Insider Secrets of Patent Valuation Revealed: What Experts Know That You Don’t

In today’s innovation-driven landscape, patents have evolved into crucial intangible assets. Once solely protective measures for innovations, patents are now commonly traded commodities, facilitating patent licensing and sales. However, determining the true patent value remains a challenge. This is where patent valuation comes into play, enabling patent owners to assess their market worth accurately. Understanding the patent value is essential for maximizing financial returns and informing strategic decision-making.

Despite the availability of modern financial tools, patent valuation remains a complex task, as it involves intricate considerations. This article delves into the nuances of patent valuation, including its necessity, various approaches, and the pivotal role of claim analysis. Additionally, we’ll explore how Sagacious IP approaches the practice of patent valuation.

Table of Contents

Why Patent Valuation Matters More Than You Think

From negotiating equitable deals to safeguarding against infringement, the need for accurate patent valuation is undeniable. Whether you’re contemplating a merger, seeking investment, or simply aiming to maximize the value of your intellectual property, understanding the intricate nuances of patent valuation is paramount.

The potential reasons behind patent valuation are shown in Figure 1 below:

Patent Licensing, Sale, or Purchase

Whether you’re selling, licensing, or buying a patent, accurate valuation is crucial. Sellers aim for fair compensation, while buyers seek reasonable pricing, making patent valuation vital for negotiating equitable deals.

Patent Enforcement

In today’s competitive landscape, patent infringement is common. Proper valuation helps quantify losses from third-party infringement, enabling patent owners to seek appropriate compensation and protect their rights.

Mergers & Acquisition

In complex financial transactions like mergers and acquisitions, patents are significant assets. Accurate valuation is essential for seamless integration and informed decision-making, providing insights for investors and stakeholders.

Assessing Research and Development (R&D) Investment

While investing in research and development, the real goal is to have the patented item increase revenue or be a cost-saving measure for the business. In such cases, the patent value is the actual cash value in the future. Therefore, patent valuation is also conducted to set a budget for R&D activities.

Internal IP Audit

Organizations conduct IP audits to assess portfolio value and mitigate risks. Patent valuation assigns accurate values based on market and technology relevance, facilitating effective IP asset management and strategic planning.

Raising Funds

A robust patent portfolio is an attractive resource for raising funds. Patents not relevant in specific geography can have high demand in other locations due to a lack of technology or market penetration. Therefore, patent valuation becomes essential to command the right price. In addition, while availing a collateral (patent) based loan, the optimal patent valuation helps secure the best possible loan offer.

Insurance of IP Assets

A new market is coming up as some of the leading insurers across the globe are developing insurance products linked to the capital value of the IP assets. The valuation of patents helps get the best deal on IP insurance products.

Financial Reporting

While IP assets were traditionally not included in a company’s balance sheet, the accounting community has realized the value of mentioning IP assets in financial reporting. The International Accounting Standards Board (IASB) has started recognizing identifiable intangible IP assets, and requires companies to mention all acquired IP assets, separate from goodwill, on their balance sheet. Therefore, the task of patent valuation becomes crucial to capture the correct value of patents on the balance sheet.

Liquidation

During bankruptcy or liquidation, the company’s IP assets have to be valued along with other physical assets in determining how those assets are to be distributed. The right patent valuation can make a massive difference in the amount of payout for debtors, investors, etc., at the time of liquidation.

Taxation

While planning for tax optimization, the task of patent valuation assumes a significant role. IP assets create several opportunities for tax planning, including third-party transactions and internal strategies, such as centralizing the ownership and cross-border transfer pricing. The tax authorities are also always extra curious to know the methods for the IP valuation to spot any discrepancies for possible tax evasion. Therefore, it is also crucial from the taxation viewpoint to employ the right valuation technique and eradicate any flaws.

Once you know when the patent valuation is required, the next step is to understand the patent valuation approaches required to carry out the task. Let us take a look at these.

