Monetizing Patents: Selling vs Licensing, Core vs Non-Core – Webinar

Webinar Topic: Monetizing Patents: Selling vs Licensing, Core vs Non-Core. Key Points Covered in this Webinar Session:

- Which option is suitable for my business – Selling or Licensing?

- If selling is preferred, then

1. How to identify which patents to sell?

2. What is the best way to find a buyer?

3. How to show the value of the patents to a potential buyer and what is the best way to determine the selling price of a patent?

- If licensing is preferred, then

1. Identifying which patents to license?

2. How to identify potential licensees?

3. What is the best way to choose a licensee which won’t counter-assert its portfolio?

4. Identifying deal drivers from the portfolio?

5. Deciding between exclusive vs non-exclusive license?

6. Determining the apt royalty fees? - Brief about importance of buying IP

o Why this may be a good time to buy IP?

Table of Contents

Speakers:

Submit Your Information to watch the Webinar Video:

More details about this Webinar:

Coronavirus (COVID-19) is impacting all aspects of our daily lives. Moreover, on top of the very real health risk, it is disrupting our social fabric and also interrupting ‘business as usual’ operations. And, apart from a direct impact on production and sales, there would be an indirect impact on supporting functions such as IP. Consequently, R&D centers and CoEs may face budget cuts on NPD and IP activities.

Thus, in such a scenario, monetizing patents can be a solution for IP departments to lower their overall cost and increase the revenue generated by patents, therefore, hedging losses.

In addition to that, patent monetization can be done by means of sales, licensing and financing based on the value of the patents, among other things, with compensation ranging from upfront or deferred cash, to equity and business partnerships as well.

This webinar sheds light on learning key issues in patent monetization and how Fortune companies are dealing with them.

Webinar Transcript:

Abby Woods speaking- Hello, everyone! This is Abby Woods with Sagacious Research, your host for the session.

Thank you for joining us for today’s webinar.

I am the Global Key Account Manager at Sagacious IP and I’m your host for the session. Sagacious IP, as you may know, is an award-winning IP research and consulting firm specializing in Global patent information searching, patent licensing and monetization, Innovation management, technology scouting and other aspects of IP lifecycle with over 350+ professionals in the business of patent search for 14+ years.

In addition to that, I would also like to welcome you all to another important webinar in the on-going webinar series, which is on the topic Monetizing Patents: Selling vs. Licensing, Core vs. Non-Core.

We also have had successful webinar topics previously like Best Practices in Innovation management, F3 analysis. Also, we had a wonderful session by our experts called Portfolio Pruning last week. And, if anybody missed it, it’s definitely there on our website.

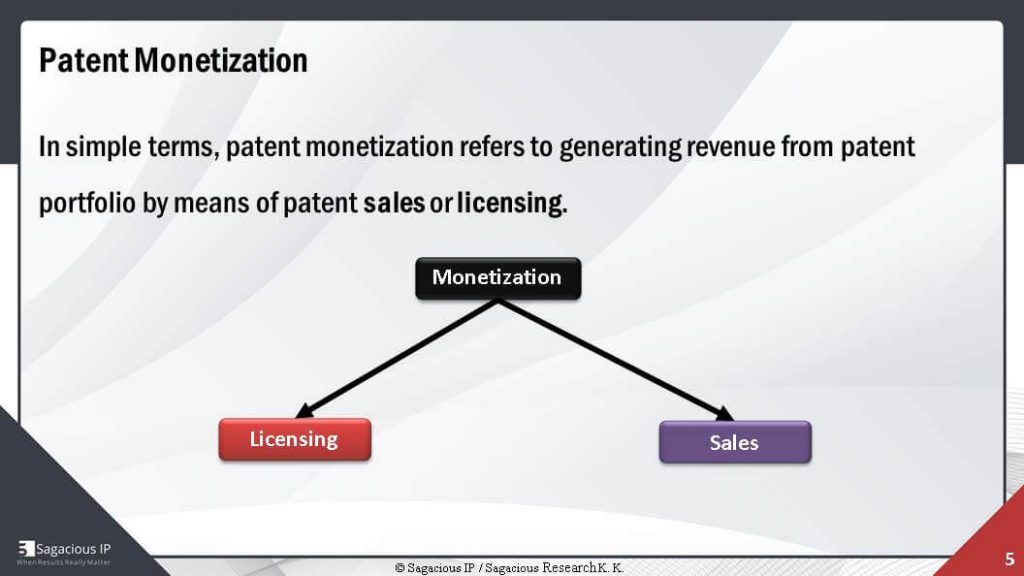

As I mentioned, Patent Monetization is what we’re going to talk today and it, in layman terms, refers to the generation of revenue or the attempt to generate revenue by an individual or a company by selling or licensing the patent it owns.

Now, before we go ahead further and talk on this topic and introduce the esteemed speakers on our session today, I would like to welcome all the participants from around the world. I think, we have quite a good mix of attendees, today. Wonderful!

Welcome all of you once again and your participation, basically, is a wonderful encouragement for our efforts in spreading knowledge during these unfortunate times. And, I hope you and your families are all keeping healthy and safe and we’re also grateful and thankful to our clients for always sharing their problems with us such that we get an opportunity to come up with the relevant solutions.

Okay, without any further Ado, let me go ahead and now introduce our first speaker for the session.

His name is Aman Goyal and he’s, basically, an Assistant Manager, High-Tech licensing and commercialization. He is an intellectual property professional with more than 5 years of work experience in identifying monetization opportunities for its large and small and medium enterprises patents in a cost-effective manner.

Now, welcome to the webinar Aman.

Aman Goyal speaking- Thank you, Abby, for the introduction and having me on this webinar session.

Abby Woods speaking- Fantastic! Great! Supporting Aman is, Mr. Vaibhav Henry. He’s basically the backbone of Sagacious IP with more than 10 years of experience in supporting clients on licensing activities. Henry, basically, helps the entire high-tech team at Sagacious. Welcome to the webinar, Henry.

Vaibhav Henry speaking- Thanks for having me, Abby. It’s a pleasure to be here.

Abby Woods speaking- Fantastic! Now before we start off with the presentation today, let me ask both Aman and Henry for their initial remarks on Patent Monetization. Go ahead, guys.

Aman Goyal speaking- As far as analysis of IP domain in 2008 crisis, we have observed that company tried to boost their top line by monetizing their ideas and patent monetization is the need of the hour in Covid-19 scenario. When we talk about monetization, then, 2 things generally come to our mind, sales and licensing. However, to choose between the two is quite cumbersome without any expert help.

