F3 Analysis of Patent Portfolios: A Solution for Strategic Optimization – Webinar

Webinar Topic: F3 Analysis of Patent Portfolios: A Solution for Strategic Optimization. Key-points Covered in this Webinar Session:

A. Which patents to let go

1. Should the patents be abandoned OR

2. Should the patents be sold to the someone who could use it (and hence pays for it)

B. Which ones to keep

1. Which patents are core to your business

i. Product Protecting Patents and Competition Covering Patents

2. Patents that have high probability of implementation in the future

3. Patents that could be non-core but generate additional revenue sources with almost no risk

C. How can companies further benefit from the intelligence drawn from such analysis in making strategic decisions

1. Better Cross Licensing Negotiation

2. Counter Assertion

3. Directed Prosecution

This webinar would cover the overall workflow of implementing the F3 analysis framework on patent portfolios.

Table of Contents

Speakers

Key-note Speakers

Arshjot Singh Gill, Manager ICT, Sagacious IP

Rachita Goel, Asst. Manager ICT, Sagacious IP

Anchored By

Vaibhav Henry, EVP – ICT Licensing and Searching, Sagacious IP

Submit Your Information to watch the Webinar Video:

"*" indicates required fields

More details about this Webinar:

The current economic slowdown, due to COVID-19, has forced companies to re-think their strategies for patents due to budget cuts in the IP departments.

Hence, it is imperative for IP departments to lower their overall cost and increase the revenue generated by patents thereby hedging losses.

F3 analysis of patent portfolios provides a framework to derive such objectives for IP departments. This framework aims to provide macro level insights on patent portfolios, while ensuring to generate value from each and every patent.

Webinar Transcript:

Vaibhav Henry- Hi everyone, this is Vaibhav Henry from Sagacious Research and I would like to welcome you all to the webinar.

Welcome everyone!

My name is Vaibhav Henry and I am the Executive Vice President for the High-Tech Patent Operations team and welcoming you all to the webinar today, which is on the topic F3 Analysis of Patent Portfolios: A Solution for Strategic Optimization

I would like to mention that this is a primary webinar or a series of secondary webinars that would follow in to the next 3 weeks. But, this is the parent one and this provides the framework for all of them. And, before I go on to introduce this topic and the speakers, I am delighted to let you know that we have people from all around the world and so that’s very heartening for us, so wonderful encouragement for our efforts and helps us in our efforts to spread this knowledge gathered.

So, we are thankful and we are also thankful, equally, to our clients who have always shared their problems with us such that we always get an opportunity to come up with relevant solutions and then we are able to share those relevant solutions with others as well.

Intoduction

Alright, now I would like to introduce our speakers.

Our first speaker is Arshjot Singh Gill. He is the manager in the ICT licensing or the high-tech licensing team at Sagacious. And, he has been in the patents research area for more than a decade; so, a 10+ years of experience. Arsh is a patent licensing expert with specific technical expertise in the domain of Computer Sciences. Technologies that he deals with are cloud and storage virtualization and then he also has expertise in computer networks and specifically SDN architectures like openstack and openfuel. He has been working with one of our Fortune 20 clients and while working with them for more than 5 years, he came up with the solution and he has been managing their portfolio for more than 5 years.

Welcome to the webinar Arsh.

Arshjot Singh Gill- Thank you.

Vaibhav Henry- And, along with Arsh we have Rachita Goel. . She is the Assistant Manager in Arsh’s team with more than 6 years of experience. She is the one who executes everything at the ground level. She’s the one who implement solutions like these and she has expertise in validity searches, infringement opinions, and freedom-to-operate searches with a special focus on Cloud Technologies, virtualization and networking technologies, content delivery networks, security stream services and similar computer science disciplines.

Welcome to the webinar Rachita.

Rachita Goel- Thanks Henry for giving me the opportunity to be on this webinar.

Initial Remarks

Vaibhav Henry- Great! All right! Before we dive in, I would ask a quick comment or we can call it the initial remarks from our speakers on F3 analysis just to set up the stage. Let’s start with Arsh.

Arshjot Singh Gill- Hi everybody! So, F3 analysis has been an amazing framework which has generated huge value for our clients. Basically, we have, primarily, been using it for one of our clients for around 5 years now and within the last one year itself they have had the potential to save about $1 million from maintenance fee alone and I’m not considering any potential licensing revenue.

Hence, in short, it has been a tried, tested and proven method to strengthen patent portfolios while saving costs and generating new revenue streams.

Vaibhav Henry- All right! Thanks. Thanks for that. Rachita, we can also have your quick views about the topic.

Rachita Goel- Thanks Henry! Now, taking further the conversation from which Arsh left, I would like to comment on the output of F3 analysis. So, the output of F3 analysis is very fruitful and it yields vital information on the patents that are Fundamental, Future or Fringe.

So, these, fundamental, future or fringe, are the 3 Fs in the F3. Using this one deliverable only, that is our F3 report; one can deliver different work products. For example, if we consider the first work product can be EoUs which are Evidence of Use and it, basically, shows infringement on target companies.

The second work product can be Directed Prosecution which is a method of drafting new claims that can be mapped in future. Hence, it is like a future case.

So, overall considering, we can say that the cases which are marked as fundamental we can generate EoUs from those and the cases which are marked as future, we can generate Directed Prosecution cases so that they can be mapped in future.

Hence, based on this one framework only, multiple perspectives can be derived like as we discussed before which helps in maintaining an active and a successful portfolio. So overall, this is a very good platform in a successful portfolio management tool.

Vaibhav Henry- Great! Thanks Rachita and yes, everyone, so what Rachita mentioned we have another 3 secondary webinars lined up. So, I think the next in line is Directed Prosecution and then we have How to Make Money from your Portfolio where we talk about Core versus Non-Core patents and we talk about patent sales versus patent licensing and then we have a third one.

Arsh, what is the third one that you guys are presenting?

Arshjot Singh Gill- That’s patent portfolio pruning! Wherein, you can save the cost.

Vaibhav Henry- Absolutely and that is also one of the highest costs reduction solutions that we offer to our clients. Great!

And, I think, one last thought I had, in fact, you know, so the thought is I want to invite our listeners to keep sharing their questions. People who want to know where the question box is, you will find it on the right hand side in the control panel of the Goto Webinar session box.