Deciphering the Different Approaches: A Dive into the Methodologies

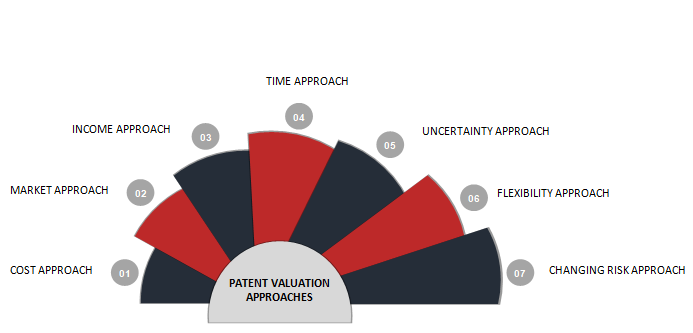

Patent valuation isn’t a one-size-fits-all endeavor. It’s a multi-faceted process that demands a nuanced understanding of various approaches. Each approach holds its own set of intricacies, paving the way for a comprehensive understanding of a patent’s worth. There are seven distinct patent valuation approaches, which are illustrated in Figure 2 below:

Cost Approach

This approach is based on determining the value of a patent by calculating the development cost of the related patent, either internally or externally. The method finds the patent’s value by combining the opportunity costs and direct expenditures in its development and obsolescence. For instance, if a patent owner has the data related to the cost incurred for the last five years, then the current value of the patent is calculated by adjusting for inflation. The cost approach is employed when the patent is not contributing to any real income. There are two types of cost approaches, i.e., the reproduction cost method and the replacement cost method. The differences between the two are shown in Table 1 below:

| S. No. | Reproduction Cost Method | Replacement Cost Method |

| 1 | It deliberates the construction of a duplicate of the original patent | It considers the cost necessary to recreate the functionality and utility of the subject patent |

| 2 | It is the overall cost, at the current price, for developing a replica of the patent to be valued | It is the overall cost, at the current price, for creating a new patent with equal functionality or utility to the patent to be valued |

| 3 | The replica is created using similar standards, materials, designs, and layout, and has the same quality as the original patent | The replacement patent is developed as per current standards, using the latest technology and adhering to the highest quality standards |

| 4 | The method does not factor in change in technology, greater utility from other materials, and other important factors | The replacement patent might have higher functionality and utility than the original one |

Market Approach

: In this approach, a comparison is made with the actual price paid for a similar patent under comparable situations. In addition, the concerned market where the price has been paid must be active. For valuation in this approach, three essential factors need to be met:

- Presence of an active market.

- An exchange of identical patents or a group of similar patents.

- If the patents are not comparable, variables to control the differences.

The volume of information, such as the nature and extent of rights transferred and the transaction’s circumstances, determines the exact valuation of the concerned patent. This approach reflects the market perception and moods regarding a specific patent compared to valuation based on other methods. The five essential steps involved in the market approach for patent valuation are listed below:

Research:

A thorough examination is conducted to obtain information about a market, such as sale transactions, offers to purchase/sell a similar patent, etc.

Verification

The information obtained is verified for its authenticity to ensure that market transactions indicate an arm’s length market consideration.

Selection of Units

Relevant units of comparison are selected, such as per drawing, per customer, per location, and line of code, and a comparative analysis is developed for each unit.

Adjustment

Market patent transaction is compared using various factors, and the necessary adjustment to the price is made for the subject patent.

Reconcilement

All the indicated values produced from the analysis of the market transactions are reconciled into a single value or a range of values.

Income Approach

The underlying assumption of the income approach is that the value of a patent is the result of its future success that will generate cash flows for the business. Within the income approach, there are four different methods available for patent valuation:

- Direct cash flow prognosis method

- Relief from royalty method

- Incremental cash flow method

- Multi-period excess earning method

Each method mentioned above allows a unique way of separating the specific cash flow for the relevant patent. Therefore, based on individual cases, the most suitable strategy can be figured out.

