Patent Portfolio Pruning: Realizing Immediate Cost Savings – Webinar

Webinar Topic: Patent Portfolio Pruning: Realizing Immediate Cost Savings. Key Points Covered in this Webinar Session:

- Are corporates’ vast intangible asset inventories 100% significant and acceptable?

- Are IP managers and Heads of IP actively and radically examining the options and using this current economic slowdown as an opportunity to cut out expensive deadwood?

- How would you decide on which patents to let go in the budget-cuts due to economic slowdown?

- Lastly, How can companies employ efficient, data-driven processes to create meaningful savings and returns from what is not valuable to their organization?

This webinar is aimed at discussing the activities that can answer the above questions to realize immediate cost savings.

Patent Pruning is a process of identifying patents which can be shed-off. It needs an in-depth understanding of the business and IP objectives of a company such that no valuable patent is lost.

Table of Contents

Speakers

Key-note Speaker

Amit Kumar, Asst. Manager – ICT, Sagacious IP

Anchored By

Vaibhav Henry, EVP – ICT Licensing & Searching, Sagacious IP

Submit Your Information to watch the Webinar Video:

"*" indicates required fields

More details about this Webinar:

The current economic slowdown due to COVID-19 is slowly but surely pointing towards recession. Moreover, this crisis will affect companies differently depending on their sector and/or size, and depending on the size of their IP portfolios and the importance of intangible assets for the company. However, overall, it would force companies to rethink their strategies for patents due to budget cuts in the IP departments.

Webinar Transcript:

Abby Woods speaking- Hello everyone!

First of all welcome you guys, welcome everyone to the webinar. My name is Abby Woods. I’m the Key Accounts Manager, Sagacious IP, and I’m your host.

Sagacious IP, as you may know, is a 350+ patent IP professional company and is in the business of patent search for 14+ years. I would definitely like to welcome you all, to possibly one of the most important topics of our webinar.

Now, this is an on-going series and today’s topic that we will be talking on would be Patent Portfolio Pruning: Realizing Immediate Cost Savings.

This is a very popular topic and I think as far as my information goes it’s going to be very informative. And, before I go on to introduce this topic and the esteemed speakers on our session today, I’m delighted to welcome all the participants from around the world.

I can see different names and different people from different geographies.

So, welcome you all. Just to let you know, your participation is a wonderful encouragement for our efforts and spreading knowledge gathered by our teams at Sagacious over several years. This has been happening, as we know, we’ve been there for more than 10 years now and all our speakers are well-known experts in their fields. We are also thankful to our clients for always sharing their problems with us such as different stuff that we could get an opportunity to come up with the relevant solutions as well.

So, let me just go ahead and introduce our first speaker for today without further ado, his name is Mr. Amit Kumar and he’s an Assistant Manager, High-tech licensing and takes care of the commercialization part as well at Sagacious. In addition to that, he’s an intellectual property professional with more than 6 years of work experience in identifying monetization opportunities for various large and small companies. He’s worked with, as I mentioned, many companies and he’s advisor with them and he has an expertise of taking care of the patents and taking care of patent portfolio pruning in a cost-effective manner.

Welcome to the webinar Amit.

Amit Kumar speaking- Hi Abby, thanks for having me on the webinar.

Abby Woods speaking- Fantastic! Thank you, Amit.

Also, I have Vaibhav Henry as well. He’s going to support Amit and he, basically, is an expert in patent industry with more than 10 years of experience. Henry, basically, leads the high-tech team at the Sagacious.

Vaibhav Henry speaking- Hi, Abby. Thanks for having me. It’s a pleasure.

Abby Woods speaking- Fantastic! So, before we start off with the presentations today, let me ask Amit for his initial remarks on this particular webinar.

Amit Kumar speaking- Sure. So, if we look at the current overall world scenario, the companies are looking for immediate cost savings and trying their best to cut down their budget. Therefore, keeping this in view in today’s presentation, we would cover how you can assess your patents based on several important indicators, to quickly assess whether you can renew the patent and pay the maintenance fee or you can abandon those patents which do not hold much value for your business outlook. In this way, you can, therefore, generate a reverse cash flow which you can further use to streamline other processes in your business.

Abby Woods speaking- Fantastic! Thank you, Amit. And, thank you for all your thoughts and for setting up the context for this webinar and Henry, do you also have a couple of pointers on that?

Vaibhav Henry speaking- Well, I think Amit has given enough points here and I would let Amit guide us through the webinar and I’ll just support along, based on my experience. I’ll give some example and I’ll just be a support to Amit.

Abby Woods speaking- Fantastic! Good!

So, before we move ahead, I also invite our listeners to keep sharing their questions as and when they have during the course of the session and, basically, they can share the questions via the Goto webinar question box on the right side of this presentation window. And, me and Vaibhav will pick up on those questions and ask them to our speakers after they finish their brief talks.

In addition to that, just one more announcement before we go ahead further, Sagacious is offering a 50% discount to the attendees of this webinar on patent portfolio pruning and the participants of this webinar can drop us an email later at [email protected] and we will share with them.

So, let us now get started with the main part of our presentation and for that, let me invite Amit to take us through the first part that helps us understand the topic Patent Portfolio Pruning: Realizing Immediate Cost Savings.

Over to you, Amit!

Amit Kumar speaking- Thank you, Abby.

So, basically, the agenda of today’s presentation would be to know what exactly is patent pruning and also why it is necessary, followed by the steps that you can use in identifying high quality patents that can be retained and/or renewed and identifying low quality patents that can be abandoned. Hence, the process here will initially comprise of an objective analysis followed by the subjective analysis.

So, let’s get started.

What exactly is patent portfolio pruning?

Firstly, what exactly is patent portfolio pruning?