Keep sending your questions there through the presentation and I will select some of them. However, I’m not sure if we’ll have the time for getting through all of them but I’ll select some questions and we’ll answer those after the session is over.

Great! So, without wasting any time, let us start the topic. Arsh should present some of the fundamental, some of the primary, things about the framework and Rachita would talk about specific case studies of implementation.

All right! Over to you, Arsh!

What is F3 Analysis?

Arshjot Singh Gill- Hi, Henry! Thank you.

Basically, let me just give a brief overview that what we will cover in this presentation. So, broadly will cover patent portfolio management and the basics of F3 analysis.

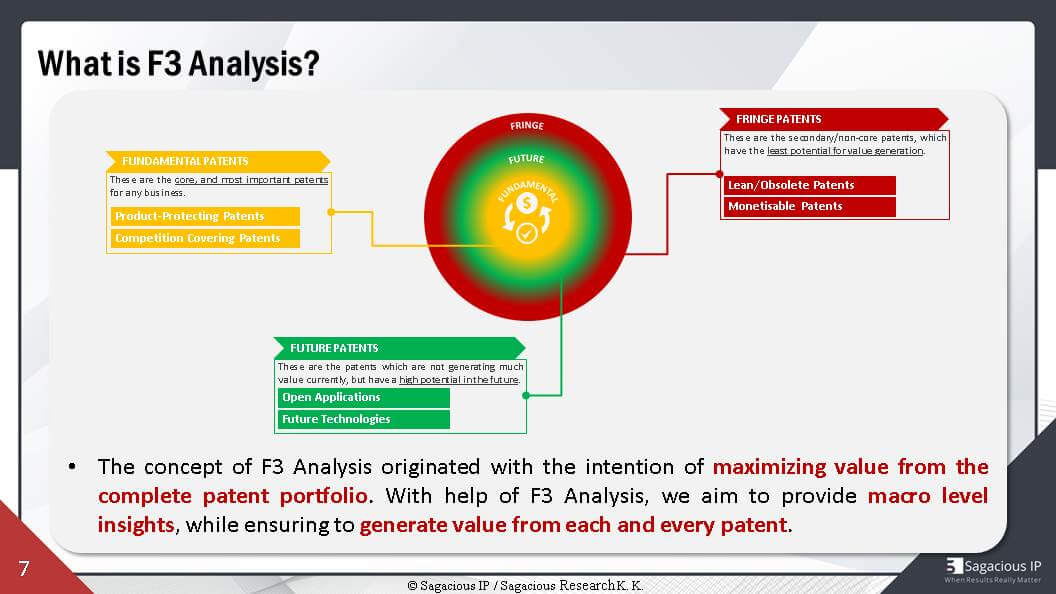

F3 is, basically, a term coined based upon the 3 primary buckets into which we generally categorize the patents. So, those are fundamental, future and fringe. We will go over these through the presentation and then the last part is the case studies and examples and Rachita will take you through these.

Currently because of the Covid situation, there has been huge impact on different companies in the businesses.

This impact on businesses has resulted in a global economic slowdown, because of this economic slowdown, the businesses have to rethink their strategies and one of the primary outcomes of this rethinking has been different budget cuts and constraints.

So, these budget cuts and constraints have pushed companies to think about different revenue streams as well and in addition to that people right now would have a lot more time to sit, think and innovate a lot more which would give rise to a higher Global competition.

All of these factors, combined, have resulted in different expectations of various shareholders and the management as well. Shareholders, primarily, expect the companies to save from wherever possible. Whereas, the management expect the companies to generate new revenue streams from wherever possible. So, the culmination of all of this is kind of F3 analysis.

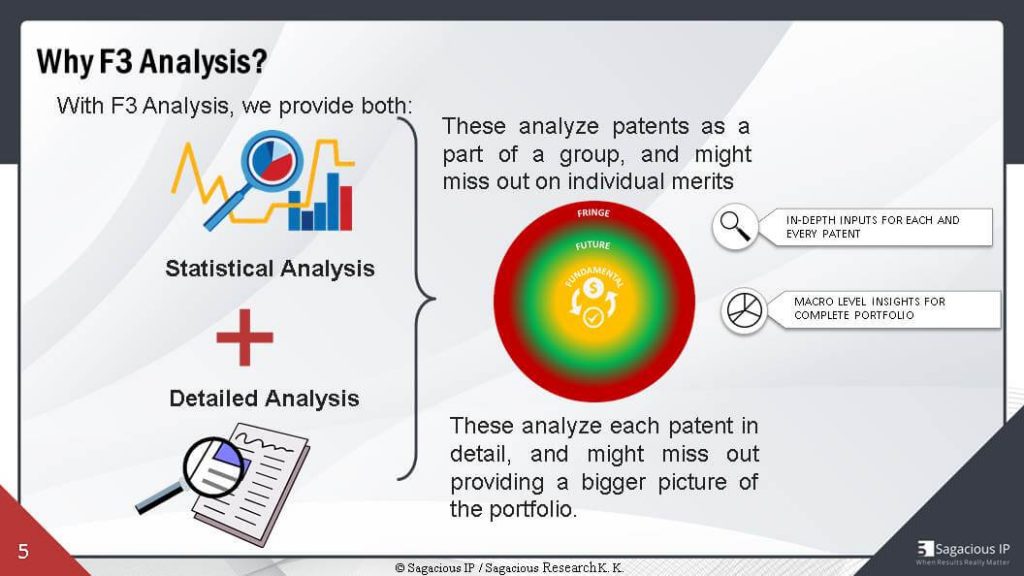

F3 Analysis- Effective Method for Managing Patent Portfolios

F3 analysis of Patent Portfolios is a method for managing them. So, managing patent portfolios can be done in multiple ways; one of the primary methods is statistical analysis and the other being detailed analysis.

In case of statistical analysis kind of portfolio management, most of the patents are kind of distributed into different sets. This distribution could be based upon the technologies or different business units where they originated from or it could be based upon the statistical parameters which are part of different patents. So, the statistical analysis, though it’s kind of good for a quick analysis but it has the potential to miss out on the individual merits of the patents.

Now on the other hand, if we take a look at the detailed analysis, it generally takes a lot of time and it kind of gives insights about each and every patent but they might miss out on providing a bigger picture of the patent portfolios. So, this is where we kind of realized the need of F3 analysis.