Hence, we will be addressing various intricacies involved in deciding which option is most suitable, in this webinar.

Henry would you like to add to that?

Vaibhav Henry speaking- Thanks, Aman.

So, just a high level overview that now is the right time for sowing the seeds such that you are reaping the benefits when things settle down. Nothing more! I’ll support you along the webinar and I will talk about some of my experiences and some examples wherever required.

Abby Woods speaking– Wonderful! Thank you both of you for setting the context for this webinar, Aman and Henry.

Also, before we move ahead just a little housekeeping that if you have any questions during the presentation, then, you all can share your questions via the Goto webinar question box on the right side of this presentation window. And, we will pick up on those questions and then ask them to our speakers after they finish their brief talks.

Now, basically, finally in fact before I go further, I would request everyone to stay till the end of the webinar for announcement that could benefit you all in these desperate times. Now, without further ado, let’s now get started with the main part of our presentation and for that let me invite Aman to take us through the first part that helps understand Monetizing Patents: Selling vs. Licensing, Core vs. Non-Core.

Over to you, Aman!

Aman Goyal speaking- Thanks, Abby.

Hello, everyone. As already mentioned, that we will be covering various aspects involved in deciding between Sales and Licensing. And, hence, we have divided our webinars in various sections to touch base all the important topics that we have done over time.

What is Patent Monetization?

To begin with, I would like to discuss what Monetization is.

Monetization, in simple terms, is, basically, generating revenue from your IP.

IP consists of multiple things. Here, we are concerned with patents. And, then we refer monetization.

We will be talking about generating revenue from the two most widely used methods: Patent Sale and Licensing.

Patent Sale involves transfer of ownership to a person and/or a company for some mutually agreed amount received, generally, as lump-sum.

Whereas in Licensing, patent owner retains the right. However, he might give exclusive or non-exclusive license in return of royalty payment which is directly related to the sales of the product by the licensing.

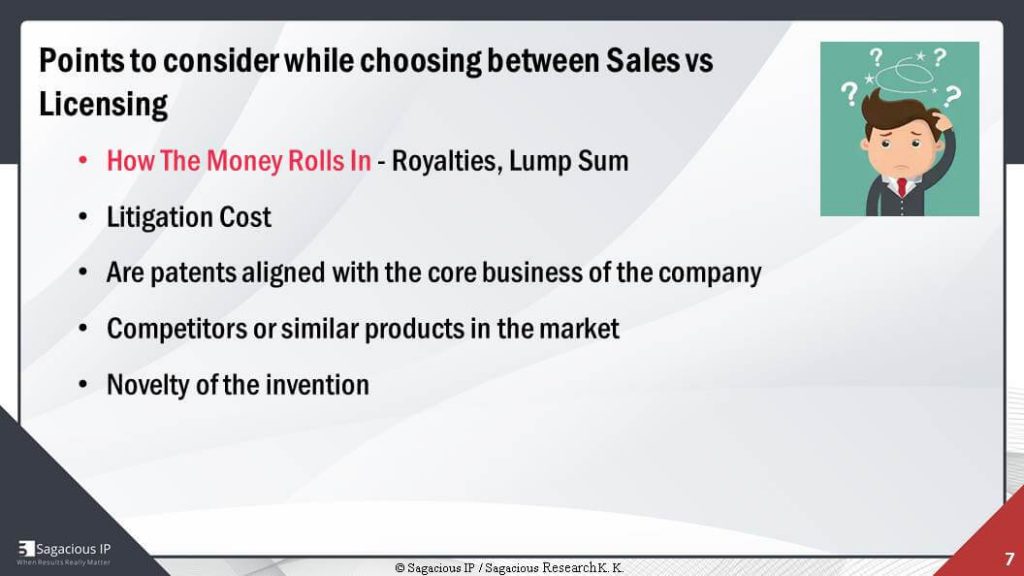

Factors to consider while choosing between Sales and Licensing

There are multiple factors involved in choosing between sales and licensing. The most important one is how are we anticipating to receive money?

We want it as a lump sum or royalty. Say, if you had that in your balance sheet, which is quite huge, and then lump sum might be your choice. Therefore, then, you can go for sales or you have the bandwidth to bear the litigation cost, then you might go for licensing.

As we have seen that licensees generally have less in incentive to enter into licensing negotiation with those patentees who have no means to enforce their patents.

Further, in addition to that, there are other factors like what type of patents you want to monetize, are they core to your business? If they are core to your business, then our suggestion is that better to go for licensing and not to sell them.

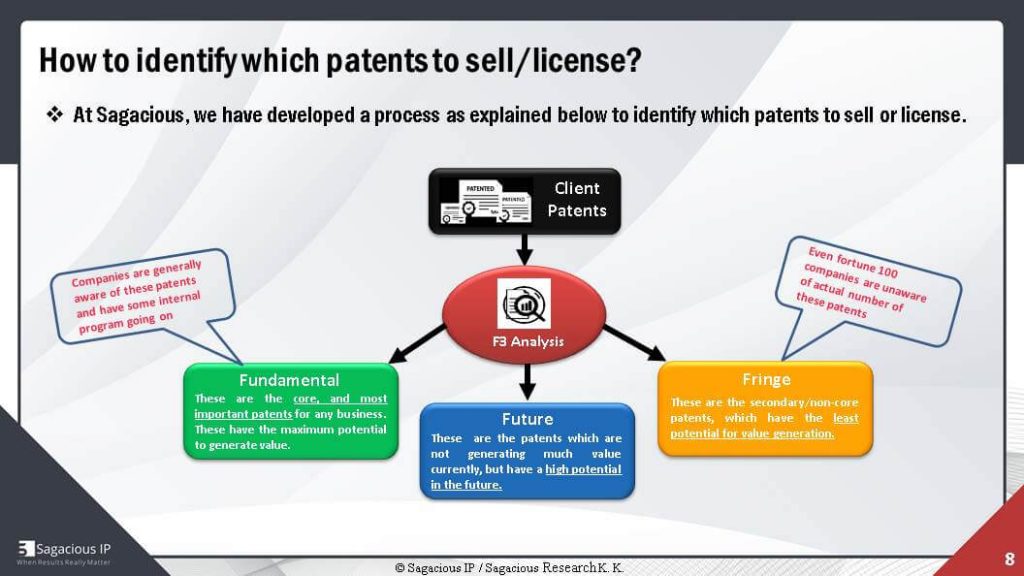

These are just some objective parameters which might help you in deciding which option is best. However, we will touch upon other factors as well in this webinar. Considering the factors discussed previously, we have developed a proprietary solution known as F3 analysis to assist you in deciding which patent to license or sale.