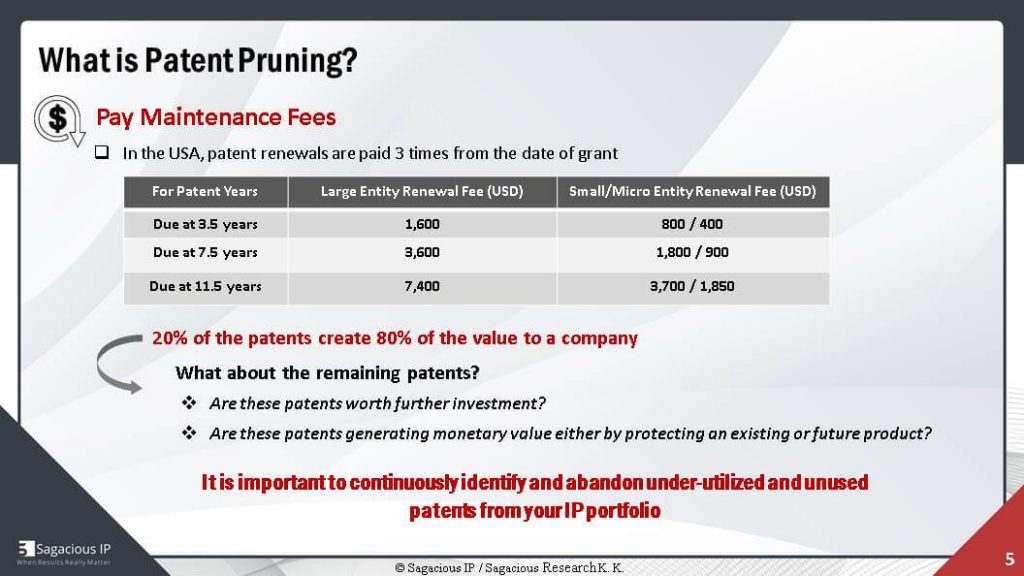

Companies, usually, own a number of patents in their patent portfolio and, statistically, if we see most of the patents will not generate any economic value to the owner. Moreover, these patents require continuous maintenance fees to be paid during their lifetime.

Like we see in the US, we have to pay maintenance fees for about 3 times during the life of the patent.

In the table, if you see, the maintenance fee during the last tenure of the patent is mostly the double of the previous one. This is because it is generally assumed that the older patents are maintained due to the higher market value of the innovations they protect but generally the technology for which the patent was obtained becomes obsolete as the time passes by. Therefore, there is a need to look upon the worth of the patents in the final years of existence.

Also, it is seen that just 20% of the patents create 80% of the value to a company. So, what about the remaining patents?

How much patents from these remaining patents are worth further investment? I mean to say how many patents are still worthy of generating monetary value either by protecting an existing or future products? Or, can this patent be used for any sort of Licensing or Sales opportunity and if they are not of any use then why are these types of patents still in your portfolio? And, why are you paying the renewal fee?

Therefore, considering the above scenarios, it becomes utmost important to identify an abandoned, underutilized and unused patent from your IP portfolio.

For instance, there are patents in your portfolio that might not be applicable to your current business objectives but they might be applicable to other businesses. Therefore, it becomes a wise strategy, here, to be sure that you are protecting the right patents and the comprehensive IP valuation, thus, will help you to make informed decision.

Why patent portfolio pruning is necessary?

Now, let’s see why patent portfolio pruning is necessary.

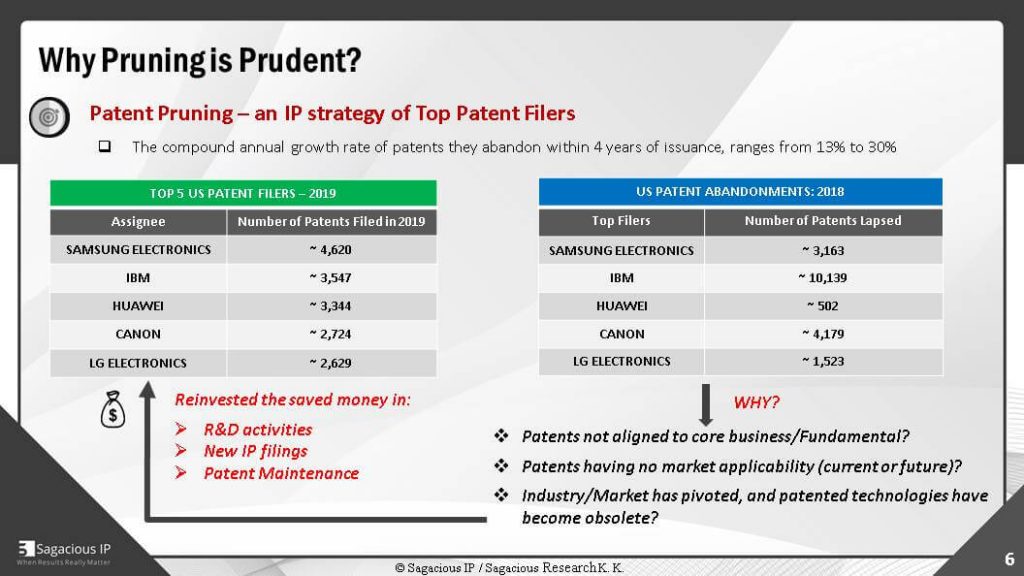

The study suggests that the top patent filers are also top in patent portfolio pruning. One of the main reasons for that is, with time, the patents may become invaluable to the business and therefore pruning them does help these companies realize significant savings of renewal fee. The rate of patents they abandon within 4 years of issuance generally ranges from 13 to 30%. In fact, if we see in the year 2018, the top filers have abandoned a decent amount of patents.

Look at IBM, IBM has solely abandoned more than 10,000 patents in the year 2018.

Now, the question here is, why these companies let go of their patents? Maybe, because these patents were not aligned to the core business or maybe these patents does not have any market applicability or maybe the industry has pivoted and the potential technologies have become obsolete, therefore, with such a vast patent portfolio it becomes vital to analyse which patents are worth keeping and which ones should be abandoned, after all, the patent maintenance cost for a 100-1000 patents could run into millions.

The money saved by these filers while by abandoning these patents is reinvested in their R&D activities and other activities like new IP filings. Like, we see here, in the last year 2019, there are decent numbers of new patents filed by the top filers. Therefore, this means that the money they saved by abandoning the patents is utilized in the R&D activities or new IP filings or paid the maintenance fee for other patents.

Pruning Process

So, now let’s see the process of pruning.

