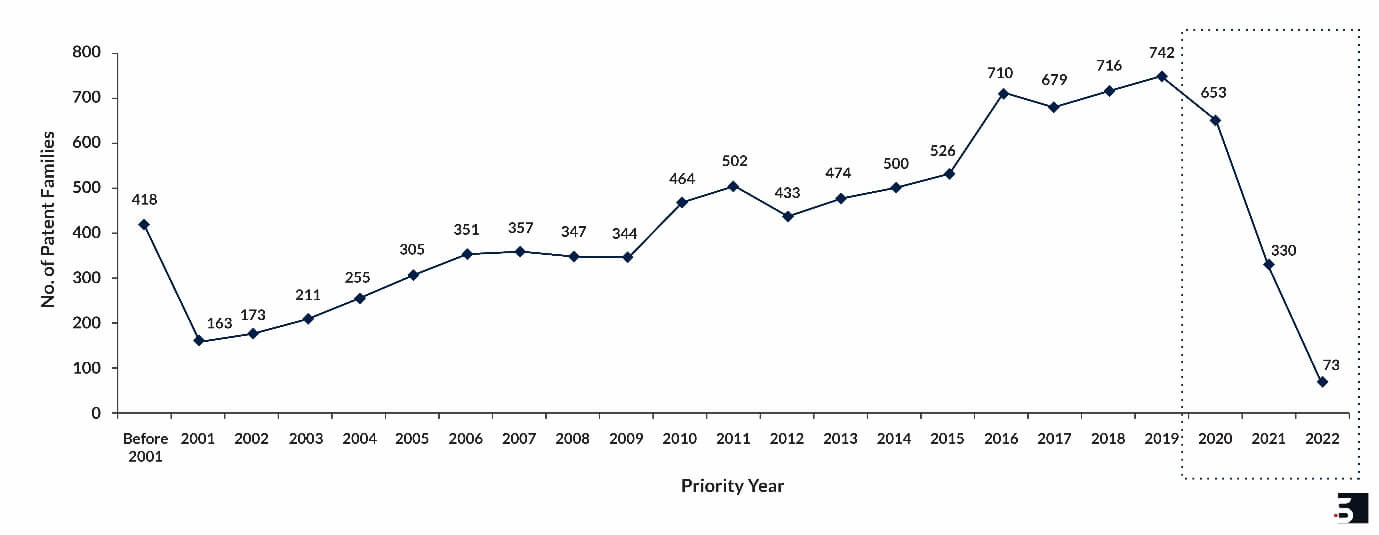

The innovation in the field for the treatment of various diseases has led to tremendous hydrogel patent growth in recent years. Sagacious IP analyzed the hydrogel patent trends in the last ten years. The findings are highlighted below.

Note:

- Priority Year refers to when the earliest hydrogel patent application was filed for an invention.

- The data about the years 2020, 2021 and 2022 might not be complete since it takes 18 months in general for a patent application to be published in the public domain.