If we combine both of these kinds of analysis what we end up with is F3 analysis. This is the kind of Crux of the F3 analysis. So, in F3 analysis, we can provide both in-depth inputs for each and every patent whereas we can have macro level insights for the complete patent portfolios.

Whereas, how strong the portfolio is or basically what are the different actions that you can do or decide based upon the different categories the patent might fall into. So, this is kind of tried, tested and proven method, this kind of, eventually, results in saving money and also this F3 analysis has been an award-winning solution as well.

Fundamental, Future and Fringe Patents

Getting into the details of F3, we basically divide patents primarily into 3 different sections. One is fundamental.

Fundamental patents are the patents which are kind of core patents to any business. These are the patents which protect the current products of a company or these could be the patents which kind of cover the competitors as well.

The next section is future patents.

Future patents are the ones which are currently open applications or could be the patents which have at least one family member which is currently under prosecution and these could also be technologies which are right now under research and might come up in the future.

The third part of this is the fringe patents.

The Fringe patents are the patents which have the least potential for value generation. So, these are generally the patents which are kind of obsolete or they might not have very good set of claims because of which it’s difficult to generate value of these but then again, there are different methodologies using which value out of these patents can be generated.

Whole of this framework originated from different set of questions and there was a lot of thought process that was put into it. So, we kind of distribute patents based on different reasons and different merits of the patents.

Basis of Categorization of Patents

If it’s possible to generate an EoU or basically an infringement analysis against a competitor then it would come under the section of fundamental patents. If we see, kind of, an Intent of Use but not the exact infringement available, but the patent specifications kind of cover that would come under the future patents and the fringe patents, these we will cover these in the later slides as well.

So, fringe patents are the ones which would kind of not generate money directly, but there are different ways using which you can generate money out of the fringe patents; you could license out these patents or you could kind of package these as part of different deals.

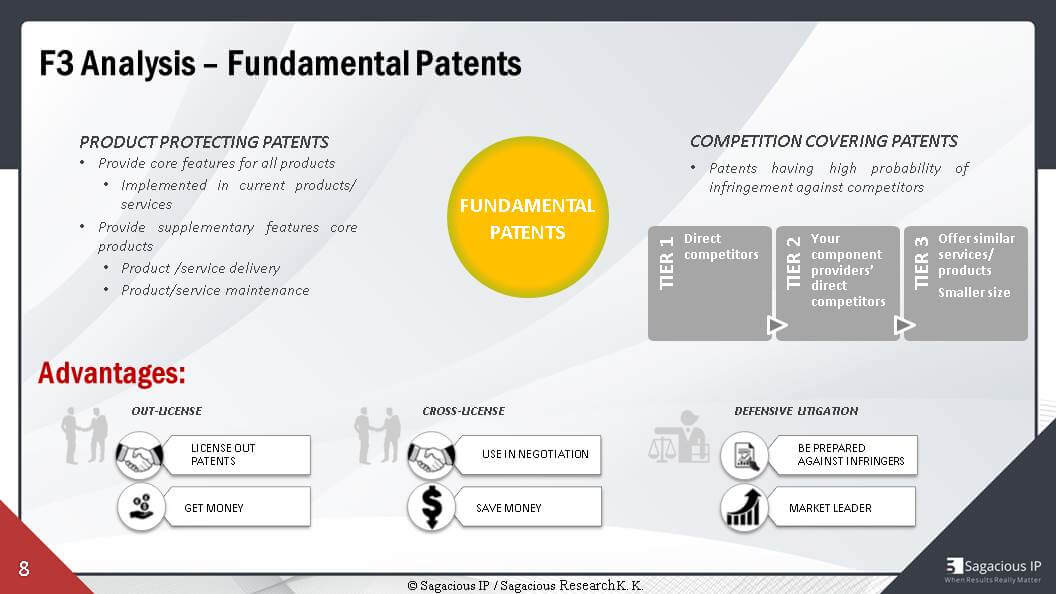

Categorizing Fundamental Patents and its Advantages

Getting into the section of fundamental patents; so primarily the fundamental parents are two different set of patents constitute as fundamental patents. These are product protecting patents and competition covering patents. So, product protecting patents are the ones which are core to your business and have been implemented in the current production services or these could also be the ones which help you maintain and deliver different services and products.

Competition covering patents are the ones which have high probability of infringement against competitors. And, we can even divide the competitors into three different sections.

Tier 1 is the direct competitors which are the direct competitors of your company, which have, say, almost similar size as your own company and they, kind of, offer similar products and services.

The 2nd tier would be the one which are direct competitors of the component. So, component providers form an important part in the whole supply chain, wherein if any of the component provider is affected, so that would directly impact your own supply chain as well.

The 3rd part is the ones which provide similar services and products but are a lot smaller in size. These have the potential to take a smaller chunk of your business or for example, they could provide the similar services at a lot less lesser price, so which would kind of not impact the business at large but they could always kind of deplete the business in smaller chunks.

So, the fundamental patents, these are the main advantages of categorizing these fundamental patents. The primary being that these are the patents which have the highest potential to out-license because these are the ones which your productive use and these are the ones which cover the similar services and products that your competitors use. So, this is where you can use these fundamental patents to license-out and by licensing out, this could open up a new revenue stream itself.

The second way you can use these as by cross-licensing. So, cross-licensing is something which could help in adding new features to your product and services whereas you can keep the innovation cost to the minimum.

Somebody else could use your patents to include somewhat similar features as compared to your own products and services and you could incorporate some other features which their products or services might have. And, since you would already have knowledge of these patents and an insight into these patents, you can always come up with this solution or suggestion that they can license your patents or you could license their patents.

And, the third could be defensive litigation in which you can be prepared against potential infringers. For example, the tier 3 competitors, the ones who are smaller in size but they could eat up small chunks of your business. So, this is where the fundamental patents are the ones which would be the most important ones.

Basically with help of defensive litigation, you can restrict these smaller competitors from eating into your business and hence you might end up emerging as the market leader.