Time Approach

Discounted cash flow methods (DCF) or time approach for valuations are practical in many domains, including intellectual property. It takes two critical factors into consideration – time and uncertainty/riskiness. The problem of patent valuation adjusting for time is solved by using equivalent cash flows in which the projected cash flows are adjusted to account for riskiness over time. The values are then discounted for the time value of money. As patents have a limited lifetime, the problem of estimating residual values for the cash flows beyond the expiry period is not required. It is one of the significant advantages of patent valuation using DCF method.

Uncertainty Approach

Similar to the time approach discussed above, the problem of patent valuation adjusting for future uncertainty and risk is solved by using equivalent cash flows to account for uncertainty. With a multi-stage cash flow for a patent, the risk involved with the cash flow will fluctuate over its lifetime. For instance, a newly granted patent under litigation for the first time has a greater risk than a ten or fifteen-year-old patent that has survived many litigation onslaughts. All the influencing variables are considered to see their effect on the final DCF value.

Flexibility Approach

In the simple DCF method, no consideration is paid to the various possibilities open to the managers of a project. For instance, it could be allowed to lapse or be abandoned at different stages of the patent lifecycle. The flexibility approach for patent valuation enables the capture of such possibilities in Decision Tree Analysis (DTA). It is the process of defining a decision with a graphical representation of many alternate solutions available to solve a given problem to find the most effective course of action. The greatest advantage of the DTA method over simple DCF is that it considers the value of flexibility in the patent lifecycle.

Changing Risk Approach

The significant point in changing the risk approach is to account for fluctuating risk and develop a probable risk-neutral valuation. Contingent claim analysis is one of the powerful methods to adjust for the changing risk with the underlying idea of both discrete-time type analysis and continuous-time option valuation models.

Moving on, we will discuss how claim analysis plays a vital role in patent valuation.

Role of Claim Analysis in Patent Valuation

Proper patent valuation needs the combination of three specialized disciplines: technology, patent law, and finance, with a particular focus on claim analysis. To determine a patent’s value, one must determine the scope of the patent claim, the services or products covered by the patent claim, and the economic advantages associated with the service or product.

A patent’s claim defines the limits and boundaries of the technical subject matter. Therefore, the patent value coincides with the value of the covered technology. In other words, a patent’s value coincides with the value of a product or service which infringes the patent claims. Hence, an accused infringer only needs to show that their product lacks a single element of the asserted claim to absolve themselves of all the infringement charges, thereby eliminating the need to pay licensing royalties.

Let us understand the concept with an example. Suppose a claim contains five elements while the product accused of infringing has four elements. In that case, the accused product does not infringe the claim. As a result, the patent owner is not qualified for 80% of the damages it would receive otherwise. The patent owner would receive no damages irrespective of the number of citations that the patent has received, relative age and the cost incurred in obtaining the patent. Summing up, one can say that the extent of the patent claim supersedes all other proxies for patent value.

Besides choppy claim constructions, other significant factors affecting patent valuation. We will be discussing the same in the next section.

Factors Influencing Patent Valuation: Navigating the Complex Terrain

Numerous factors influence the valuation of patents, ranging from technological relevance and remaining lifespan to economic obsolescence and functional considerations. By understanding these key determinants one can gain deeper insights of patent value and make informed decisions that align with their strategic objectives and financial priorities.

Functional Obsolescence

It occurs when the patent owner incurs an extra operational cost to use the patent against the current alternatives. Functional obsolescence can bring down patent valuation by several notches depending upon the degree of practical relevance.

Technology Relevance

Technology always plays a critical role in patent valuation. Upcoming technology with a booming market always commands a premium during valuation. Patents related to obsolete technology can drag the valuation quickly due to their little or no practical utility.

Remaining Lifespan

The patent’s lifespan also plays a role in its valuation. Generally, a patent with a shorter duration pulls down the valuation by varying levels depending upon the buyer’s interest.