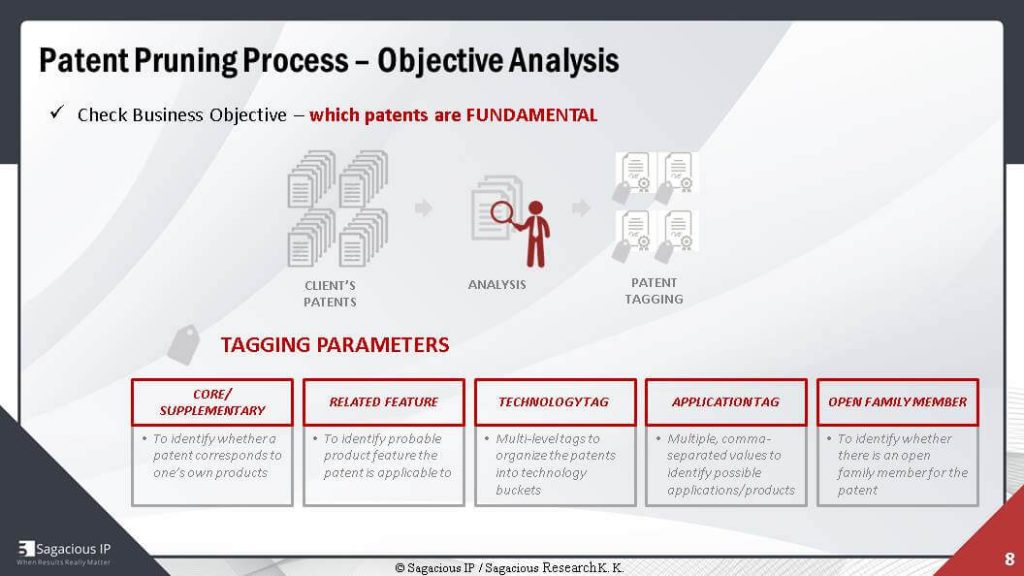

There can be multiple objectives for your business and to start with, you can first do an objective analysis. For this, your main motive should be to check which patents are the fundamental patents. By fundamental patents, I mean, you need to identify those patents which are directly aligned to your company’s objectives. We have held a webinar previously and we had talked about the F3 analysis in that webinar. The F3 analysis, basically, talked about the 3 categories of patents- the fundamental patents, the future patents and the fringe patents.

The category of the patents that falls in the pruning category is the Fringe Patents.

So, coming back to the process now, how do we see which patents are fundamental or core to the company?

This can be easily done by reviewing the patent tags. This, patent tagging, is either already done internally at the companies and or can be quickly done by using IPC-CPC classification codes.

The major parameter to see, here, is that whether a patent corresponds to company’s own products and if a patent corresponds to company’s products, you should take it as a core, else supplementary. So, in this way, you should get a list of patents that are core to your company’s objectives and those that are supplementary to your company’s objectives. The core patents will clearly be attained by you and fee will be paid whereas for supplementary patents, you can assess whether these patents are to be pruned and a detailed analysis can be done for them to make any decisions like licensing them or abandon them.

Besides these, core and supplementary tags, there can be other tagging parameters also that can further help you shortlist patents for pruning. For example, we can see if the patents relate to other products or we can organize the patents by multi-tier technology tags as well as market applicability tags, or we can see, if there is any open family member for any future aspects.

Objective Analysis

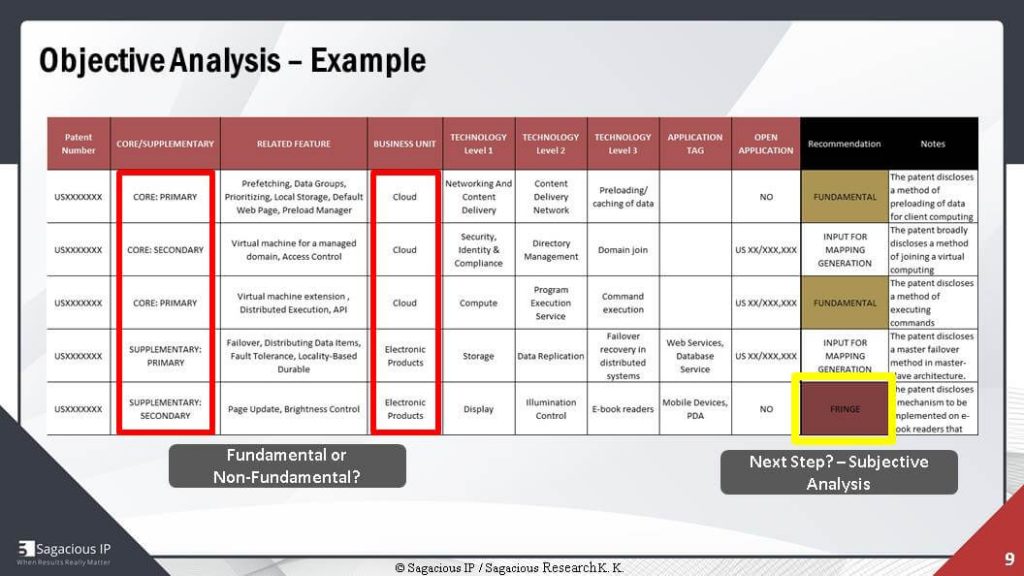

Let’s now have a look at an example of how the objective analysis is done.

So, we have done an objective analysis for one of our clients. The client here is one of the biggest cloud service providers and its patents have been tagged as per the tagging parameters. Like, if the patent is core or if the patent is supplementary, if you look at the first patent based on the technology tags given, it seems that the first patent is related to networking and content delivery; Content delivery Network, Casing of data, local storage. So, this means that this patent is related to the cloud category. That means, this patent is obviously core to the company and the company will obviously retain these patents.

Apart from these patents, some of the patents that company owns are supplementary patents. That means, these patents belong to the electronic products, like mobile devices, PDAs, ebook readers; these patents are, obviously, not core or I should say not fundamentals of the company. So, these patents basically fall in the category of fringe patents.

Now, it is on the company that whether they have to go for the detailed analysis of these fringe patents, so they can look for any licensing or sale options for these patents.

Henry, I would like to invite your comments, if you have any.

Vaibhav Henry speaking- Thanks, Amit. I’ll quickly take everyone through what this example was.

So, as Amit pointed out, it was a cloud company. So, of course, if you see the column- business unit, the business unit column was their internal structure or how the business units are organized and whenever a new invention came up, they internally tagged which business unit the patent was generated from, so this was a very good indication.

We advise companies even if they have a small function to, at least, have a separate business unit tag of where the patent originates from. If you have just one business unit, then the selection criteria would be technology level tags. So, what is the technology?

These are the two important aspects, if you see. There is another one related feature. The related feature is, kind of, a word cloud which helps you understand what the areas that the patents talk about are. Sometimes, there are a lot of providers or there are a lot of automated word-cloud generation software as well. So, it gives you a quick indication in terms of objective analysis.

It gives you a quick indication of what the patent in the portfolio represents and based on these tags you can take a decision on this column, the column number second, which is core/supplementary.

If you see, there are 2 types of core which is core primary and core secondary. And then, there are 2 types of supplementary, supplementary primary and supplementary secondary.