In F3 analysis, we basically categorized the patent in the portfolio into 3 subcategories.

Fundamental, Fringe and Future Patents

First one is fundamental. These patents are core to your business and have maximum value.

Next is future patents. These patents have future value. And, say, you have patents related to Cloud domain but you are currently not into the business of public cloud like companies, Google and Amazon. But, you are also a reputed server based company which might enter into the business in the future. So, these patents are future patents which might be helpful for you.

Another category is fringe patents and these are basically non-core patents and have least potential.

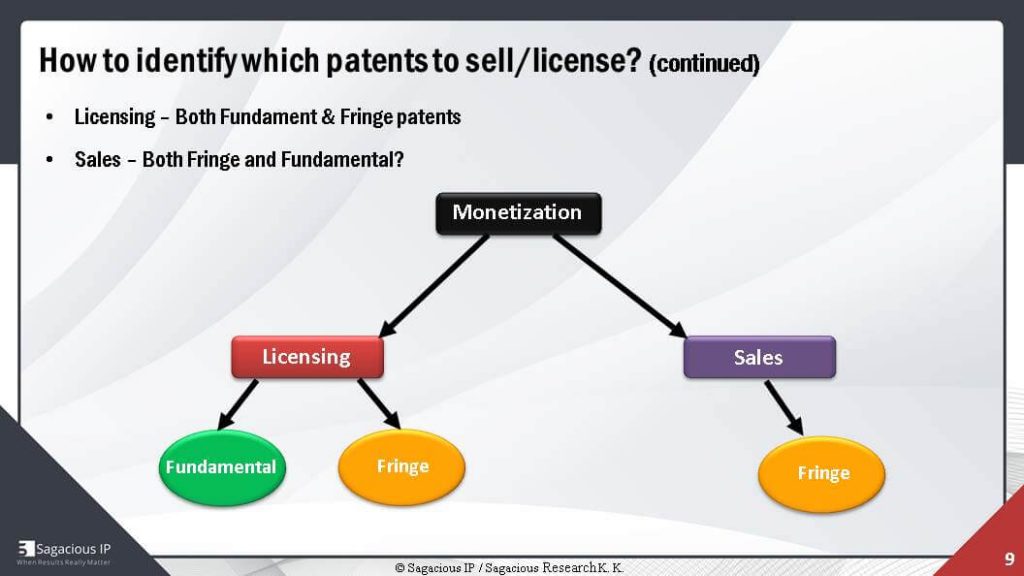

Based on our past experience, we have seen that we can license both fundamental and fringe patents as well.

Licensing fringe patent also prevents counter assertion as you will be asserting your patents to companies which are not your direct competitors.

You can even sell your fringe patents. Thus, by selling them, you won’t lose your competitive edge as these are not related to your core business. These are non-core patents.

So, consequently, we can license both fundamental and fringe patents and we can sell fringe patents. We should not sell fundamental patents, ideally.

How to identify fundamental patents and fringe patents?

Having understood about fundamental and fringe, the next question arises how to identify what are fundamental patents and what are fringe patents?

In order to identify fundamental patents, the fundamental patents are the core patents which are essential to your daily business and are also important to maintain your competitive edge.

You would have a different terminology regarding your core patent. But, the concept remains the same when we talk about fundamental patents and that is, that these patents are core to your business.

We generally look into multiple factors but the four factors that we have mentioned are more important.

Generally, we have seen that big companies have categorized their patents. So, by looking at their technology tags which are related to their business units, we can identify which patents are who.

If, in case, you cannot categorize your patents and you don’t have those technology tags, then, you can identify core patents by looking at the CPC codes which are related to your core business or you can also identify patents which have related features. Say, you are in a mobile domain and you have a patent related to authentication. Authentication patent is relevant in multiple domains but it is definitely relevant to your mobile domain. Therefore, this patent is fundamental and this patent should go into fundamental patents.

Now, the next thing to understand is that how we can identify a Fringe patent.

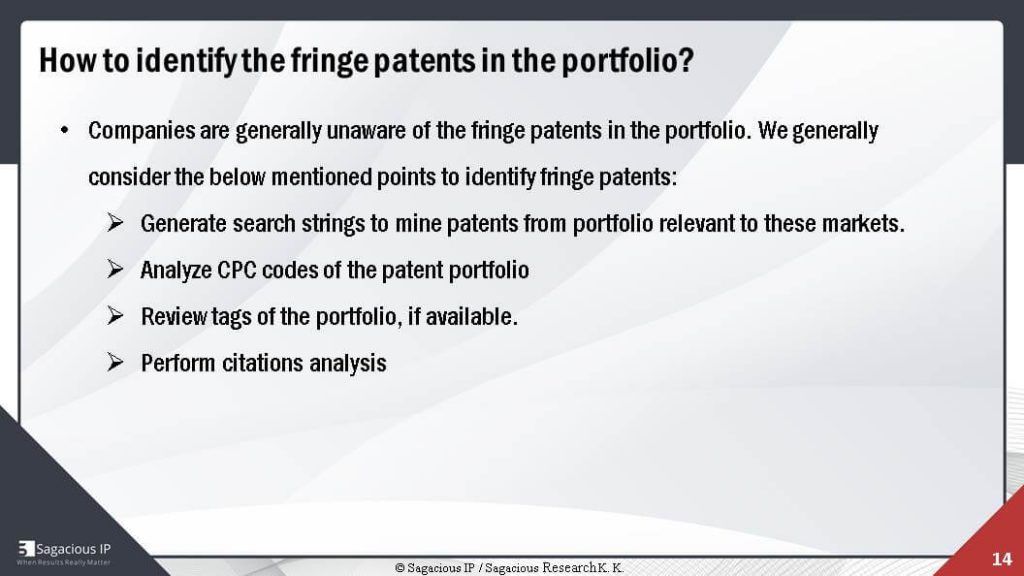

There could be multiple factors like you have some fringe domain. For example, non-core domain in your mine and you can also mine your patent using search string. Say, the non-core domain is mobile domain and you can mine using the search string. You can use CPC analysis. And, you can also analyse that tag and perform citation analysis. We will discuss CPC code methodology in detail.