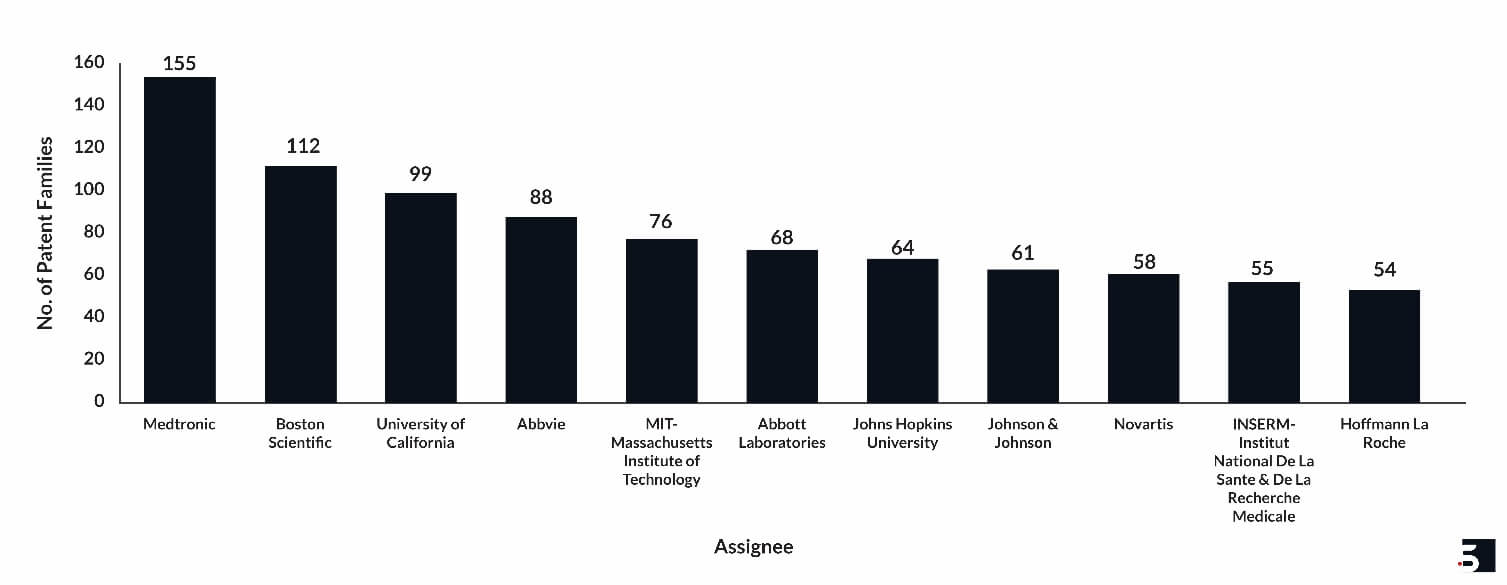

Leading Hydrogel Patent Assignees in the Domain

Some of the major companies in the domain are Medtronic (155), Boston Scientific (112), and AbbVie (88). Some universities and institutes have also played a significant role in the domain, such as the University of California (99), MIT (76), and Johns Hopkins University (64). Major patent assignees for the drug hydrogel implants are shown in Figure 2 below.