Core patents we also call as fundamental patents.

We tag it into two categories; primary ones are the product protecting patents which protect your products. So, it’s the primary motive and then, there’s a secondary set of patents, which is competition covering patents, which stop others from getting your market share. The basic idea is that you can actually use your patents to stop others from taking the market share of your product.

That is how we seek core patents and, of course, they are aligned to the business lines that you think are the most important for you.

For example, in this case, if you see the supplementary secondary category, it’s an electronic product, so the business unit is electronic products and this company we know it was into electronic products as well. But, the strategic value from this line of business was decreasing and hence, we could tag this particular patent as a supplementary secondary because it talked about just the brightness control aspect of its electronic product which it was deciding not to sell anymore.

So, that’s how we felt that this was a fringe patent and we could, if at all it has, say, for example, if brightness control can be applied to displays, if you see the technology level-1 tag its display, level-2 elimination control. So, if using this we can apply these patents to say mobile devices, it’s a win for us. We should retain the patent.

Because mobile is a huge market. So, this objective analysis led to flagging of this patent, although it’s a fringe patent, we can keep the patent, we would take a look at it in the subjective analysis process which Amit would take you through now. That’s it from my side.

Purpose of Objective Analysis

Amit Kumar speaking- Thanks Henry. So, you see that the main purpose of objective analysis is to quickly see which set of patents shall be considered for pruning.

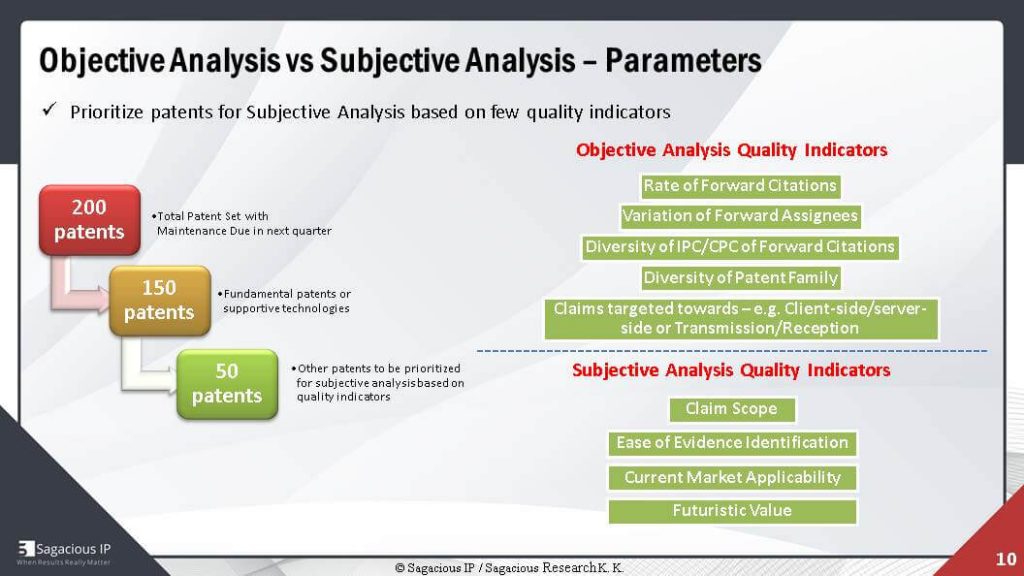

Now, we will see how you should shortlist patents for the subjective analysis.

Suppose there were 200 patents for which maintenance fee was due during the next quarter and out of these, based on the tagging process, 150 came out to be the core patents. That means, the remaining 50 patents were non-core or non-fundamental patents and should be studied in detail before abandoning. For this, instead of moving with all 50 patents all together we can prioritize or shortlist which patents to start with. For this, short listing process we can consider various parameters.

Objective versus Subjective Analysis

There are various parameters for objective analysis vs. subjective analysis.

Like for objective analysis, the quality indicators would be the rate of forward citations, variation of forward assignees. Like in data forward citations, what we see is, you can see the area on your citations for that patent, for example, like initially there were few citations for the patent but recently the patent citing have increased, so and more companies are citing it, that means the patent has obtained importance over the years, this implies that the patent can have a good potential and this can be searched in detail for subjective analysis.

The next parameter is the variation of forward assignee and this parameter; you can see the different type of companies citing a particular patent. For example, if there is an authentication patent and is being cited by the payment companies as well as server companies.

So, this means that this patent could be a basic authentication patent and could be applicable in diverse domains, which eventually means a patent can be a useful asset. Other parameters can be diversity of IPC-CPC of forward citations, diversity of patent family or the end to which the claim is targeted with. The claim is written from the client side or server side or from the transmission or reception end. The next set of parameters that we look here are the subjective analysis quality indicators.

Claim Scope and Evidence Of Use

The main parameters here are the claim scope and the ease of evidence identification. Like in claim scope, you can see if the claims of the patent are broad or narrow and if you are looking for any monetization or licensing activity, you can check what is the ease of identification.

Like, to check EoUs or claim charts, you need to find evidence for the products and if those evidences are easily available from the product literature that would obviously be a good patent else if you require a brief search for that patent that would also work but that would incur more cost.

So, here you can do a sort of high, medium and low analysis or we can say HML analysis to see if a patent should be taken ahead for a detailed analysis.

Also, in the subjective analysis, we can check the current market applicability of a patent or the future value of the patent; like in future what products might be coming that would have the applicability on the patent.

Based on this analysis and based on these parameters we come to a conclusion that which set of patents would be considered for pruning and will be taken for the next step of subjective analysis.