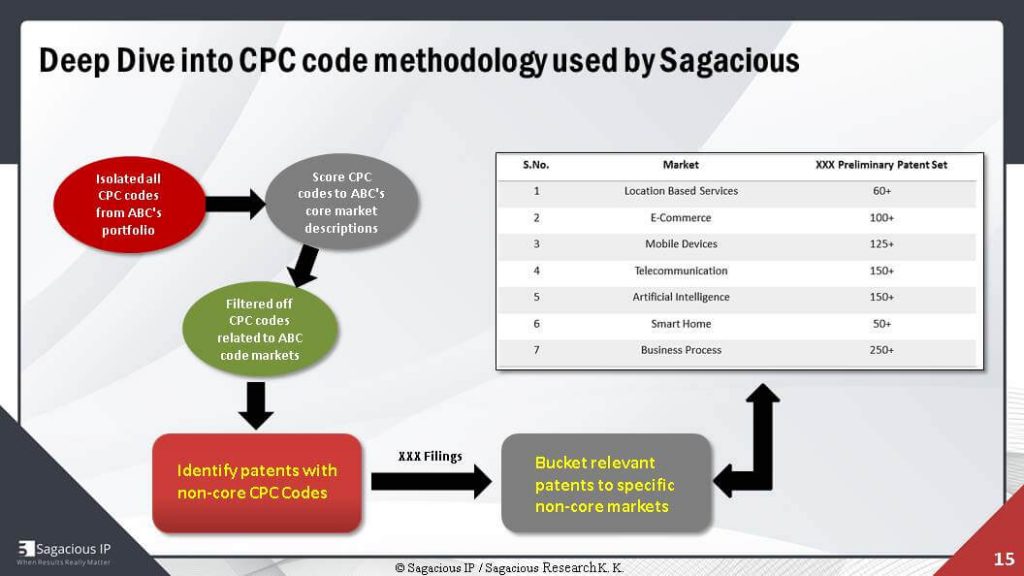

The idea behind the CPC code methodology is to quickly identify non-core patents from a large portfolio. It takes a lot of time.

Here, you can simply filter-off the patents with code CPC to obtain non-core patent and then bucket them with respect to your non-core domain.

Moreover, we have applied this approach for one of our client which is, primarily, a server based company and we obtain multiple core domains in their portfolio. As you can see that their portfolio has patents related to location-based services, smartphone and e-commerce. So, there are multiple non-core domains in which their patents lie.

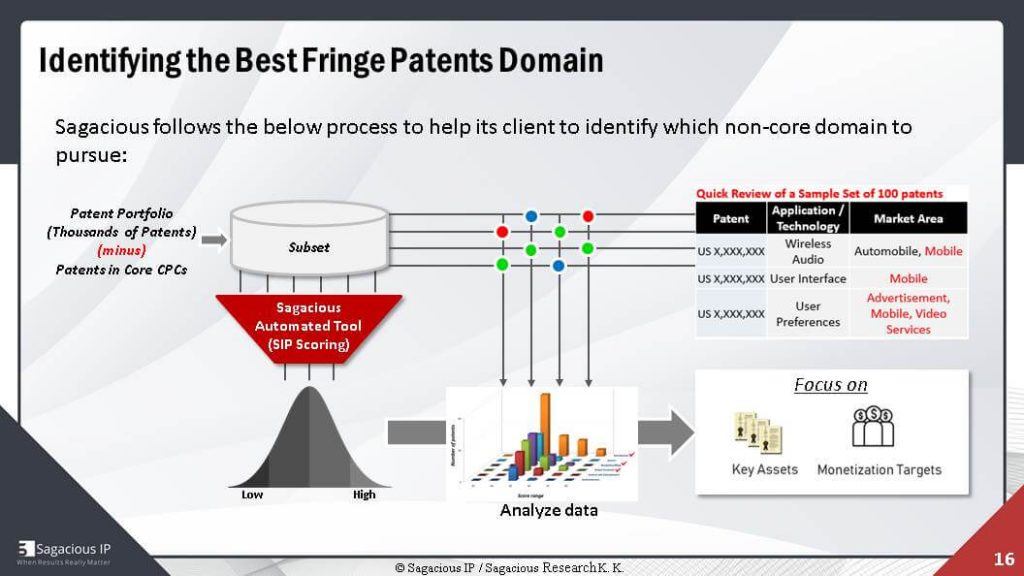

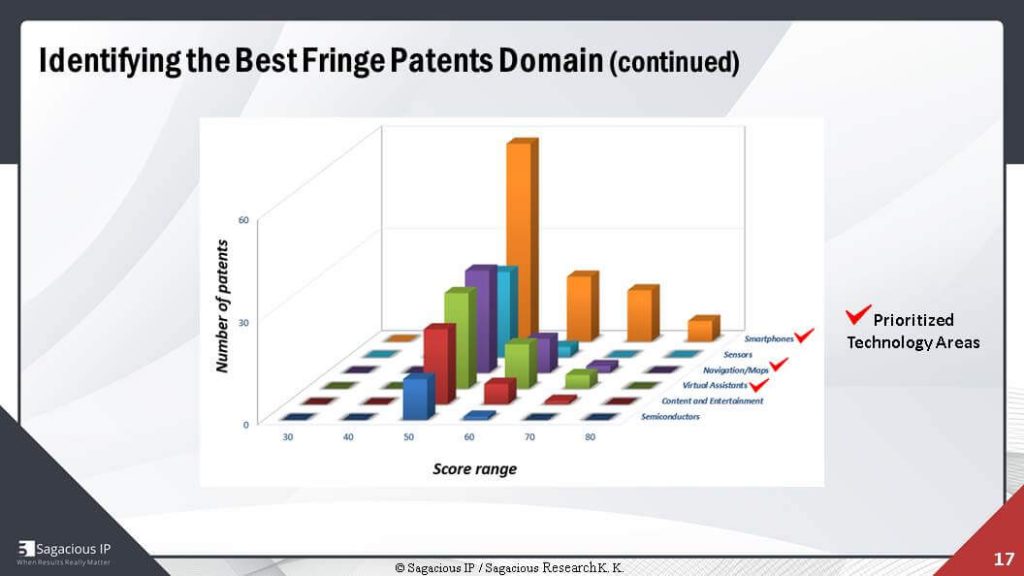

As we have seen that if we have large portfolio, which large companies generally have, then your non-core patents would belong to different domains and it could also become quite difficult to prioritize these domains. In order to solve the scenario, we have developed a solution where we perform automated scoring of the non-core patents and analyse their score with respect to their domain.

As you can see in this slide, this analysis we have done for automotive OEM Company to identify which non-core domain is suitable for them.

In this graph, we have observed that patents related to smartphone, navigation and/or virtual assistant technologies have better score than other technology area and we can prioritize these areas for macro analysis. And, this we will explain in the subsequent slide.