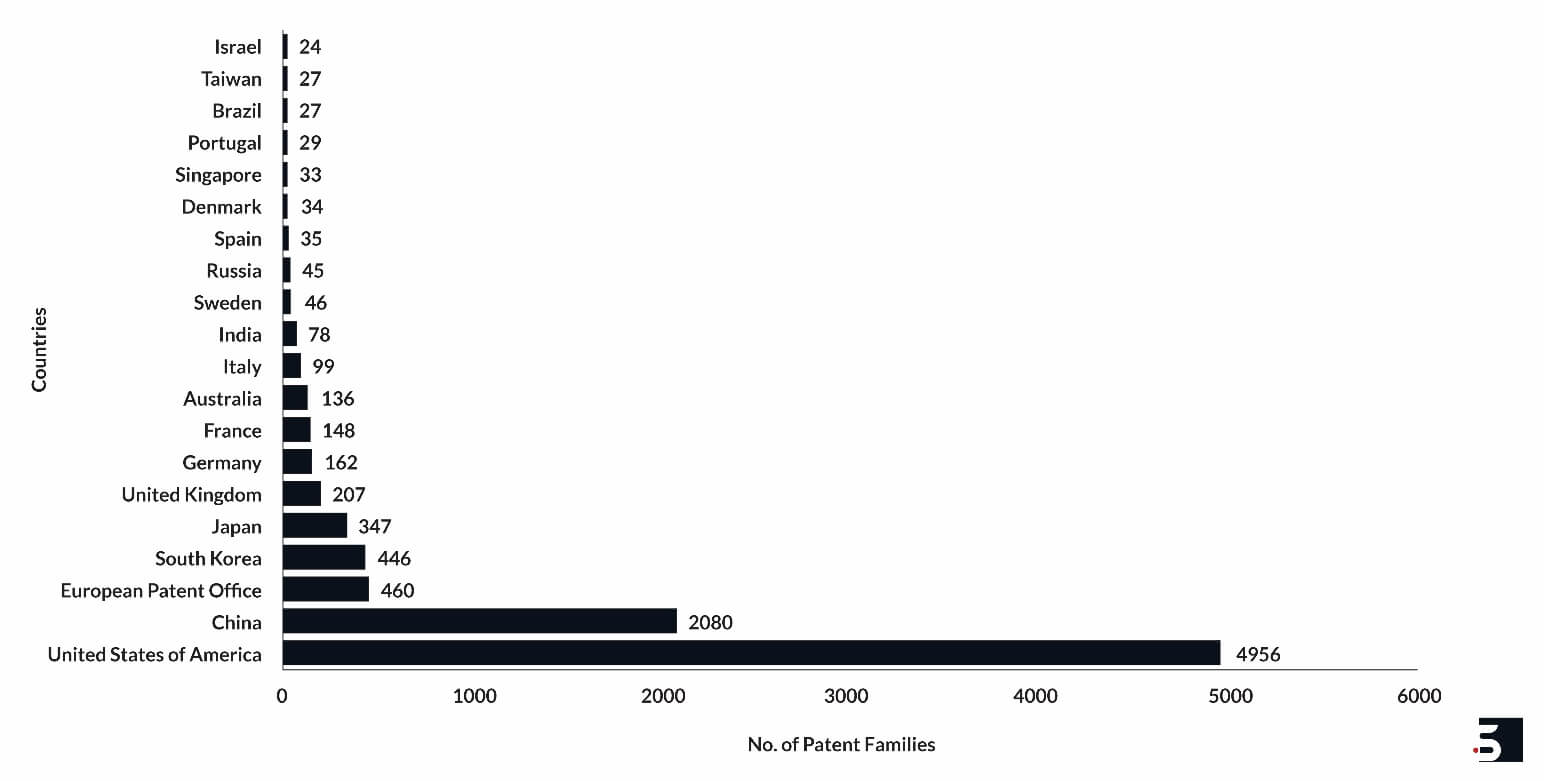

Leading Countries of Innovation and Research

The United States leads the list of countries innovating in the domain and filing hydrogel patents. University of California, MIT, Abbott, University of Pittsburgh, Massachusetts General Hospital, Rutgers University, and Johns Hopkins University are the leading assignees of hydrogel patents from the US.