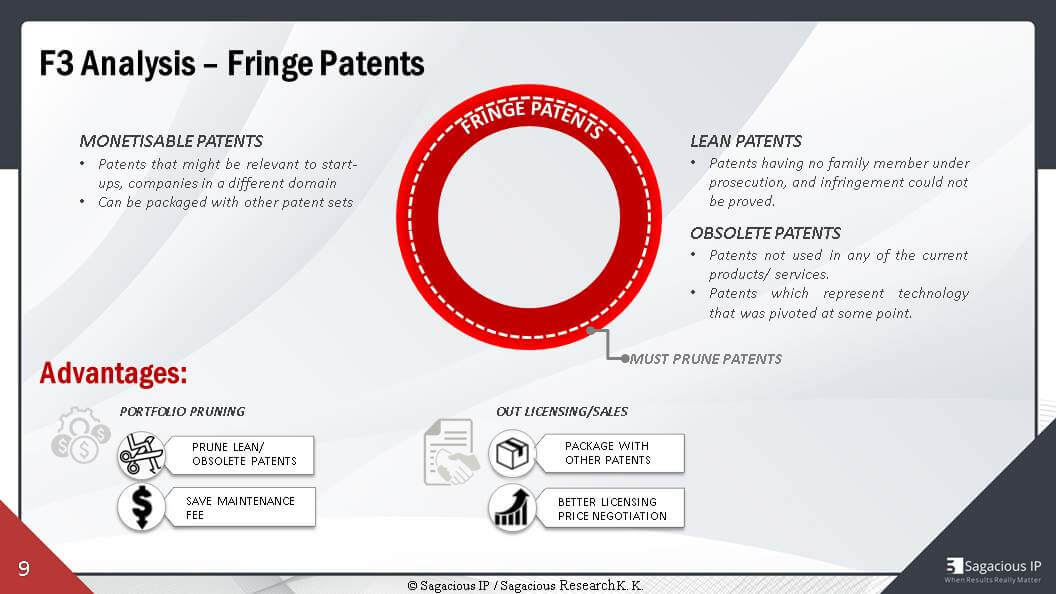

Categorizing Fringe Patents & its Advantages

Next we’ll talk about Fringe patents.

Monetizable Patents

Fringe patents are the ones which have the least potential for value generation, and these only constitute of 3 different section of patents which are monetizable patents. Monetizable patents are the ones which might be relevant to startups and which are not core to your own business. So, these could be relevant to some other businesses or could be relevant to some other companies as well.

These are the patents that you can use for transaction or you could use these for out-licensing or you could sell these patents to such companies.

Lean Patents

The second section that comes under this are the lean patents. So, lean patents are the ones for which there is no open family member and infringement is something which could not be proven in these cases. These are the patents which would have very low value or very low potential for revenue generation.

Obsolete Patents

And, the third section that comes under this are the obsolete patents. Obsolete patents are the ones which are not used in any of your products or services. It could be possible that the technology deviated at some point in the past. The Innovation or the product which are coming up in the market right now, they could not differ from this or it could be possible that there are multiple alternatives available to the same technology.

But, how you can generate money out of these is, basically, you could package both monetizable and lean patents together in and then, sell them together as a bunch or maybe license them out as a bunch.

Lean patents would, primarily, help you beef up the patent portfolios. That are, basically, the patent deal that you want to out-license or that you want to sell and the ones which have least potential to sell, those are the ones that you can, probably, prune.

By pruning them you could save maintenance fee which actually comes out to be lot. So within last one year, we helped a few of our clients save money to almost 1 million dollars just by pruning the patents.

And, the next thing that you can do, as I mentioned, you can package these patents together, because of packaging these patents together you could actually beef up the patent portfolio. So, in most of the cases for patent transactions, what happens is generally 10 -20% of the patents, in a patent portfolio that is being transacted, are the ones which are the most important patents in that patent portfolio.

Plus, they just add value to the patent portfolio. So, those patents just add a number to the patent portfolio are the ones which is where your lean patents could come into the picture and hence, you could ask for a higher price because the total number of the patents that you are licensing or selling is higher.

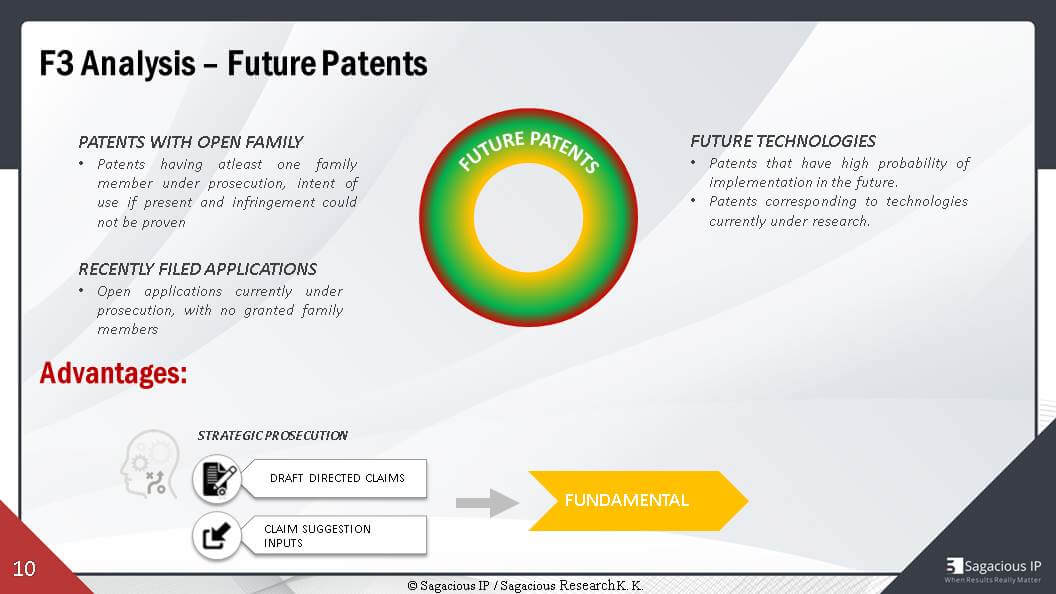

Categorizing Future Patents & its Advantages

Next we will talk about future patents. In case of future patents, these are the ones which have at least one open family member. It could be any patent which has an open family member or these could be recently filed patent applications as well.

And, the third section which comes under this are the future technologies. Future technologies are the ones in which there are multiple research papers published around the technology but it could be possible that the patents that you have, they are the pioneers in that technology.

So, the market might not have evolved to that stage at that point of time and those are the patents which would come under future technologies.