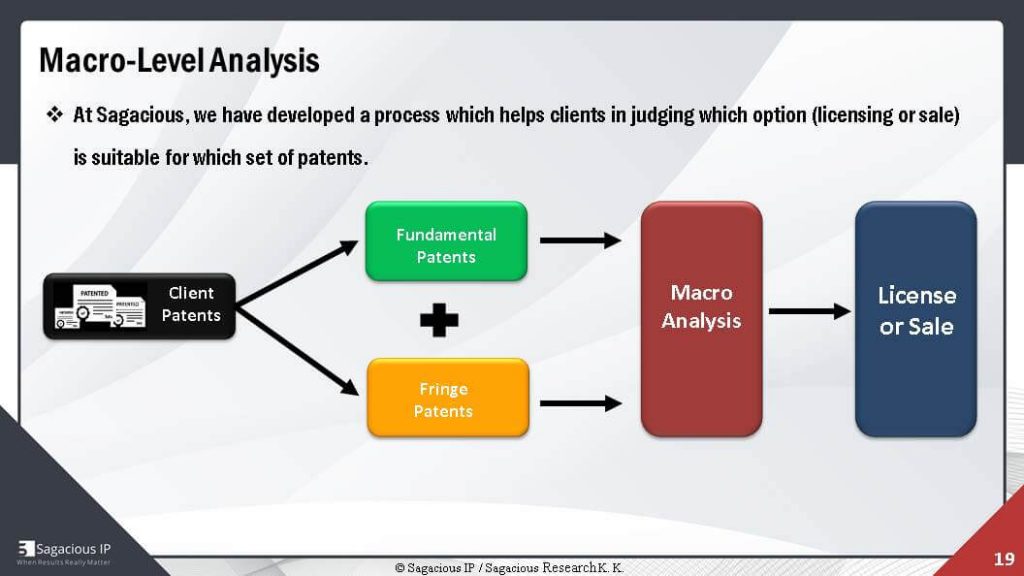

So far, we have covered how to identify fundamental and fringe patents using F3 analysis, CPC code analysis. But, the final decision whether to license them or sell them would depend upon the macro analysis. The macro analysis gives you an insight about actual number of potential asset in the portfolio.

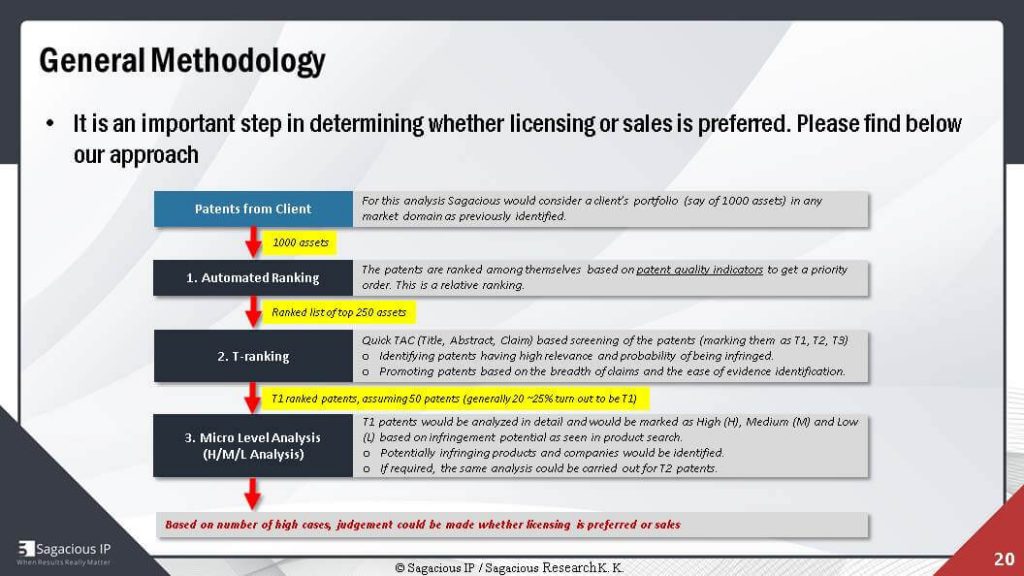

Hence, in order to so, you might perform detailed analysis for each patent which is obviously a very time-consuming task. Therefore, we have developed an approach where we perform detailed analysis on a very small subset of patents.

Using this approach, I would also like to explain it with the help of an example, say, you have a set of 1000 patents. Firstly, by performing step one which is automated ranking, we would reduce it to 250 patents, so we will choose 250 best scored patents. Then, secondly, we would quickly perform T-ranking.

T-ranking

T-ranking is, basically Title, Abstract and Claim.

Looking at the Title, Abstract and Claim and entering this patent is suitable for us or not. We will further reduce them to 50 patents on which we actually perform detailed analysis or H/M/L analysis.

As a result, by using Step 1 and 2, we have reduced the set of 1000 patents to 50 patents. So, by using this approach we are saving lot of hours for our client.

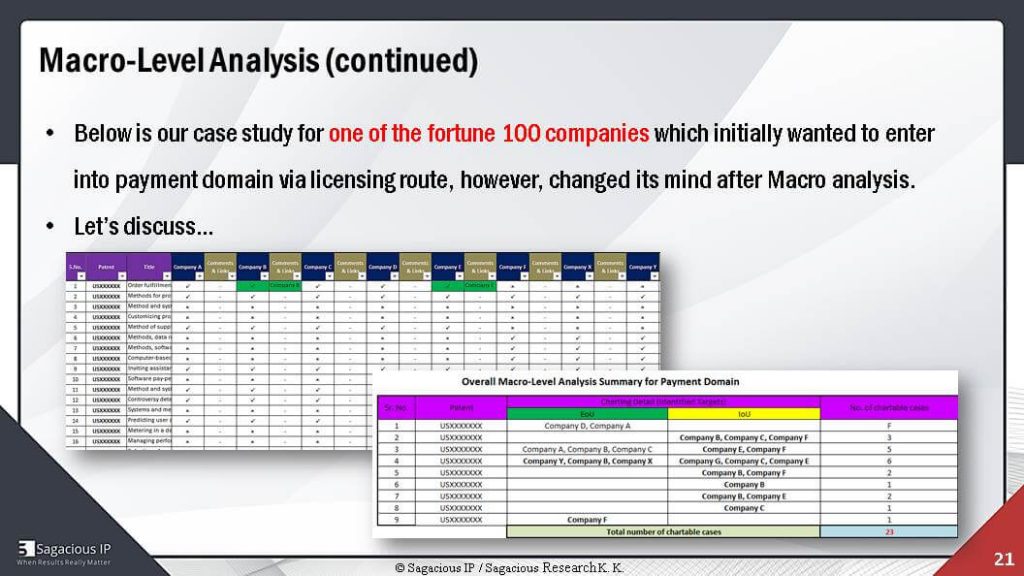

We have also applied this approach for one of our fortune 100 clients which wanted to enter into a payment domain via licensing rules.