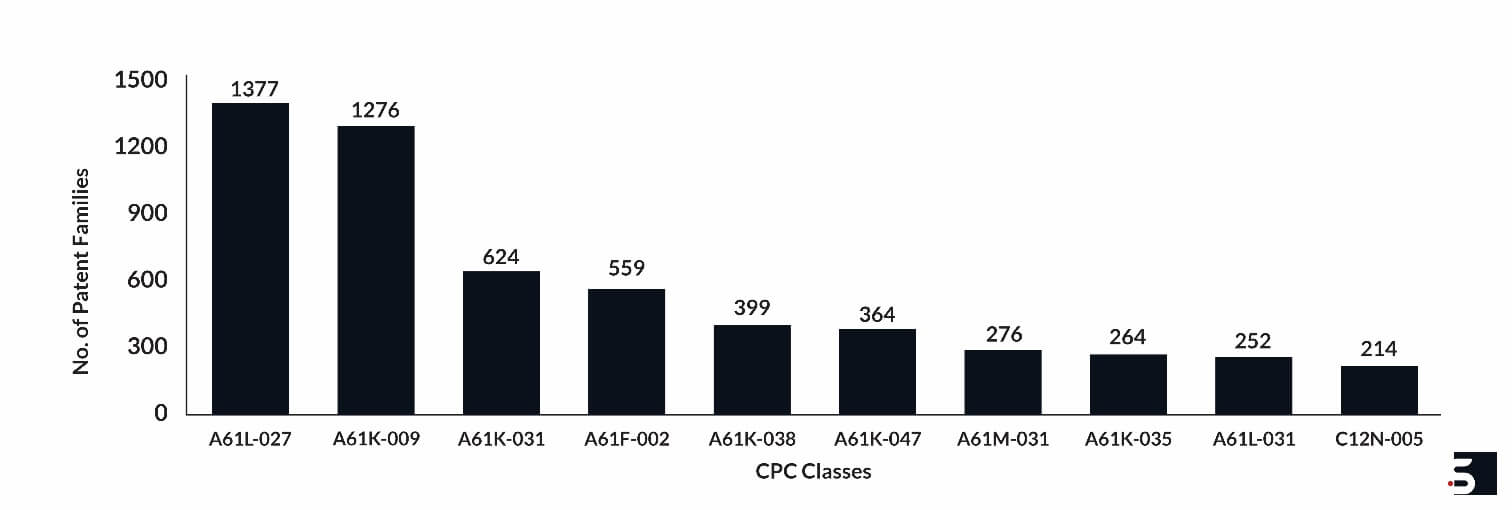

Top Technology Focus

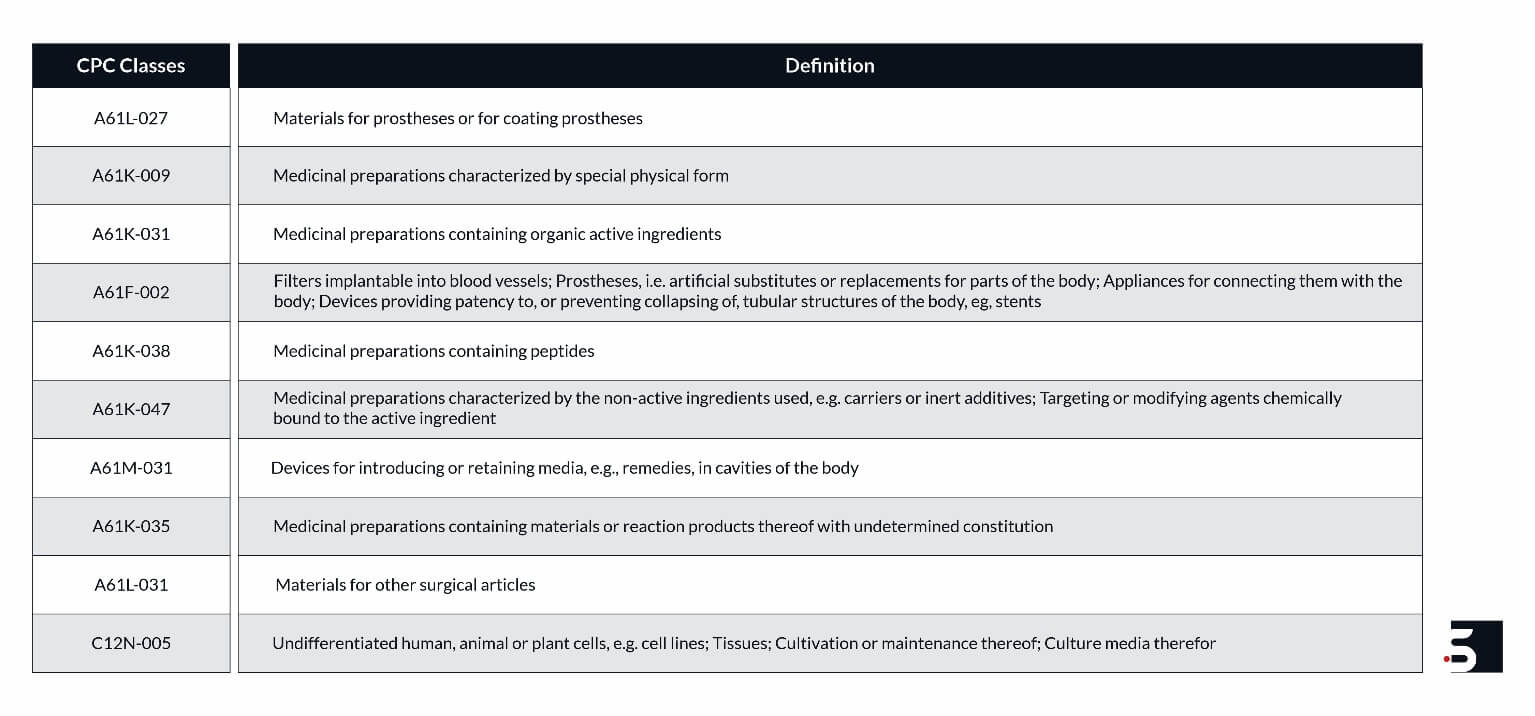

The leading hydrogel patents focus on technologies for materials or coating for prostheses, medicinal preparations, filters implantable into blood vessels, cultivation or maintenance of tissues or cell lines, etc. Figure 4 below shows the number of hydrogel patent families in different CPC classes.

Conclusion

Biocompatibility, biodegradability, and controlled release profile have added to the popularity of hydrogels. Despite the various challenges in the field, hydrogels have a promising future. Some of the important factors likely to contribute to the growth of the market for hydrogel-based drug delivery systems are the high drug loading capacity, controlled release and targeted distribution. Formulating the desired drugs in the form of hydrogels helps in dose sparing, decreased medication administration frequency, improved patient compliance, and fewer adverse effects.

Owing to these specialties, vaccine implants gained great coverage during the Covid-19 outbreak. A significant number of studies were conducted to evaluate the development of the Covid-19 vaccine using hydrogels, contributing to its market growth. Further, accelerated IP filing in this space has been observed in recent years, with more focus on materials/coating used in the prosthetics indicating research around the implant materials. Some more possible areas of hydrogel patent progress in the near future can include using hydrogels for the treatment of local infections in the presence of antigens or for the treatment of genetic diseases.

Sagacious IP assists clients with their inventions by distinguishing disruptive technologies from innovations, identifying major players driving a specific technology domain, and identifying solutions for emerging difficulties in technological spaces. Through our technology scouting service, we have worked with multiple organizations researching in various sectors, such as biomaterials, polymer science, and others, to find solutions for major technical problems. Click the link above for more details about our tech scouting service.

– Devika Saini (Life Sciences & Chemistry) and the Editorial Team

Having Queries? Contact Us Now!

"*" indicates required fields