Patents in open family, these are the patents which would have at least one family member open and why we are focusing on at least one open family member is because, in case, if there is no open family member you cannot file a continuation.

Innovations are the ones where you can improve the set of claims which have already been filed. So, patents with open family members are very important for further future scenario because that is the innovation. That is the place where innovation has already happened.

The market could be maturing towards the services and products that your patent covers and hence, you have the potential to file a different set or a newer set of claims which are directed towards competitors as well. Secondly, in the recently filed applications which are currently under prosecution you always have a chance to amend the claims which you have filed.

So, because these amendments could be directed in such a way that, again, your competitors could be covered under the different set of claims which have been filed.

And, future technologies, these are the ones where the technology hasn’t matured yet. And, basically, these are the ones which could have high potential in the future. If, at a later stage, the technology deviates from or, basically, the market deviates from this technology, these patents could go into fringe.

Whereas, if the market deviates from these technology, that is, covered by these patents, then, these patents would actually become fundamental patents.

The most important part of future patents is the patents with open family. For the patents with open family, you could do a strategic patent prosecution or which is also known as Directed Prosecution.

Strategic prosecution is something in which you could draft directed claims if your specifications cover that. You could draft directed claims which are directed specifically at competitors. This is generally possible or basically done in most of the cases where there is an Intent of Use of the invention, something similar which is already there and the patent specifications cover but the claims which have already been filed, they make it a bit difficult for you to prove infringement. So, this is where directed prosecution or strategic prosecution could come into the picture.

These Directed Prosecutions would be something which would convert these future patents into fundamental patents.

Now, Rachita will take you through the case studies which we have done with respect to this F3 analysis.

Vaibhav Henry speaking- Thank you Arsh! This is Henry. Thanks for that.

Yeah, Rachita would take us through the case studies.

F3 Analysis- Case Studies

Rachita Goel speaking- Thanks Henry and Arsh!

Now allow me to take you all through the case studies that show different aspects of F3.

We’ll be discussing 3 case studies in this webinar.

First is the fundamental. The second would be the future in which it would correspond with the subcategory where the case is either an open application or it’s an open family. The third would be the future.

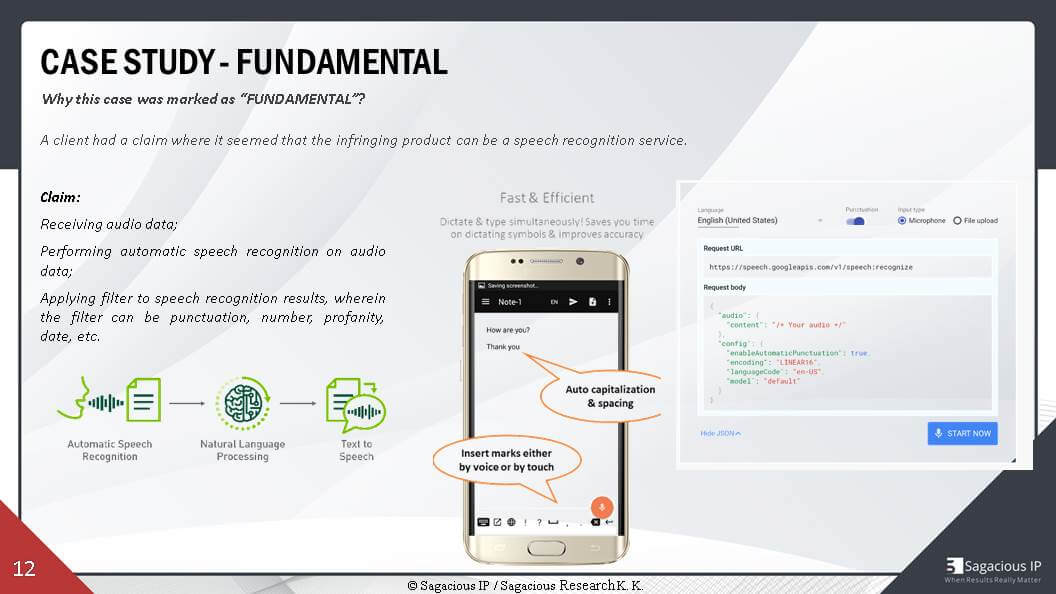

Fundamental Patents- Case Study

Now coming to the fundamental case study; so, how we decide that this particular case is a fundamental?

So, to decide that a particular case is the fundamental, we used to show two concepts.

One is the patent having a high economic impact and second is that the patient is having the high infringement scope.

For economic impact, we do a market research on the particular technology and why we know that this particular case that we’ll be discussing today has the high economic impact because when we were performing this analysis, the portfolio which we received from a client was a very important Business Unit of the client. Hence, this case already was involving a very strategic importance.

Considering this, we learned that it is having a high economic value.

Why this particular case had a high infringement scope?

For this, I would take you through the claim; what was the claim and how we felt that this particular case is the fundamental case.

Now, this particular claim is with respect to a speech recognition service in which the client, which is any user, is speaking to the mobile device or any client device which is having the speech recognition software installed and this client device is, then, communicating with the server.

So, the client/user, speaks something, it utters some words and these words are taken by the mobile device.

Mobile device further sends the data to the server. Server receives the audio data and performs the speech recognition. It recognizes the speech and then it performs the NLU process. That is, it converts the speech into text.

The main crux of this particular case was to apply filters to the recognition results since it was like a very basic technology performing automatic speech recognition then converting into text. But, the main crux was applying filter. The filter can be punctuation filter, it can be a profanity filter, it can be a number filter etc. So, spec was broad enough for this.

I would like to give you a practical example of this. Like, if we speak something to the mobile device, if we say, ‘how are you?’, then, automatically there is a question mark. We do not need to insert it and if we are pausing somewhere, automatically there’s a comma, so we do not need to add it. It is automatic. So, this is a very basic technology.

Hence, we identify that infringement scope is also high because the claim is broad & we are able to identify the infringing products, so, that’s why.

Also, you can see in another screenshot that the server receives the audio data and then, the automatic punctuation is marked as true, hence, it is very clear that the punctuation is coming. It is automatically coming out. The filters are automatically being applied by the server. Considering overall this particular case, it was covering the high economic value. Also, it was covering the infringement scope and hence it was a fundamental case.