Subjective Analysis

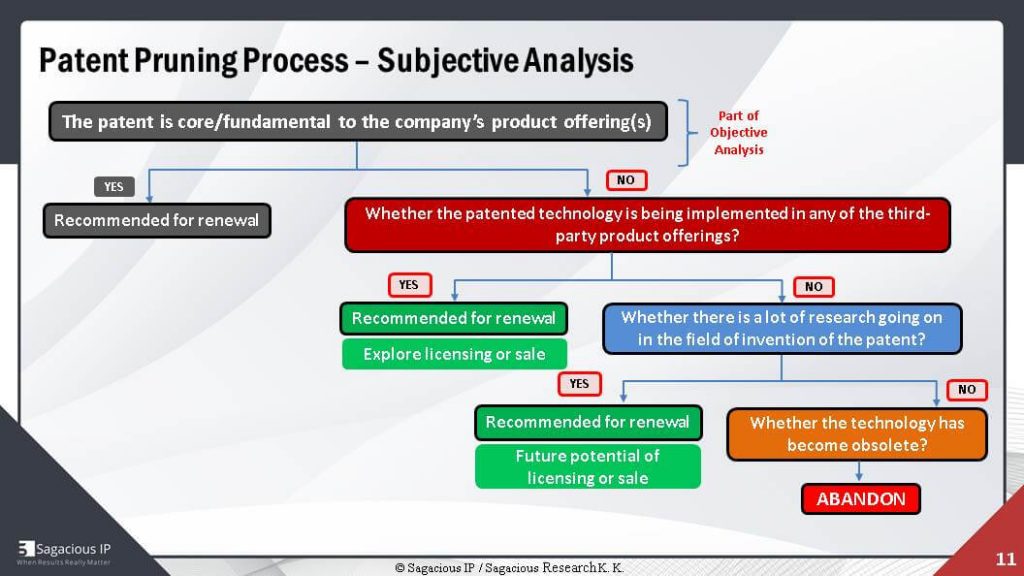

Now, let’s move on to the subjective analysis.

This subjective analysis, basically, highly manual in nature, is quite detailed. Here, what we do is, first, with make a good understanding of the patent and then further analyse it in detail. So, let’s see a flow diagram of how it is done and what major aspects of that are covered. Now, from the previous objective analysis that I explained, you were clear that which patents are core patents and that are obvious to be recommended for renewal.

What should be done for those patents which are not core to the company?

We can assist those patents on various parameters. Like, the first one can be whether the patented technology is being implemented in any of the third-party, including competitors, product offerings.

Let’s see. This is an evident example, like suppose, there is a telecom company that produces network devices.

Decent number of patents would pertain to telecom but this telecom company also comprises some patents that belong to smartphones.

Now, it would be a wise strategy for this telecom company, here, to see if the telecom company competitors would require such patent, like suppose there is a smartphone manufacturer that provides phones as well as network devices. So, here this smartphone manufacturer could be that third party for which this non-core patent of Telecom Company would be useful.

This is how this parameter is approached and if it seems to have third-party product offerings, the patent is recommended for renewal and other licensing and sales operation and if it is seen that there are no other product offerings then the next parameter is examined which is whether there is lot of research going on in this field of the invention.

In this parameter, we generally see the likelihood of applicability of patents in the futuristic products. Like, here, you can see the rate of forward citations that would help you identify different domain related companies citing a patent. Also, you can see here the diversity of IPCs in that section.

In this parameter, you can also check the patents which have significant life remaining, the possibility of patent being implemented in the future products. Like, here you could look at whether the companies are doing research in the related technology areas and look into the information disclosed by these companies on the futuristic products or prototypes.

Considering all the above instances, the patent is assessed and considered for renewal with respect to its future potential of licensing or sales, else we have to assess the next parameter which is whether the technology has become obsolete.

As, can be simply interpreted by the title itself, here, you can check if they are successful alternatives that happen to exist in the market catering the same problem as of the invention. So, if there are so many other alternatives in the market, that means technology is obvious to become obsolete and a good option would be here to abandon those patents. For example, consider the plasma technology. Despite being used in almost all the first generation televisions, it is now replaced by LCDs and LEDs.

Consequently, the patents covering this plasma technology are now worth nothing. Therefore if the technology has become obsolete, the patent shall be abandoned.

So, with this, you see, we have covered some of the factors that we considered in the subjective analysis and in the next slide we see an example of how we actually do the subjective analysis.

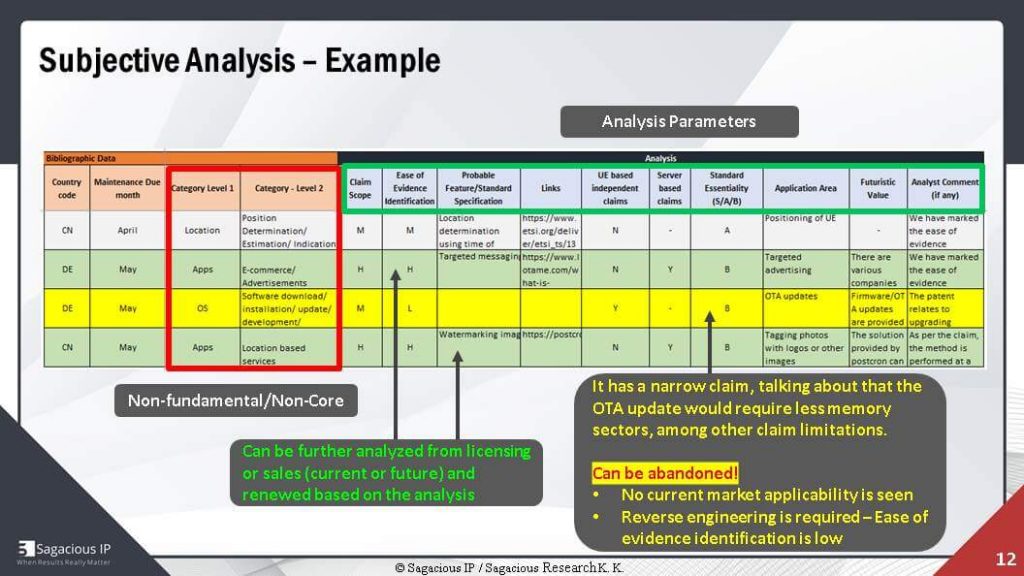

Okay, so this subjective analysis is basically done for non-core patents. The client here is one of the largest European Network device manufacturers. So, what we did was we got a set of patent numbers and first we did objective analysis and categorize the patent as core and non-core or fundamental or non-fundamental.

Then, for the non-fundamental patents, we assessed these patents based on certain other parameters, like if you see the third patent, the yellow highlighted patent; this patent has medium claim scope and low ease of evidence identification.

That means, specially this patent was, basically, about getting the OTA or Over the Air updates, the claims of the….as they were generally talking about installing the software update such that it should occupy less memory sectors as compared to the previous software version. So, we see that it is not easy to identify product information at this level, reverse engineering might be helpful here but that can also be a bit tough and it would also incur cost.

Seeing this limitation, we believe since this patent is a non-core patent plus it has no market applicability, plus it has low licensing potential. So, the wise strategy here would be to abandon this patent.

Now, let’s have a look at second and the fourth patents, the green highlighted patents, both of these patents have high claim scope and high ease of identification.

To give you a brief, the second patent here is about the targeted advertising based on the user’s activity, which can be user’s location.

And, the fourth patent is basically based on the tagging of the photos with logos of the places or any other image. These patents clearly have valuable market applicability. So, these patents can be analysed in detail from the licensing and sales perspective.

Talking about the licensing and sales opportunities, I would like to mention here that we have an upcoming webinar on May 14th on the various aspects of Monetizing Patents by means of licensing or sales.

Henry, would you like to say something about this webinar?

Vaibhav Henry speaking- Yeah, thanks. Thanks Amit. Yes, so we have an upcoming webinar on Patent Monetization. The previous one which went was the F3 analysis. If anyone missed that webinar, please feel free to visit our website and all of the webinars are being recorded and they are there.

So, if you want to or even if you missed, you can access the recordings, it would be helpful, a lot. F3 is a complete framework, so you would find a lot of relevant material there which will help you to understand how we can come to patent portfolio pruning using that framework. That is the reason why last week we talked about the F3 framework and the next Thursday i.e., today we are talking about Patent Portfolio Pruning. It’s because most of our clients and most of the people that we know they wanted this topic as soon as possible because everyone is facing budget cuts.

So, today we took up patent portfolio pruning.

Next, we are taking monetization. So, we’ll talk about core vs. non-core patents; will talk about patent selling vs. licensing, when to use them and the processes methods which ensure a good amount or a licensing deal. So, that’s next week and post that, Thursday next to that, we are doing one for Directed Prosecution. So, all of these webinars we are doing as a series. The F3 was the first which describes how we use the framework, which is the fundamental, future and fringe framework for generating revenue out of your portfolio.

So, right now we are presenting how we analyse the fringe patents to make sure that we get value out of even the not so relevant patents as well.

Next week, we are going to cover the fundamental patents and generally how you can generate monetization revenue and then post that, the next Thursday; we will talk about the future cases. We will talk about Directed Prosecution. Some companies call it strategic prosecution on how to build good portfolios from your existing assets by filing continuation applications.

So yeah, that’s all coming up. And, yeah, back to you Amit.

Amit Kumar speaking- Thanks, Henry. Also, Henry I would like to invite your inputs for this example specifically you can tell us the importance of UE based and server based claims here.

Vaibhav Henry speaking- Okay. Sure. So as Amit pointed out, for example, he explained that thing about a company which was a networks company, which was not manufacturing or may have stopped manufacturing, say, mobile phones, but at the same time there could be its competitors which may still be manufacturing phones or would have a larger share in inside of phones. So, in those cases, competition covering patents are very valuable which can help you.

For example, even if you are competing for, say, the network market and when you sign, say for example, if you sign a cross-licensing deal, so it would help you in having the upper hand in the cross-licensing negotiation. So, you should always have these competition covering patents.

That was a very good example where you talked about a company which is into mobile phones, but should retain the patents from mobile phones because they could well be covering its competition. So, again, if we talk about these two patents, which Amit talked about are actually patents which talk about location-based services. And, location-based services, of course, when we talk about transmission side and a reception side or we talk about the network side, which is the transmission side and the reception side which is the mobile device side.

So, if the claims have been written from the mobile device side, of course, you would use those claims and use those patents against your competitors in negotiations.

That is the main advantage here, you know, that is something that you have to consider in this analysis and that’s why we have sections like UE based independent claims, server-based claims. So, it helps in identifying whether what kind of area we can or what kind of market we can target based on the type of claim, if there’s a yes in both of them, the coverage of that patent is broad. And, then there are other aspects like standard essentiality of process.

A patent, standard essential, no one would abandon that application and similarly, there is another parameter called futuristic value; again, I talked about how we would be presenting a webinar on the future patents as well.

So, this is an indicator, once we do this kind of analysis if you find any patent with futuristic value, the next step to do there is see what is the closest product and then start filing continuation and improving the claims to take it in the direction of getting protection as per the products available in the market. So, that is something that we would cover in Directed Prosecution.

That’s all from my side Amit.

Amit Kumar speaking- Thank you, Henry.

In this way, we see that combining both objective and subjective analysis, you can accomplish which patents are still capable of generating monetary value or shall be renewed and which patents are not worthy enough to maintain.

So, for a quick recap all the major processes we have performed earlier, core or non-core or I should say non-fundamental patents and as I mentioned earlier in the F3 analysis, we have already categorized the patents in the 3 categories- fundamental, future and the fringe and these type of pruning patents come under the fridge category.

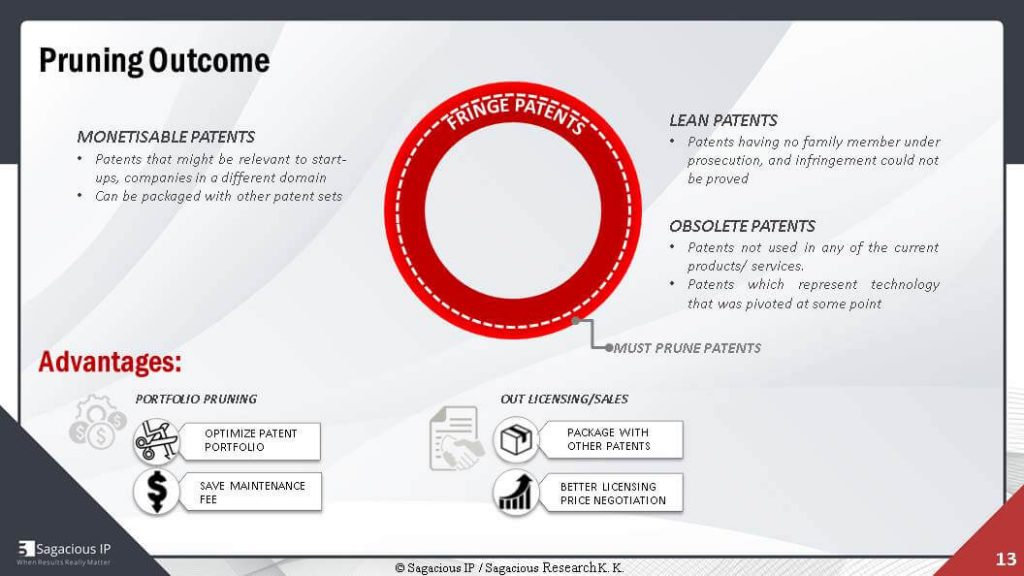

Monetizable, Obsolete and Lean Patents

To summarize these, the fringe category patents are basically comprised of 3 types of patents, the first are the monetizable patents. These are those patents that might not be relevant to your core business but might be relevant to the start-ups or other businesses or companies as well. You could use these patents for out-licensing, or sell this patent to such companies. Like, I will go back to this slide again.