As you can see, this is the output after T ranking where we have looked at the patents and identified that as out of these patents, which ones are relevant for company A, company B and company C and which are not relevant. And, by performing detailed analysis we come to know that what patents are capable means on which we can generate an EoU and when we say EoU, these are detailed charts where everything is mapped and on which we can generate IoU. So, these are high level chart where each and every element could not be mapped. Thus, we are only mapping the use of the technology.

As you can see on the EoU column, you would find that there are very few patents on which we could identify EoU possibilities but there are a large number of patents on which you are able to identify IOU possibility and even in the EoU case, there are very few companies which are being mapped.

We have generally seen that in order for a good licensing program, you should have around 6 to 8 charts against a single company, when we say chart 6 to 8 EoUs against a single company. While in the sales what matters is number of potential patents where you can identify IOU or EoU. By looking at the strategy, it seems that the portfolio of our client is more suitable for sale or a hybrid approach in which you could sell EoU or license EoU.

In order to discuss in detail about the hybrid approach, I would like to invite Henry.

Vaibhav Henry speaking- Yeah. Sure. Thanks very much, Aman.

So, I quickly wanted to touch upon the hybrid approach here.

Before we go into the hybrid approach, I just wanted to remind the attendees that we are currently talking about both the micro analysis which we saw in the previous slide, which is actually streamlining our effort such that we identify the patents which are being infringed or the patents which are being used in the market, so it kind of streamlines our effort such that we are able to identify what are the companies that are infringing and such that at every step as soon as we identify infringing companies and we have infringing patents, we are able to take a macro level look at them.

Now, this is something that we found out after the complete analysis and in such a scenario, if there are not a large number of EoUs, such that there is no depth in the portfolio in terms of identifying multiple infringing patents for a single company. Whereas, actually the portfolio is 2-3 patents for, say, company A, 1 patent for Company B, and it’s scattered.

In that case, the hybrid model is pretty useful.

So, this is something that we discussed with our mentor. So, he has been in companies like Intellectual Ventures, HP and Nokia and the hybrid approach as he suggested was about going to companies and asking them to take a license for the portfolio because you have good patents in the portfolio and at the same time, if you see, for example, here company A has used a technology or there is Evidence of Use of the technology by company A to transferring that patent to company D such that it can stop it. It has an advantage of stopping company D. And so, you’re giving him that advantage and at the same time you are leveraging the value from the complete portfolio.

So, basically, the idea is licensing should always be used as a tool. It’s not just a one-time perspective. Licensing is something that can be used as a tool for the betterment of both the parties. It’s not just an assertive stand. So, that’s an example that I just wanted to tell.

Right! Back to you Aman!

Aman Goyal speaking- Thanks Henry, for explaining in detail about the integrity involving hybrid approach.

How to value patents and what are the factors important to create a good pitch book?

Moving ahead in this section, we will discuss how to value patents and what are the factors we can look to create a good pitch book?

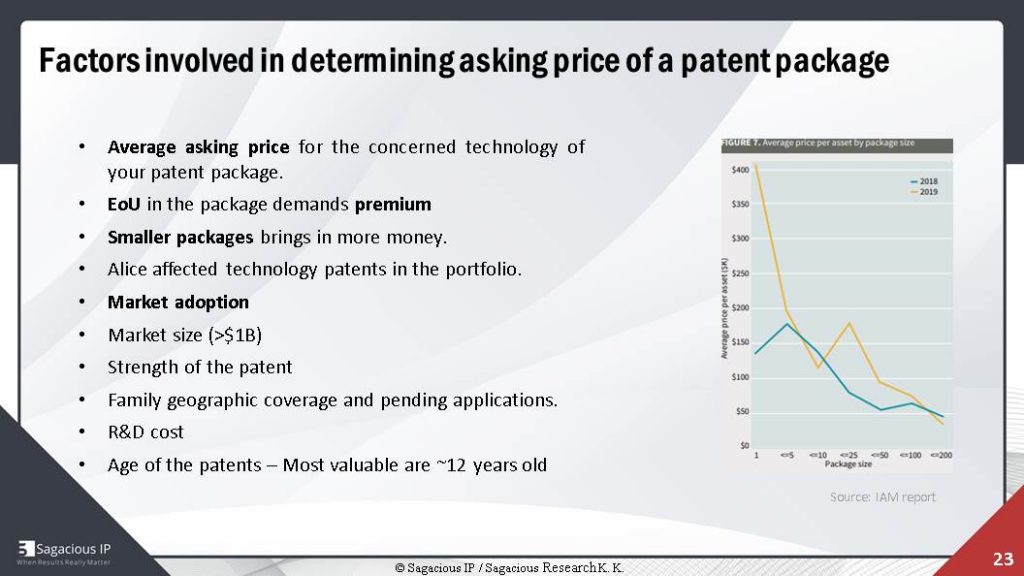

Having discussed how to choose between licensing and sales, it is important to understand the factors involved in determining the asking price of a patent package.

We are using the word asking price, it is the price that you set, it might be possible that your pitch book will get sold at a higher or lower prices. So, there are multiple factors involved in it, like you should be aware of the average asking price of the concern technology of your portfolio. So, if your portfolio is related to software patent, then you should be aware what is the average asking price involved in it. And, the other thing is we should always keep smaller packages, as you can see on the right hand side the graph.

As you can see on the x-axis, they are mentioning the package size. As the package size increases, the average asking price per assets decreases. So, it is important to keep smaller packages.

We would be covering this topic in detail in our upcoming webinars related to Patent Valuation where we will tell how we combine these multiple sectors to provide a single value. So, it would be great for you all to register it and understand the process. Now, I would give you all 10 seconds to read through this before moving on to the next slide.