Economic Obsolescence

This happens when the use of the patent in its best possible form cannot provide an adequate return on investment. It generally occurs when the patent is unique and has very little use outside a particular application. Therefore, the economic limit of the patent can also drag a patent’s valuation.

Organizations in the IP industry have different approaches to patent valuation. In the next section, we will enumerate reasons for you to choose Sagacious IP for patent valuation service.

Sagacious IP’s Unique Approach to Patent Valuation

At Sagacious IP, we introduce a novel approach to patent valuation that integrates cutting-edge methodologies with unparalleled expertise, offering comprehensive insights into a patent’s true value.

Our Hybrid Approach

Our hybrid approach to patent valuation considers various factors, including the cost for reproduction, marketability, and the value proposition concerning the intellectual property. It consists of three essential components:

- Market Analysis: The first part of the hybrid approach covers the market analysis of the technology under consideration, determining the revenue that would be generated by the execution of the subject technology, whether the technology is new or outdated in the market, discount rate, etc. In addition, several other factors affecting the market are considered to reach an expected license value.

- Intellectual Property Assessment: The next important component of the hybrid approach consists of a rigorous analysis of the intellectual property under study. There are multiple factors affecting the applicability of a patent. All the factors have to be considered to understand the actual worth of the intellectual property under study.

- Scoring System: After conducting an exhaustive market and IP study, the patented technology is scored for various markets and IP parameters. The market parameters consist of taxes, cost, market size and share, product stage of the subject technology, etc. A net profit value (NPV) is calculated using a mathematical model depending on the scores. The IP parameter covers technology uniqueness and impact, competitive technologies, legal aspects, infringement potential, etc. The scores obtained from the IP parameter are used for calculating a weighing factor. The NPV and the weighing factor eventually provide the overall value of the patent under study.

Why Choose Sagacious IP for Patent Valuation?

The reasons for choosing Sagacious IP for patent valuation are listed below:

- Flexible Approach: Our adaptable methodology caters to patents across diverse technologies, ensuring relevance and accuracy irrespective of the industry.

- Proven Expertise: With years of experience and a track record of successful valuations, we possess the acumen to determine the correct value indicators tailored to your specific patent technology.

- In-Depth Research: We delve deep into the facts and figures, conducting thorough research to obtain a practical and insightful valuation.

- Early-Stage Evaluation: Recognizing the importance of early-stage evaluations, we offer valuation services at the nascent stages of technology development, empowering you with informed decisions from the outset.

- Fast, Accurate, and Cost-Efficient: Our streamlined processes guarantee fast and accurate results, all at a fraction of the standard market rates.

- Valuation Certificate: Upon completion of the valuation process, we provide a comprehensive valuation certificate, offering transparency and credibility.

- Extensive Experience: With a wealth of experience and collaborations with top brokers, we have established ourselves as the preferred choice for companies—big and small—seeking reliable patent valuation services.

Conclusion

Winding up, we can say that as the global economy makes the rapid switch from manufacturing-centric to a more knowledge-based one, the importance of patents as intangible assets is only going to increase. Like other assets, patents also demand their correct valuation to arrive at critical business decisions. Patent owners, licensees, and portfolio managers should also remember that patent valuation is a tactful task as the concept of “one size fits all” does not apply here. Different patent valuation methods are used depending on the type of patents and the objectives. Considering the task’s complexity, it is advisable to outsource the job to the hands of a reliable third-party service provider.

Sagacious IP was started to provide seamless and transparent IP solutions in the era of knowledge and information-based businesses. Over the past few years, the company has served its clients across the globe with a team of 300+ techno-legal professionals. It has rapidly expanded to four delivery centers with offices in six countries. Our patent valuation service enables you to determine the monetary value of your patent, which in turn impacts your R&D efforts, bolsters your intellectual property rights, and enhances revenue, stock performance, and reputation. Get in touch with us now to know more about patent valuation service and the myriad of other IP-related services that we offer.

– Honey Mago (ICT Licensing) and the Editorial team

Having Queries? Contact Us Now!

"*" indicates required fields