In the above slide, you see the two highlighted patents, the green ones; these are the two monetizable patents. That means these two are the Fringe patents, but they are monetizable patents. And, so these are the good assets for the company.

The second category of the fringe patents are the lean patents. Lean patents, basically, are those patents that do not have any family member and also there is no infringement seen. The third one, the obsolete patents, that means there are other products and services available in the market. So, now the question is how to generate money from these patents.

The one is to bundle the monetizable and the lean patents and license them out as a bunch or secondly you can prune the lean or the obsolete patents and thereby saving the maintenance fee.

Monetary benefits of Patent Portfolio Pruning

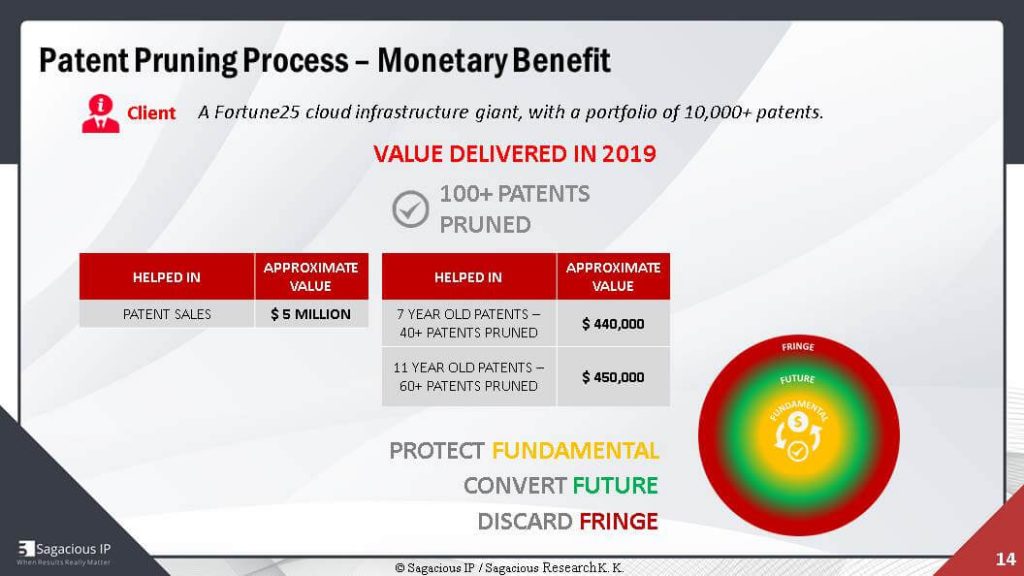

Okay. Now, let’s see what the monetary benefit of this pruning process is. Within the last 1 year, we have helped few of our clients to save money to the tune of almost 1 million dollars by just pruning the patents.

One of our clients was Fortune 25 Cloud Company with over 10,000 patents. So, what value we delivered was, in 2019, from the revenue-generating aspect if we see, we have pruned 100+ patents which helped this company in patent sales, making an approximate value of 5 million dollars just from the pruned patents and from the money saving aspect around 40+ seven year old patents were pruned, thereby saving approx. $440,000.

So, if I say 7 year old patents that mean the fee that was to be paid for the 10-year period that has also saved in this period. Apart from this, we also pruned 60+ patents that were 11 year old, saving approx. $450,000.

Hence, here we see the importance of pruning in the cost savings.

So, at the end keeping the objective of F3 analysis also in consideration, I would conclude by saying that you should always protect your fundamental patents, convert your future patents and discard your fringe patents.

So, that was it from my side. Over to you, Abby, now!

Abby Woods speaking- Thank you Amit for a very comprehensive overview of this webinar and let me just move over to the next slide please. Fantastic! Before I hand over the conversation to Henry, once again, who will take up the Q&A session, I would like the audience to just look at the slide. Right now, obviously, during covid-19 times, we are providing and offering 50% discount on patent pruning projects as well. These are initial discounts and if, anybody, any of the audience members interested, he can write us back to [email protected] and we would definitely address their queries as Henry mentioned earlier in the webinar. We have some upcoming webinars as well which is happening on the 14th of May, the topic is Monetizing Patents: Selling versus Licensing, Core versus Non-Core.

I think that’s going to be interesting as well. And, we have another one happening on the 21st of May which is Directed Prosecution: Generating Future Value from your Portfolio.

So, I think, right now, we have got plenty of questions in there. I would hand it over to Henry to take up the Q&A session.

Henry, please go ahead.

Vaibhav Henry speaking- Thanks. Thanks, Abby. Let me go through the questions. Let me pick up some questions which look relevant.

All right! So, I think the first question is; Is there any other way of doing this other than the pruning process (the one you described)?

Amit, would you like to take that?

Amit Kumar speaking- Okay. So actually we ourselves have tried a lot of ways before finalizing the discussed method.

Usually companies have tried to make a guess from quality indicators and then prune the patents back to back but in this case, you see, some good patents are also pruned. I’ll give you an example of one of our clients which was one of America’s largest computer memory and data storage companies. They let some of the patents in the lapse with the help of some sort of quick analysis and automated tools and when we looked at their lapsed patents, we identified some good patents that had monetization aspect but were obviously lapsed.

So, what went wrong here?

The main issue here was that there was no checklist made that would cover all the factors that are valuable to decide whether to keep a patent or let it go. Many people say that they have some automated tools for pruning patents but these shortcut methods are not always successful and I strongly believe that in our process, we have covered almost all the important indicators that will be useful for making informed decisions. A comprehensive study of pruning would obviously be very essential.

Vaibhav Henry speaking- All right! Great! Yeah, that’s true Amit, I think what you talked about was that company just used the objective analysis and we were able to identify 3 really good patents that it actually abandoned which it shouldn’t have. I know that case.

How to decide which criteria parameters are important in making decisions related to patent portfolio pruning?

All right, let me go to another question, right; how to decide which criteria parameters are important in making decisions related to patent portfolio pruning?

So, I think this was a question that we received very early and I think we have covered those parameters. So I’ll move on to the next question.

What shall be the starting point of doing this process?

The next question is what shall be the starting point of doing this process?

Okay. So, basically if there are a number of patents or how do we start from what I can see, we can start with the patents that are about to expire or which have the maintenance fee due most immediately but Amit, let me know your thoughts. Hand over to you.

Amit Kumar speaking- See actually a huge number of patents are granted every year and if these number of patents are not well organized you may end up letting your good patents lapsed. So, then you are, basically, indecisive about the patents you want to hold or not.

So, the foremost and the most crucial step here would be the technology tagging of the patents. Through this tagging process, you would get to know which of the patents in your portfolio are fundamental and which are non-fundamental, like I would go on this slide which shows here that we have tagged the patents accordingly, which patents are the primary and which are the secondary, the first step would be here to tag the patents to give them a technology tagging; tag them as core patents or supplementary patents.

Vaibhav Henry speaking- Right!

Okay. I see some other questions as well and I think if it’s about which patents among those patents, for example, to select; we generally select based on the payment due month.

So, for example, we are working for a company whose fee payments are due in May, so, you know, they still get a 6-month extension period but you know, that’s how you align yourself, you start looking at the patents which are about to expire very early. But as Amit pointed out, tagging is a very important exercise for maintaining a portfolio. That is the least that you can do if it’s a big portfolio.

Even if it’s a small portfolio, of say 50 patents, it’s important to know what the technology tags are so that you can have a macro level understanding of all the patents.

And, what Amit also talked about was the micro level analysis, which is very important about each of the patents before you abandon those patents.

Should jurisdiction be considered?

The next question I see is should jurisdiction be considered?

This is a very good point, so I see the gentleman has left without getting his answer. But the question that he has posted is a very good question- whether the jurisdiction should be considered and the answer is yes, of course, the jurisdiction should be considered.

A lot of it is based on the market coverage; of course if it’s an infringing patent, you should never let it go. But if it’s a non-infringing patent then market coverage is an important aspect. So, for example, there could be companies in Europe that have bigger coverage than companies in the US but anyways you never let go your patents in U.S. but at the same time if you feel that a geography that you initially targeted for your invention, it’s not growing in the direction of that technology.

Then, it’s important to leave that patent because we have seen for US and EP jurisdictions, a lot of companies in a given period of time start using the features of your patents in their product because they are looking to provide as many features as possible in the competition. So, we have found out that in U.S. and EP, the markets that generally find infringement and generally, you end up having companies using patented invention as a feature in the product.

So, of course, you will never leave EP, US and similarly China is a huge potential as well.

But again, it also depends on the adoption rate of the technology. So yes, we also advise companies on whether there are certain jurisdictions but again, that is something when we have decided that you we have to save money on the patent dispute to the jurisdiction as well. And that’s when we do that otherwise when you sell the patent the kind of geographical coverage that it provides is also very important. We would cover that in another upcoming, said, webinar which is on IP valuation or patent valuation. So, that was a pretty good question.

Let me see if I see anything else.

All right! So yeah, it’s an important question. So, Jim here says you are saying you saved $5million by pruning 100 patents that mean 50k per patent, which seems high?

Yeah Jim, I’m sorry. We wrote patents there however we meant patent families because generally when we sell, we obviously as I just discussed, we generally sell patents by family because of the coverage that they provide in each of the jurisdictions and the scope of the claims that they cover. Even if we find one infringing claim, then the value of the whole family goes down.

So yes, you’re right, 50k is a lot, if you see, if you’re talking about selling patents in big batches but it depends on the batch size also. Of course, if you are, say, selling more than 10 patents or 10-15 patents and there is, say, one infringing or one deal driving asset then you would sell it for around 350 or 400 thousand dollars. So, that’s roughly 30K per patent. But yeah, you are right if the size is more than that, the values may decrease and again, it depends on the valuation. And, it depends on the factors that are considered into valuation.

One of the main aspects of it is that whether you have infringing products for the feature provided in the patent but yeah good question.

I understand and that’s a very practical question. All right! I think we have still more time.

How frequently do we need to run this patent portfolio pruning process?

All right, so I think, I already answered that how frequently we need to run this pruning process. Companies do it monthly with huge portfolios and/or some people do it quarterly. With one of the companies, we do it quarterly. Some people even do it yearly. Therefore, for example, for the next year, people do it in the previous year.

All right!

In biotechnology sector, how to decide on core and supplementary?

I would pass this question onto the folks at Biotech and Life Sciences. I would only comment on high-tech area which we have been working for the past decade. We have 3 teams- the engineering team and the life sciences team. I think they would be the right people to comment on that.

Then we have, is pruning reversible? If so, what would be the time frame within which it can be done?

Again, this is something that you know one of the people from the drafting team and the filing team, I would let them comment because we generally advise technically on patents. I do not have a right answer for that.

But, if you want then please write to us and I’ll have this reviewed by a drafting and filing team.

Can you please comment on primary secondary benefits?

All right, so there are primary- secondary patents for non-fundamental patents. I can’t seem to understand that question.

Thus, those were all the questions I have we could take up for this webinar.

And, Over to you Abby!

Abby Woods speaking- Absolutely! Thank you for your time Henry. Now on as far as closing remarks go, I mean, I think first of all this has been intriguing topic and this has been wonderful, especially with you Henry, and obviously, Amit; the experts regarding this topic.

I’m sure our listeners have actually great takeaways from the session and would be able to use several of these pointers while working on trademarks for their businesses. I can still see questions coming up but not being able to cover all the questions that we have received from the audience.

However, as I mentioned you can certainly see, our email address is there. Please feel free to drop in an email there. Those which could not be covered will be answered in the write-ups which we will publish post this webinar on website as well. So, thank you again to Henry and Amit; our speakers and our experts at Sagacious and one more thing which is very crucial, as I already mentioned, that participants of this webinar can definitely drop their any queries that you have at [email protected] as well and we will share it with them.

Any other questions regarding any other domains, please write us to this email address as well. So, as I mentioned there will be a special promotional 50% off on the first patent portfolio pruning project. Please take note of that audience.

I want to extend a big thank you to our listeners who helped us start on time, stayed with us for the extra 15 minutes or so, and we highly appreciate that and thank you very much all of you guys to take out time to join us in this particular webinar series and please do not forget registering yourself for the next top two topics. The next one that we have is Monetizing Patents. Hence, we will definitely like to talk about selling and licensing of these patents with core versus non-core as well.

So again, thank you all of you to take some time out of your busy schedule for the webinar. Lastly, you stay safe. These are crazy times. I hope you stay safe. Take care of your family and take care of yourself well, and have a great day ahead. In fact, I’ll definitely meet you guys in the next topic real soon. You have a great day and take care of yourself.