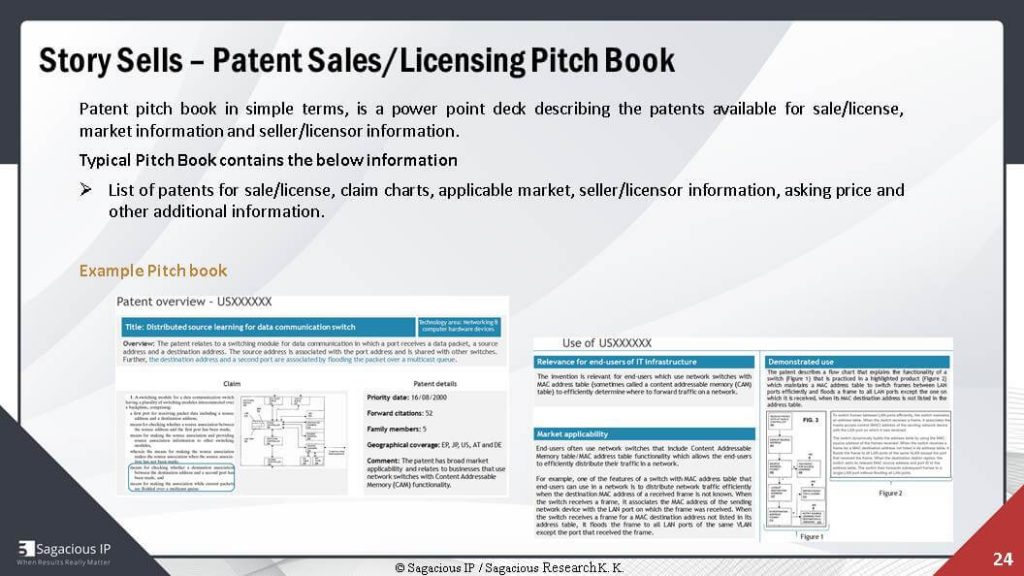

In any sales/licensing, it is important that we create an informative slide of pitch book. There, we are presenting a story to our buyers so that he can easily relate. In any pitch book, story is important because we have seen that when you want to sell something, it is important to sell as required by the buyer & so, buys it easily.

Exemplary page will contain patent bibliographic data, use of patent among others. As you can see that on the bibliography, you can provide information about what is the family size, citation and on the other side you can provide its market applicability, how you are visioning that, some IT infrastructure and users’ benefit by using this.

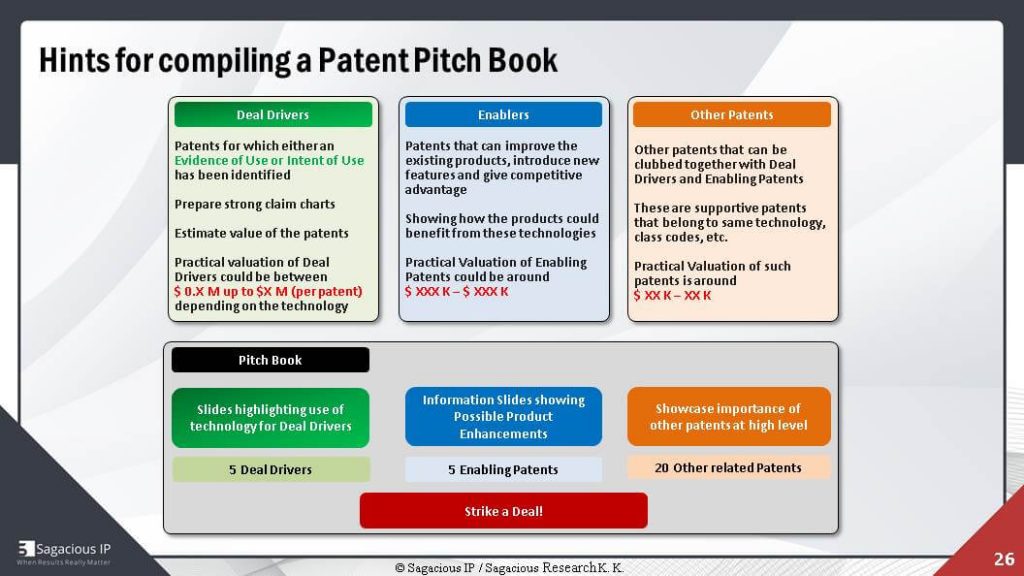

So, we have provided some hints for compiling a patent pitch book, it is already highlighted in the previous slides. Also, identifying deal driver is important. So, deal drivers could be for licensing case. These are the EoUs and for sales it would be EoUs, IoUs or any document showing use of technology. So, we should use those.

Then, we can include enabler patent. They are such patent which are providing improvement to your current technology. So, a buyer might be able to improve their current product if it is part of your portfolio, so you should present it accordingly.

You can, then, provide related patents also because we have seen that it’s not only deal drivers or enablers, even related patents are important because buyers are or even the licensee is looking for a complete package.

So in a pitch book, you can include 5 deal drivers, around 5 enabling patents and some other related patents. As you can see that we have kept the size of the pitch book quite small as we have already discussed that the small size of pitch book is important to enhance the value.

There are other factors also like Henry mentioned that in licensing pitch book, our tones should be defensive. We should better show the use of technology rather actual charts in the pitch book unless specifically asked. You can even look into the merger and acquisitions of top companies to identify what they are basically buying and align our pitch book accordingly because in pitch book buyers’ perspective is important.

So, we should be aware that what they are currently buying, so we can get this information from the merger and acquisition. This is one part, there are other parts also.

So, that’s it from my side. I have covered various approaches involved in monetizing patents that we at Sagacious follow.

Over to you Abby!

Abby Woods speaking- All right, thank you once again, Aman that was quite a comprehensive overview, I must say, of patent monetization.

And, before I hand over to Henry to answer some of the questions people have been posting, I can see a lot of people asking questions there, I would like to basically remind all of you some offers right now as you can see the first offer, right now, for all the attendees out here is free consultation. Plus, no costs proposal and a 15% discount which is 1-5 % discount on patent monetization project. Basically, you can actually avail the offer by writing at webinar@sagaciousresearch.com .

Also, as you can see, you can enrol yourself and register yourself for the upcoming webinars. We will definitely like you all to register for those as well. I mean, there is a lot of learning involved, a lot of information, and lot of hard work which is actually put in by our teams as well for all of you. Next, there is a topic called Directed Prosecution that you can be part of. It says, generating future value from your portfolio. And, there are other upcoming webinars as well, those we definitely like to talk about, like Patent Valuation: A hybrid approach for practical value.

Also, before I go further now, let me hand over the questions to Henry, who would be taking all the questions that the audience have been posting because I can see a lot many questions there.

So, I think time to answer these questions. Henry, please go ahead.

Vaibhav Henry speaking- Thanks, Abby. Let me take a look here. Alright, I think, the first relevant question is; Is there any other process which; it seems our attendees have not actually gone through the F3 analysis which we have been talking about in the last three webinars. So, is there any process and where do you start from?