Also, like Arsh already mentioned in the previous slides that for fundamental case, it is very necessary that particular patent is protecting the product also and it is covering the competition also. And, we all know that the speech recognition services are very much in demand these days and in future also, in current market also. Hence, it is a very important case and it was marked as fundamental. We performed the analysis, we submitted the EoU and it was a good bang-on case.

I hope I made myself clear with this case study.

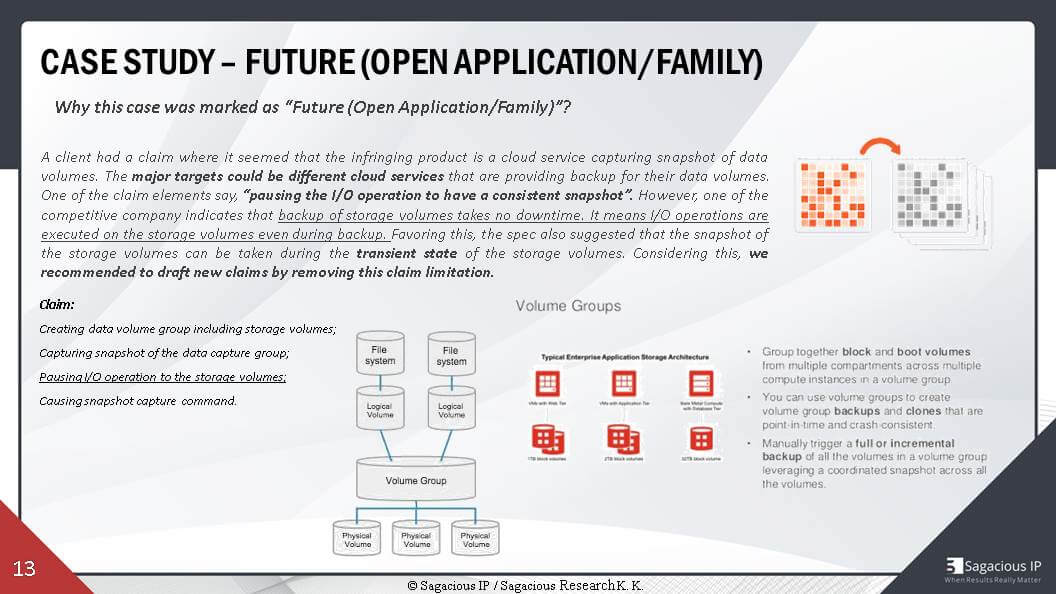

Future Patents (Open Family) – Case Study

Now, moving on to the next case study which is future and it is for an open application or an open family.

Why this particular patent was marked as future?

The answer of this would be very clear if we go through the case study but before that I would again like to mention what is an open application or an open family.

What is an open family?

The application or family is considered as open if the family is open and we have the area to draft new claims. You can draft new claims and you can file new products. So, that’s an open application or an open family.

In this case, like you can see that the claim was basically there’s a volume group. A volume group is created. So, these all steps of the claim were being performed by the server and so, this is a volume group. It is having multiple physical volumes. There are multiple volumes which are combined together and it forms a volume. The user wanted to create a snapshot, a backup of this part of this volume group.

To perform this, the server was, automatically, pausing the input/output operations on this physical volume so that a consistent backup is taken and then the snapshot was taken.

When we went to the file wrapper analysis, we learned that capturing the snapshot, capturing the state of the volumes, was more important rather than pausing the I/O operations. Also, it is very clear, like we are continuously working in this domain and we know that pausing the I/O operations would be a negative effect.

Now, it is like considering the benefits of the hot swappable technology also. We know that we can also take snapshots; we can also move data if you have not paused the data. Considering this in our mind, we look for specs.

In the spec it was clearly mentioned that the backup of the storage volumes take no down time. It means I/O operations are executed on the storage volumes even during back and this snapshot of the storage volumes can be taken during the transient state of the storage volumes.

Considering this, we recommended our client to remove this particular limitation and hence if the client removes this limitation and draft new claims, we would be able to make this case as fundamental in the next one.

This way this particular case is considered as future in which we had an open application in which the family was open and we were having the privilege to draft new claims and the pausing of I/O operations was not as important as it was not covering the novelty. That’s how we decide that this particular case is a future case.

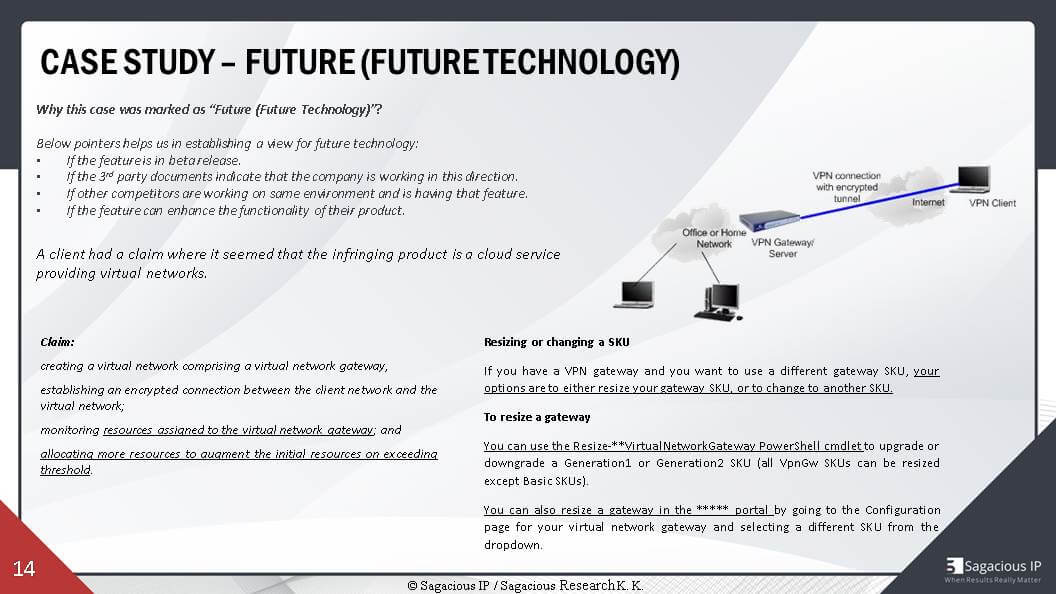

Future Technology- Case Study

Now, the last case study is a future technology. So, like many times, we see that we are not sure whether this particular technology is future or not. But, there are some aspects which helps us to decide that this particular technology is future.

What are the pointers that should consider before marking the case as future?

So, first is, if we know that the feature is in a Beta release of any company or any product, so, we know that if it is in a Beta release, it will definitely come out as a product or as a feature.

The second pointer says if the third party documents indicate that the company is working in this direction, like the third party documents from the companies like the words or any news article.

These websites, they provide a very clear indication that the company is working in this direction and definitely in near future like 1 or 2 years, a new feature will be added or if we see that other competitors of the particular company are working in the same environment and having the particular feature. It is very much certain that to beat with this, other competitors; the company will have this particular feature also.

The last is, if we know that the feature can enhance the functionality of the product.

So, this particular case, the fourth pointer, we will be discussing in our today’s case study. It will be clear after that.

In this case study, we had a claim in which it was like the server was creating a Virtual Network.

The virtual Network was having virtual machines, it was having a virtual gateway and then a connection was established between the client network and the virtual network using a VPN gate.

As we all know that the VPN Gateway is having different resources in it. It is having different CPU resources in it, it is having different memory. All of these resources were continuously being monitored by the server. And once, if the resources were exceeding the threshold, then the server would automatically add next set of resources, would add more CPU, more bandwidth or more memory. So, this was the case.

We know that overall if we see the claim, the claim was covering two aspects. One was creating of a virtual network and establishing a connection. This is very basic. The second concept was that we need to monitor the resources automatically.

The server was monitoring the resources automatically and was adding more resources. Now, when we looked for the information on Target Company, we identified that these two steps are very much available in the product documentation.

Why is this future?

Because, we identified that Target Company, the competitor company, the resizing of the virtual network gateway was being performed manually using any portal or the user was submitting the request through a port which indicates that it is currently being done as a manual process and the claim is automatically increasing the resources.

Sources automatic provision, like we all know that automatically performing a method is more beneficial than manually doing it; hence we marked it future technology because we have a very strong intuition that this case would be a future technology.

That’s three case studies. I hope they all are very clear to you.

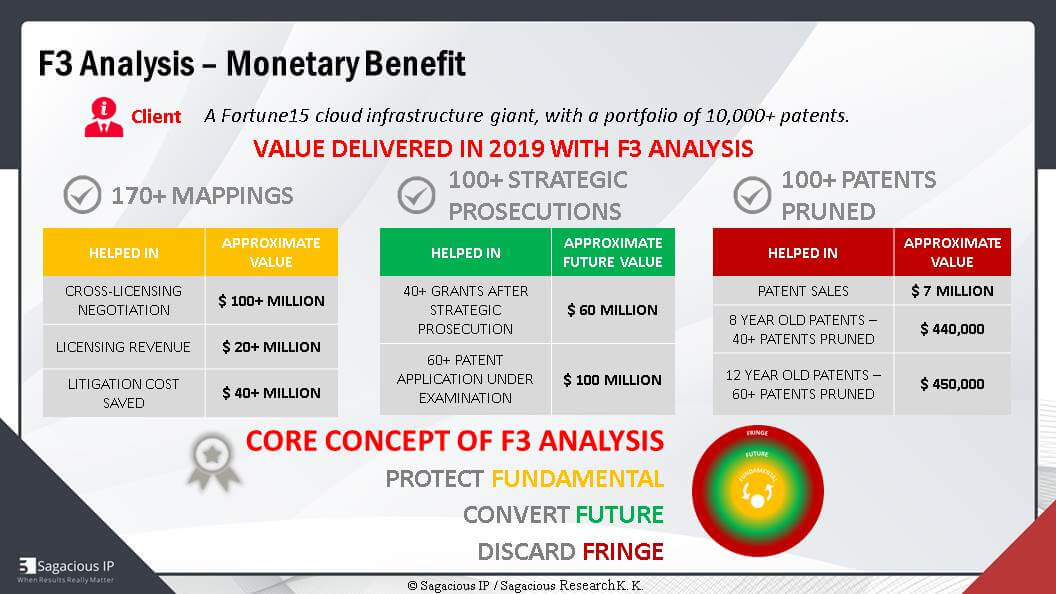

Monetary Benefits of F3 Analysis

Now, next I would like to discuss how the F3 analysis can result in monetary benefits.

Like all the previous slides, our main objective is to save our money or to generate more money. Similarly, our client was a fortune 15 Cloud company. It was having a portfolio of more than 10,000 patents. And, what value we delivered in 2019, we performed F3 analysis on the portfolio and what we identified was we created 170+ mappings from the fundamental cases which helped in cross-licensing negotiation. It helped in licensing revenue, litigation cost was saved.

You can, now, see what the approximate value that was saved was.

Next, 100+ strategic prosecutions were created. This step is for the future case in which are marked with open application. These are the directed prosecution cases. It helped in 40 + grants after strategic prosecution. So, when we suggested that mould this claim like this way so that it should be mapped to a company; so there were 40+ grants and 60+ patent applications were under examination. It was approximately $160 million in total.

The next covers the fringe patents. We pruned 100+ patents which helped in like the Patent Sales. It was $7 million approximately we made out of these pruned patents.

The patents which were 8 years old, we pruned 40+ patents from it and the client’s save was $440,000 billion and the patents which were 12 years old, we were able to prune 60+ patents and it also saved a lot of money, it generated a lot of revenue for our clients.

Overall, this is how the F3 analysis helps.

Core Concept of F3 Analysis of Patent Portfolios- Summing it up!

Now, we have gone through the slides and we know the core concept.

What is the whole concept of F3 analysis?

We need to protect our fundamental so that we have mappings and also, they are protecting our products and they are competitor covering. So, we need to protect this.

Second is, we need to convert the future, we need to convert it so that it comes up as fundamental in near future.

Then, we need to discard the fringe since we need to generate revenue from it.

That’s how F3 analysis helps us in monetary benefits.

That’s all from my end. Over to you, Henry!

Conclusion and Questions

Vaibhav Henry speaking- Thanks for that Rachita. Thanks for the explanation and taking us through the case studies and specific implementation from our clients.

As you see here, people who are attending this webinar, they get a complimentary F3 analysis for 50 patents and in this we would identify the patents that would be fundamental and patents that could be future.

It’s the first level analysis of your portfolio, just suggesting that what kind of patents fall under which kind of category.

You can write to us. The contact details are in the next slide, but I would also like to mention the upcoming webinars as I pointed out.

The first webinar is, in fact, portfolio pruning. We saw that how you have to prune the fringe patents, so, we are taking up this because that is something that we realized every company needed, immediate cost savings is something that we have coming next.

Post that we are covering how to monetize patents or how to actually make revenue.

Basically, cost savings and then how to make revenue and then of course, we’ll take the future cases where we will tell people how to generate future value from their portfolio.

Those are the upcoming webinars. You can actually go ahead and register at our site.

Now, I don’t see any questions from the attendees. So, Arsh, are you able to go through all the questions that people sent before this analysis? I think I see a couple of questions.

How can litigation cost be saved using F3 analysis?

One of the questions is can you please explain as to how the litigation cost can be saved using F3 analysis? And, any used case if we can discuss?

Arsh, would you like to take that up?

Yes! Okay, the question is how litigation cost can be saved using this.

Basically, if you have infringement analysis against the one who is litigating against your company, so, that kind of increases the chances of an out-of-court settlement. That is where we cover all the different tiers in fundamental patents with respect to competition covering.

Tier 1, being the primary, are the direct competitors.

Tier 2, being the ones which are direct competitors of the component suppliers and tier 3 are the smaller players. These 3 tiers cover each and every type of competitor from which you could have a threat.

So, if you already have, maybe, infringement cases in your watch list. Now, that is something which will definitely save infringement litigation costs because that is where you could push the other party as well for an out-of-court settlement as well which is, of course, always cheaper than getting into a litigation.

Vaibhav Henry- And, the idea here is you are always prepared. The other party is not sure whether you’re prepared or not but if you want to settle it in court then you can use counter assertion as well.

Alright, let me see.

How to calculate economic value of a patent?

There is the question: how do you calculate economic value of a patent?

Rachita, would you like to answer that? Arsh or Rachita?

Rachita Goel- Yes, sure! I’ll answer that.

In order to determine the economic value of the particular patent, we perform a market value research on the particular technology. And, after performing the market research, we are somewhat clear in our mind that how important this particular technology is and how impactful is it, for example, if it is a speech recognition service, we can say that it has high impact since many different companies are using it.

But, if it is, like a very small technology and is not covering much, then it would not benefit our client economically more contrary to the major technologies, and hence, then it’s having a lower economic impact.

We can also see that how the second aspect of determining an economic impact can be considering the work-around of this particular technology. So, if we see that the same technology and/or the same work that our patent is doing, it can be implemented in five different ways. Therefore, then it is not having a much economic impact.

Consequently, based on these two factors, we can determine that what the economic impact of a particular patent is.

Vaibhav Henry- And, just adding to that, if you’re watching your competitors, you can always refer to their 10-K reports and to which of their products are actually flagship products and anything that maps to the flagship products also has huge economic value.

So, therefore again, majorly product protecting and competition covering and if the scope of product protection is great and/or if the scope of competition covering is great in terms of returns from the market covered by the competition, then it has a great economic impact.

All right, I see! Arsh, could you please move to the last slide with the 3Fs? Someone requested to see the overall structure of 3Fs.

In the meantime, I will move on to the next question. Alright, so there’s a question.

Is F3 Analysis valuable for SMEs?

Is this kind of analysis valuable for an SME with only 10 -15 patents in the portfolio?

Firstly, I would say this is valuable in the sense that can still identify the companies that are operating in the space in which the patents are and you can hence take your patents for them to license to improve their product.

Secondly, another most important aspect would be a Directed Prosecution. If you see that the very first thing that you need to do is identify who are using the technology disclosed in new patents and, therefore, then you can see whether you can modify the claims such that it is more viable for them.

It looks like eventually they might implement those patents. So, consequently, that is how you can use them.

Also, they are separate, maybe you might not need the complete F3 model but that’s why we have these separate modules on Directed Prosecution, on monetizing your patent and patent pruning.

Directed Prosecution and Monetization is something that would be very relevant with a small portfolio.

Arshjot Singh Gill- Basically for SMEs, this is something which could have a very high value and open up a very high potential and high-value revenue stream. For instance, let’s say, if you uncover a patent which maps onto a direct competitor and direct competitor could be somebody who is, maybe, 2 times or 3 times or 4 times our size. So, just imagine the amount of revenue that you could generate. Therefore, it depends on the potential of the patents also.

But, of course, knowing what is there in the patents is something which is very important irrespective whether it’s in SME or a larger company. But yes, of course, for an SME the stakes would be lot higher.

Vaibhav Henry- And, I think we have one last question.

Is it possible that very old patents will appear as state-of-the-art while assessing the portfolio? If yes, how can we overcome such scenario?

Arshjot Singh Gill- In case, if very old patents come up as the state-of-the-art, so that is where the Directed Prosecution is something which could come into the picture.

So, while doing a Directed Prosecution, if there is something which is already available as state-of-the-art, we can always help file a different set of claims which would not be part of the state-of-the-art that might already be available.

Yes to an extent but, again, it kind of depends on what the specifications of the patent are and how broad they allow us to go with respect to the features or the technologies or the elements which are mentioned in the patent specification itself.

Vaibhav Henry- And, I think, this one important aspect, all of the things that we are dealing here with is mostly about how patents are mapped onto products or how patents protect product. That is, if it’s an old patent which feels like its state-of-the-art, then it’s a good thing, in fact, because a lot of companies might be implementing that feature in their product. So, that is a candidate for high revenue generation.

I think that’s it and those were all the questions. Those are all the main questions that we had here.

And, this was a great session. Thanks Arsh and Rachita for providing your practical knowledge of working with the clients and I thank all the participants for giving us their time and sitting through this webinar and please remember that you are also eligible for a quick complimentary analysis. Feel free to write to us. Arsh, if you could move to the last slide with our contact details, you can write to Arsh or Rachita, at the given contact, at this email address.

Alright, everyone! That’s it from our side and thanks a lot for your time. Thanks so much. Thanks Rachita.

Arshjot Singh Gill- Thank you Henry for having us here.

Submit Your Information to watch the Webinar Video:

"*" indicates required fields