Where and How to start the monetizing process from?

All right, so my understanding of the question is if not using the F3 analysis, how do you start? How do you start to monetize the process from?

Aman, would you like to answer that?

Aman Goyal speaking- Yeah. So, if you have not done F3 analysis, we have seen that in F3 analysis, we, basically, categorize the patent into fundamental and fringe but we have also observed that many companies are aware of their fundamental patents. So, you can start with your fringe set and how you could identify your fringe patent effectively, we have discussed that we can follow CPC analysis with which we can easily identify how many fringe patents we have.

Once you identify fringe patents, you can, definitely, see what all prospective domains you have, then, by using the automated tools that we have for you. Actually, we have received a request from one of our client which is Automative OEM, which we have also discussed.

In our slide, that client had idea about their fundamental patents but they were not aware of their fringe patents and they have come to us to understand that whether we can generate revenue from their fringe patent.

So, we have developed an approach which we have displayed over there where there is a graph showing the patents related to smartphone and navigation. These are their important patents and based on that, we have performed further analysis that we have mentioned like performing detailed micro analysis and based on it, our client was very happy because they were not aware that they have that potential in their portfolio and their patents related to mobile domain which could be monetized or licensed to other companies.

Vaibhav Henry speaking- Right! I remember that Aman. So, that was a case where those were the BUs that these guys were not considering and they didn’t tell us that they internally had these tags based on the BUs and based on the output of our report, they told us that they have organized the patents internally with respect to the business units and they told us that the business units that we identified, they were never looking at those business units for monetization. So, that’s how, it was successful.

All right, let me take the next question.

How do you determine the asking price for a technology?

So, the next question is how do you determine the asking price for a technology? That info isn’t public. From Michelle; So, Michelle, yeah I understand, this information is not public per se but there are a lot of companies. We sometimes use royalty source. And, so that is, if you want the absolute value in a particular technology area, that is, there are databases out there which provide a boost on a subscription model as well as on a per query model. They provide the pricing info.

So, obviously it’s helpful if you have relative pricing for the patents that you are about to sell and then, you have to consider factors like the year of selling because we identified, for a lot of patents from the years 2008, 2009 and 2010, the average asking price was higher and we have seen that in the recent times, the asking price has gone a lot lower. So, those are the factors that you have to consider while you are asking for quotes on patent values and then we have a separate patent valuation webinar that we would be doing next month, something that Abby pointed out as well and there are multiple factors again.

We have a hybrid approach. We don’t provide a theoretical value to a patent but actually we consider the possibility of generating Evidence of Use charts and the possibility of infringement because that is the main thing that gives value to the patent.

So, if the average asking value of a family is, say, $50,000. If it has a chart, the value quickly goes up to at least one chart or at least one IoU, the value goes up to $120,000, it doubles and if there is an Evidence of Use chart and if there’s infringement or there are a couple of infringing companies than the value goes quickly to $250,000. So, from our experience the most important aspect is whether there is an infringement and if there is Evidence of Use chart and that is why we ask people to make pitch sticks.

Pitch Sticks are very important because customers know people who have been in the licensing business. That is, they know that there’s no use of negotiation if they are not infringing. If you are going to these companies, you need to have at least 2 to 3 good charts. Otherwise, if you find infringement by companies who are in the nascent phase, they are willing to get a license or they are willing to get the hybrid model that we explained. And, I explained earlier was for newer companies such that they can leverage those patents as well.

Alright, so that was about determining the asking price for a technology.

Going on!

What is the most effective method for contingent licensing and enforcement?

All right, I would say that if I had to say about the most effective method, then, I would suggest you to use a company which is very efficient in licensing and has a good reputation and that is because more than anything, the most important thing that we feel is the level of detail of your analysis. That is why people use firms like us such that no one can question the infringement over the use of technology.

The second most important aspect is relationships. So, we advise people to, of course, it might sound counterintuitive but NPEs and/or reputed patent assertion companies could be a good starting point because they can negotiate good value.

Otherwise we suggest and I’m talking about contingent licensing and enforcement but we always suggest companies to go for defensive licensing using pitch sticks such that you don’t start with an infringement at the licensee but actually you position yourself as a technology enabler and that is the job of a pitch book. But, if you are going to seasoned campaigners, then of course, the first thing that they would ask you is, do you have any Evidence of Use charts? Therefore, it depends on who you’re going to and that’s why the pitch sticks or the pitch books change with every target that you have in mind.

All right! I think those are the questions.

I see some of the questions which are not relevant at this time. There is a question on FTO searches but I think for monetization aspects we won’t be covering FTO searches.

There’s a question on why do you think 12 years is a good age for a patent.

It’s just something that we have seen. 12 years is a good turnaround time for patented technology to be, obviously, in use in the market. That’s what we have seen. So, older patents, they, find use in the market because by that time the feature that it discloses is not novel and it’s very apparent to someone who has a product in that area. And in our experience, we have seen that a lot of patents, old patents find infringement rather than the newer ones because there’s always a user space where the products come in and there’s the tech space where the patents are. So, the tech space is always ahead of the user space.

All right! I think those are all the questions that we can take and that’s it from my side, Abby. Thanks to everyone.

Abby Woods speaking- Welcome Henry. Thank you for the quick Q&A session Henry as well as Aman and, I think, it’s been a wonderful session for all of you guys as I can see and I’m sure our listeners have great takeaways from this session and will be able to use several of these pointers when working on patents and businesses also.

And, we’ve not been able to cover all the questions, as you can see, that we received from the audience. Those which could not be covered are items which we publish post webinar. Thank you to all the speakers and, as I already mentioned, team Sagacious is offering a complimentary patent portfolio ranking discount as good as 15% which is 1- 5 % discount on patent monetization services for the participants of this webinar. Hence, participants can drop us an email at webinar@sagaciousresearch.com to avail this promotion.

Lastly, I want to extend a big thank you to our listeners who helped us start on time and stayed with us for another 10-15 minutes or so, I know you guys have been waiting for a long time and, again, very kind of you to take out time for a webinar like this. So, thank you everyone.

Appreciate you being here. Thanks again for joining us today and we will see you next time with the topic Directed Prosecution: Generating Future Value from your Portfolio.

Please do not forget to register for that particular webinar. We would also love you, you know, like you to obviously go ahead and reach out to your friends and colleagues who might be willing to attend these webinars.

So have a great day. Stay safe, healthy, and please take care of your family. This is Abby Woods with Sagacious Research. Take care of all of you and Thank you.

Submit Your Information to watch the Webinar Video: